Market Forecast Based On Earnings So Far

Image Source: Pexels

The markets are now fully into earnings season.

The most critical companies to monitor are the MAG 7/ big tech plays. These are the largest companies in the S&P 500. Because of their size, they account for ~30% of the index’s weight.

Thus far, Tesla (TSLA), Microsoft (MSFT), and Alphabet (GOOGL) have reported. The results have been interesting.

TSLA reported on 1/24/24. The stock was down 10% on its results.

Last night, MSFT and GOOGL reported. MSFT is down about 0.5% while GOOGL is down over 5%.

So, thus far two of the three MAG 7 have seen their stocks collapse a LOT on earnings results while one of is effectively flat.

This doesn’t bode well for the broader market. It is VERY difficult for the S&P 500 to rally much at all if the MAG 7 plays are weak. Remember, these companies account for 30% of the market’s weight.

Apple (AAPL), Amazon (AMZN), and Meta (META) report on Thursday. Nvidia (NVDA) reports on 2/21/24. If AAPL and META also sell-off on their results, it’s safe to assume the market will experience a decent correction.

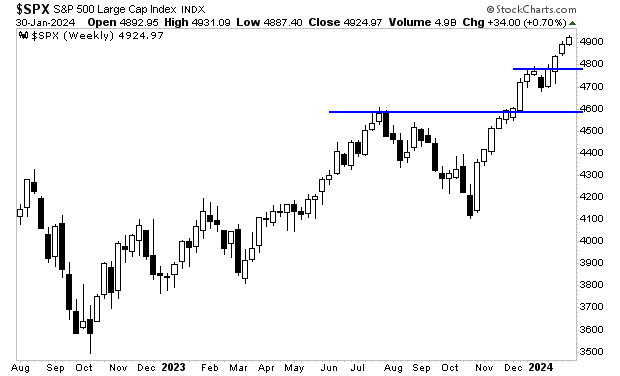

From a technical analysis perspective, the S&P 500 has support just below 4,800. After that is CRITICAL support at 4,595. Given how the MAG 7 plays are responding to earnings, I wouldn’t be surprised to see a correction to 4,595 in the next two months.

This would represent a back-test of the Cup and Handle formation I showed yesterday. Bear in mind, a correction like this would NOT negate our longer term forecast for the S&P 500 to go to 6,000 before 2025. Rather, this correction is a short-term development and would present a fantastic buying opportunity.

More By This Author:

Three Charts Every Trader Needs To SeeThe U.S. Government Has Set The Stage For A Debt Crisis

One Of The Indicators For Timing The Market Is Flashing A Warning