Markets Look To Close Q1 Strong: Stocks To Watch

Image Source: Unsplash

Stocks were moving higher in the early going on Tuesday, extending their recent rally amid the final trading week of the first quarter. It’s been a historic start to 2024, with U.S. markets propelled by a resilient economy and a bullish artificial intelligence theme. As markets are closed for Good Friday, just three sessions remain this week.

The S&P 500 is off to its 15th best start dating back to 1928; the index is up just shy of 10% year-to-date, as is the Nasdaq. The communication services and information technology sectors resumed their lead from 2023 and have advanced 16% and 13% year-to-date, respectively.

The major U.S. indices have displayed little in the way of volatility this year. The volatility (VIX) index continues to hover in the low teens; periods of low volatility are inevitably followed by periods of high volatility, but volatility can remain subdued for extended timeframes in strong bull markets.

On a similar token, investor sentiment remains bullish here, but sentiment can also continue to get even more optimistic before it reaches a truly euphoric level. Markets applauded the Fed’s confirmation last week of three upcoming rate cuts, bolstering investors’ appetite for risk. The central bank also issued more bullish forecasts on the economy including bumps in GDP numbers.

Chicago Fed President Austan Goolsbee stated on Monday that three rate cuts this year are “in line with my thinking.” He added that the underlying trend lower in inflation hasn’t changed despite slightly hotter readings over the past few months.

Trump Media & Technology Begins Trading

The company behind former President Trump’s social media platform, Trump Media & Technology Group, started trading on the Nasdaq Tuesday morning following an announcement of the merger completion with blank check company Digital World Acquisition. The company will trade under the ticker symbol “DJT”, which stands for the former President’s initials.

Trump remains heavily involved in ongoing and high-profile litigation, racking up hundreds of millions of dollars in legal expenses and penalties. The former President could potentially net a more than $4 billion paper windfall in shares from the merger based on current pricing.

DJT stock soared in the first minutes of its Nasdaq debut, triggering a brief trading halt on volatility. Shares jumped more than 40% on heavy volume.

Image Source: StockCharts

Cruise Liner Catches Fire Ahead of Earnings

Carnival (CCL - Free Report) was making headlines this week for the wrong reasons ahead of its first-quarter earnings report. A Carnival cruise ship caught fire for the second time in two years, after the ship’s funnel went up in flames while carrying passengers.

While weather conditions may have been a factor after several reports of lightning strikes, the cause of the most recent incident is still being investigated. Thankfully, no passengers on the ship were injured.

Carnival operates a fleet of more than 90 ships that visit approximately 700 ports. The company provides destination services under recognized brand names such as AIDA, Carnival, Costa, Princess, and Seabourn. Carnival sells its cruises primarily through travel agents, tour operators, vacation planners, and websites.

CCL is currently a Zacks Rank #2 (Buy) stock. The cruise liner has surpassed earnings estimates in each of the past four quarters with an average surprise of 19.2%. The company has seen its shares rise more than 86% over the past year.

Image Source: StockCharts

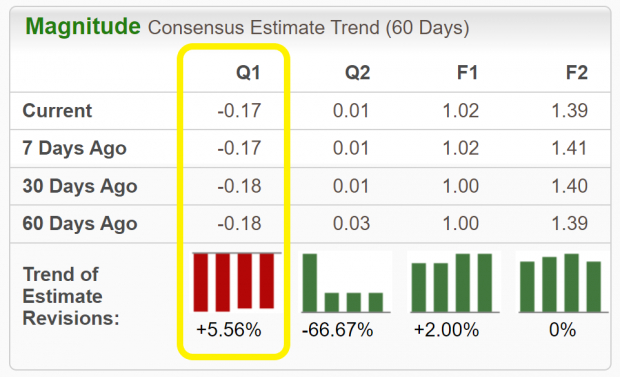

Strong fundamentals are backing up the price movement. Revenues for the latest quarter are expected to climb 21.95% to $5.4 billion. While Carnival is still expected to show a loss, earnings estimates have been on the rise for the first quarter, with analysts bumping up their estimates by 5.56% in the past 60 days. The Q1 Zacks Consensus Estimate is now -$0.17/share, translating to a 69% improvement relative to the year-ago period.

Image Source: Zacks Investment Research

What the Zacks Model Unveils

The Zacks Earnings ESP (Expected Surprise Prediction) seeks to find companies that have recently seen positive earnings estimate revision activity. The idea is that this recent information can serve as a more accurate predictor of the future, which can give investors a leg up during earnings season.

The technique has proven to be quite useful in finding positive surprises. In fact, when combining a Zacks Rank #3 or better with a positive Earnings ESP, stocks delivered a positive surprise 70% of the time according to our 10-year back test.

CCL is a Zacks Rank #2 (Buy) and boasts a +3.28% Earnings ESP. Another beat may be in the cards when the company reports its fiscal Q1 results tomorrow before the market opens.

More By This Author:

Buy 5 Top-Ranked ETFs To Play Broadening US Market RallyBuilding On The Bull: Stars Align For Above-Average Returns

3 REITs To Pick As The Fed Indicates 3 Rate Cuts In 2024

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more