Market Blast - Friday, July 5

Image source: Pixabay

Stock futures are mixed following the holiday as traders await the June labor report. Indications from earlier in the week say this report might be fairly strong, which would be bad for rates and potentially mean the markets could slip lower into the weekend.

Interest Rates are modestly lower this morning as bond buyers come back to support fixed income. There is anticipation in the works as fund managers are looking for a Fed policy pivot. We have stated the FOMC is in the state right now but they do not know when the transition will actually start.

Fed futures are predicting two cuts this year but that may change if inflation data remains hot.

Changing of the guard in England as the Labour Party takes over in a landslide victory. The FTSE was up nearly 2%, the pound unchanged. Bitcoin slid under 55K and might make a move down towards 50K or so. The US dollar fell to a three week low ahead of payrolls data, a weaker jobs report today would weigh on rates and the dollar. 10 year yields are lower this morning, oil flat but is set for strong weekly gains, gold is slightly higher while copper is up. A cut in the funds rate later this year might trigger selling in metals and the dollar, but the opposite could happen as well if inflation ticks higher.

Nothing on the earnings schedule today but next week starts a slew of bank earnings as the Q2 confession gets underway.

Though it was only a half session it was very positive as the indices galloped ahead. Even the poor Russell 2K emerged with a green session. Strong price action is the antidote for poor indicators, we do not take it lightly. As we move into the weekend with new highs from SPX 500 and Nasdaq we should remember an overbought market is a condition where profit-takers will step in and do some selling. Make sure you do yours ahead of them!

Another solid day of breadth puts this indicator back on a buy signal. Of course, it has been flipping back n’ forth for quite some time now so there is not really a buy signal here. Cumulative volume breadth is hitting new highs along with the indices, so that is actually a bullish development. Oscillators turned positive recently and now are starting to move higher.

Volume readings were lower due to the short trading day. However, buyers were coming after stocks all session, and even though the day was shortened by three hours the pace of volume was still fairly brisk. We may see a resumption of higher turnover today and into next week’s start of earnings.

Bold moves by the SPX 500 and Nasdaq vaulted the indices higher. As we continue to move up those lower support levels create some distance, which means if those are to be tested at some point there will be a sharp, painful drop that comes along with it. SPX 500 support still stands at 5,375 and 5,400, Nasdaq at 19,200 and 19,500.

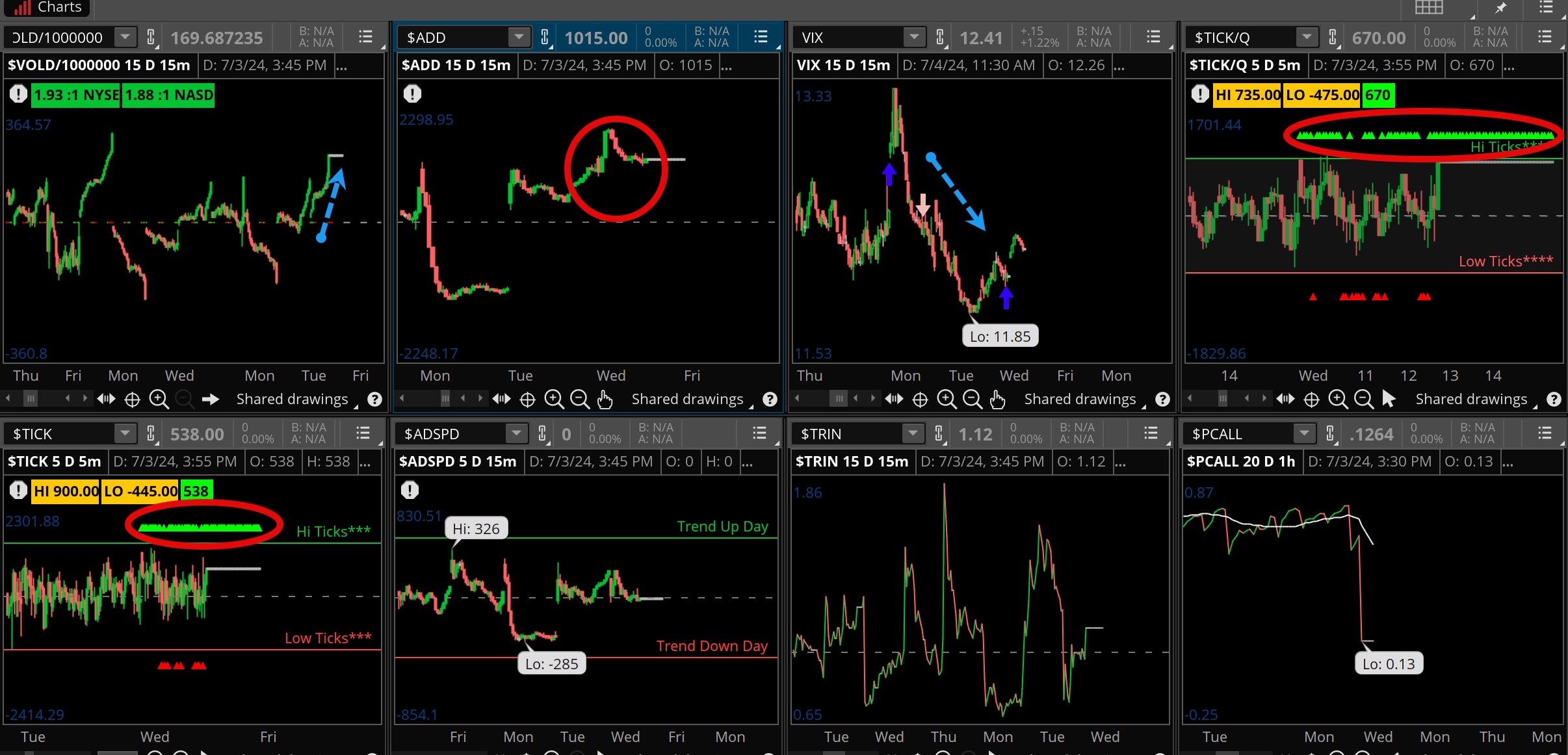

The Internals

(Click on image to enlarge)

What does it mean?

Hardly anything wrong with Wednesday’s pre-holiday session. Of course, it was a half day so the internals were only working part of the time. Yet, we had a nice positive divergence with the VOLD and ADD pushing higher with the better price action in the market. That is constructive, while the ticks were dominant green, massive buy programs hit during the short session. VIX popped up slightly then fell and finished just above 12%.

The Dynamite

Economic Data:

- Friday:employment report for June,

Earnings this week:

- Friday: N/A

Fed Watch:

This past week we heard from several Fed speakers who seem to like the trend inflation is taking. That would be lower of course, the PCE from May showed a flat month/month and lower annual number, not to the 2% target but getting there. It is increasingly like the Fed is going to cut rates at some point in 2024, more likely in September if more data shows the trend continuing. All eyes/ears on Chair Powell on Tuesday as he speaks in Portugal, later in the week NY Fed president Williams is out twice. We’ll also have the Fed meeting minutes released Wednesday during the day from the June meeting.

Stocks to Watch

Volatility – The VIX remains extremely low here and could even bust lower with a holiday coming up. We often see volatility recently and sell off before a holiday session. The VIX is telling us buyers and sellers seem satisfied at this level.

Technology – After a stellar first half of the year can the momentum continue? Nasdaq had a strong 17% gain following an amazing 2023.

The uptrend remains intact as sellers are not interested in letting go just yet, certainly not while the Fed looks ready to pivot towards an easier policy.

More By This Author:

Pure Storage Inc. Chart AnalysisCan This Huge Stock Divergence Last Much Longer?

Market Blast – July 1, 2024

Disclaimer: Explosives Options disclaims any responsibility for the accuracy of the content of this article. Visitors assume the all risk of viewing, reading, using, or relying upon this ...

more