Wednesday, December 7, 2022 1:13 PM EST

Stock markets remain on the edge. We heard a few headlines from Putin earlier, with the Russian President saying that risk of a nuclear war is "rising", and that he will defend Russia "by all available means." This led to a drop in index futures, but the markets quickly rebounded off their lows, only for the sellers to step back in again as we neared the European close. We also saw US oil prices hit fresh pre-Ukraine-invasion low sub $73. A large build in US oil product stocks has added to worries about weakness in demand.

Investors are starting to re-focus more on recessionary signals than the peak inflation narrative. They worry that weaker demand in 2023 might hurt company earnings, and the current market valuations might be too high. The fact that inflation remains around 10% in Europe and very high in other parts of the world means central banks will tighten their belts and hold their policy tight for a long enough period to hurt demand further. In the US, the stronger wages and employment data we saw last week may yet encourage the Fed to continue tightening interest rates so that it climbs above 5% before the cycle is paused. This is an additional risk facing equity markets, especially those that pay low or no dividends.

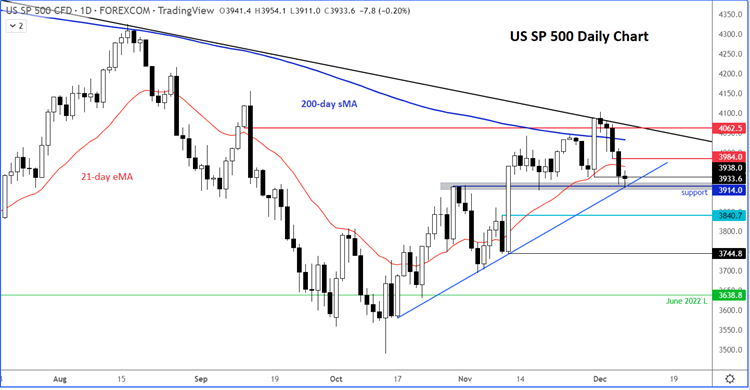

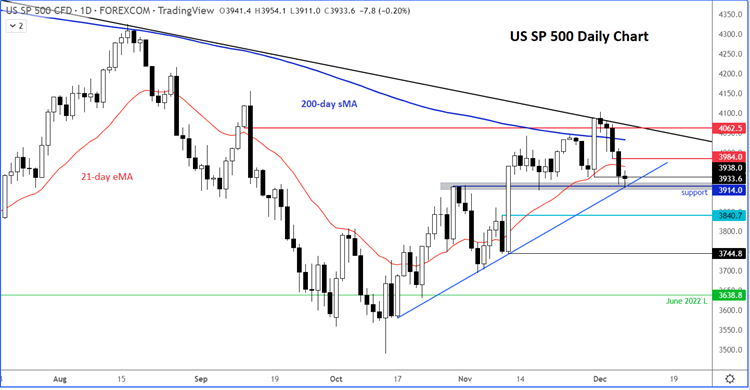

At the time of writing, the S&P had bounced off the lows after testing one of the most important short term support levels at 3914ish (grey shading). A bullish trend line also converges here. But it is now below the 21-day exponential moving average. A few days earlier, the retest and break above the 200 MA failed. Long term bear trend also held.

So, you get the feeling that if 3914 breaks now, we might get another puke lower. Let’s see what happens here. The bulls need to defend their ground here if they want higher or at least a recovery back to 3984 short-term resistance. If they fail to do so, 3840 – the base of the breakout – could be the next downside target for the bears.

More By This Author:

WTI’s Trend Break More Good News Re Inflation

USD/CAD H&S Failure?

Stocks At Risk As Crypto Turmoil Adds To Chinese Worries

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to Forex.com or GAIN Capital refer to GAIN Capital Holdings Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.

less

How did you like this article? Let us know so we can better customize your reading experience.