Markets Are Tactically Betting Against 'Stock Pickers' Ahead Of March Event Risk

2023 has seen stocks start to behave like, well 'stocks', rather than simply proxies for the overall market, moving as one with every whimsical headline.

This should not be a huge surprise as Goldman's Prime Desk noted earlier in the year: 2023 could bring a new market paradigm for stock pickers as, "historical data suggests that higher rates may create more fertile opportunity set for hedge fund returns and alpha generation, marking a shift from the challenges created by the QE era."

And sure enough, as Goldman's Brian Garrett pointed out in a note this morning, this is coming to fruition as the market digests 4Q earnings reports and idiosyncratic risks manifest at the individual stock level.

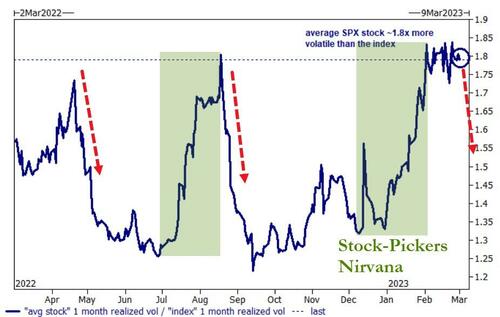

The chart below tracks the "average" S&P 500 stock's 1-month-realized volatility relative to the index itself.

Put another way, the average S&P 500 stock has been ~1.8 times as volatile as the overall market (around one-year highs).

However, the chart above is backward-looking - measuring the realized idiosyncratic moves relative to the realize index moves.

Looking forward, the market is increasingly betting on a shift to more macro-driven buying- or selling pressure as the implied correlation for the S&P 500 for the next month has been rising since early February...

It would appear traders are betting on the imminent arrival of several major event risk elements (payrolls, CPI, and FOMC in the next 3 weeks) will shift the equity market - at least tactically - back to a "it's all one trade" environment and away from the stock-pickers' nirvana.

More By This Author:

Fed's Original Mouthpiece Shatters "Strong Labor Market" Propaganda, Casts Doubt On Job Openings

Here's What People Are Expecting From Today's Tesla Investor Day

Conference Board Tumbles In Feb As 'Hope' Slumps

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more