Market Quietly Higher After Manufacturing Data

Wall Street is quiet this afternoon, with the Federal Reserve now in its "blackout period" before the Federal Open Market Committee (FOMC) meeting for July. Investors are working through this morning's manufacturing data while keeping an eye on this week's earnings schedule. At last check, the Dow Jones Industrial Average (DJI), S&P 500 Index (SPX), and Nasdaq Composite (IXIC) were all sporting midday leads.

Goldman Sachs upgraded Chewy Inc (NYSE: CHWY) to "buy" from "neutral," and hiked its price target to $50 from $42 earlier. Options bulls are already chiming in after this bull note, with 28,000 calls exchanged so far -- nine times the intraday average -- compared to 4,039 puts. Most popular is the July 40 call, where new positions are being bought to open. CHWY is off 0.3% at $37.85 at last check, though, and carries a 10.6% year-to-date deficit.

Black Knight Inc(NYSE: BKI) is leading the New York Stock Exchange (NYSE) today, last seen up 13.8% at $69.74. The company said it will sell its Optimal Blue business to a Constellation Software subsidiary to ease antitrust concerns around an Intercontinental Exchange (ICE) buyout. The security earlier surged to a fresh 2023 high of $70. and now sports a 13.2% year-to-date lead.

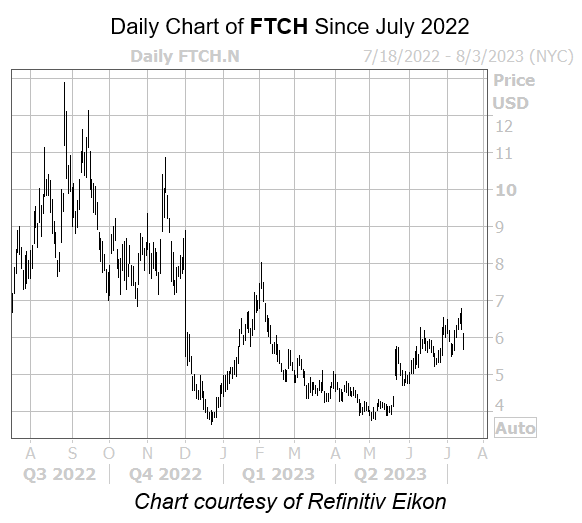

Toward the bottom of the NYSE is Farfetch Ltd (NYSE: FTCH),down 8.4% to trade at $5.73 at last glance. It's unclear what is driving this negative price action, but the equity is now mere cents away from penny stock territory, after its latest rally fell short of the $7 region. FTCH is down 11.6% year-over-year.

More By This Author:

Dow Logs Best Weekly Performance Since March

Perfect Week Of Gains Within Reach On Wall Street

Major Indexes Secure 4th-Straight Win