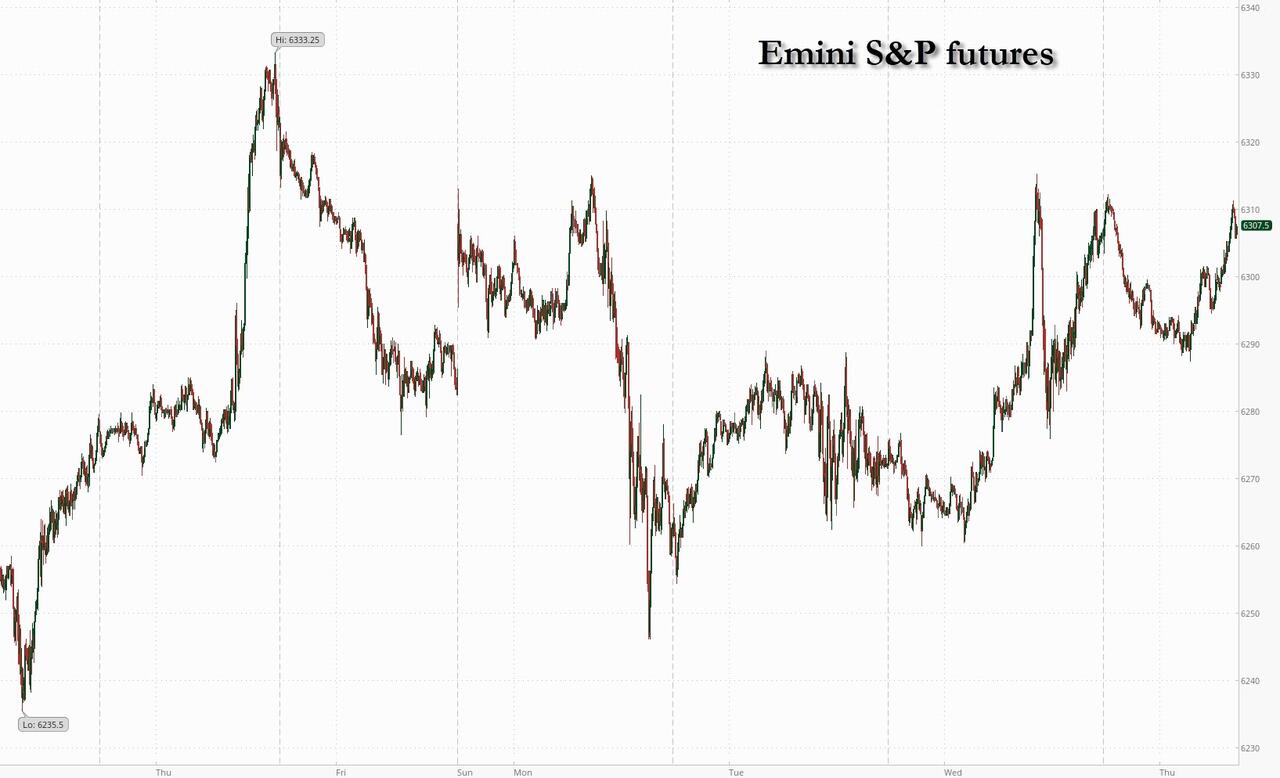

Market Analysis - Thursday, July 10

SPX futures traded overnight in a narrow range, approaching the open near the flat line. Yesterday’s attempt to break out prior to the FOMC release failed. The steep diagonal trendline lies near 6200.00. Beneath it a sell signal awaits. Ending Diagonals often retrace themselves, once complete.

Today’s options chain shows Max Pain at 6260.00. Long gamma may arise above 6275.00 while short gamma resides beneath 6210.00.

ZeroHedge reports, “US equity futures are flat, reversing an earlier loss but lagging the Asia-Pac and EMEA sessions, following the latest batch of tariff letters with the most impactful being a 50% tariff on Brazil. As of 8:15am ET, S&P and Nasdaq futures are flat after closing just shy of an all-time high on Wednesday. Pre-market, Mag7 names are mixed with NVDA leading the Semis bid post positive TSM revenue update. Treasuries resumed their decline after Wednesday’s rebound, with the 10-year yield rising two basis points to 4.35%. The dollar was steady. Cmdtys are rebounding with bids across all 3 complexes with gold, steel, and natgas the standout performers. Today’s macro data focus is on initial jobless claims and continuing claims.”

VIX futures also remain in a narrow range, with a slight uplift as the market nears its open.

More By This Author:

Market Analysis - Tuesday, July 8Market Analysis - Tuesday, July 1

Market Analysis - Thursday, June 5

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more