Market Advance Gives Another Opportunity To Sell Extended-Share-Price Stocks

What to look for in Q1-2020 data

Another light week for new financial statements with only 40 companies reporting and mostly companies with fiscal quarters ended in February. The recent SEC filing update is only 3% complete but the volume of filings will increase in coming weeks. So far there is no evidence that companies will delay their reports and we expect to see a large volume of new numbers in the next three weeks that will give a measure of the effect of the shutdown on US company finances.

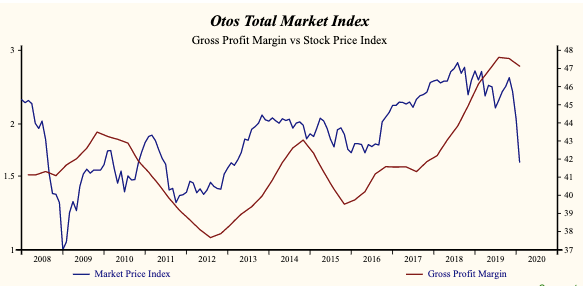

History shows that the primary downtrend, that is now over a year old, will not reverse until corporate growth recovers with an improvement in average sales growth and/or a gross profit margin improvement. Refreshed financial statements from 1,600 companies over the next three weeks will tell a story of the shut-down.

The strong market advance over the past two weeks is welcome and a recovery bounce from the March low might have been expected. We have been tracing out the declining market volatility range since the peak in the price of stocks relative to bonds in November 2018. The recent advance is a good opportunity to review portfolios again for extended-share-price stocks to sell. Such as:

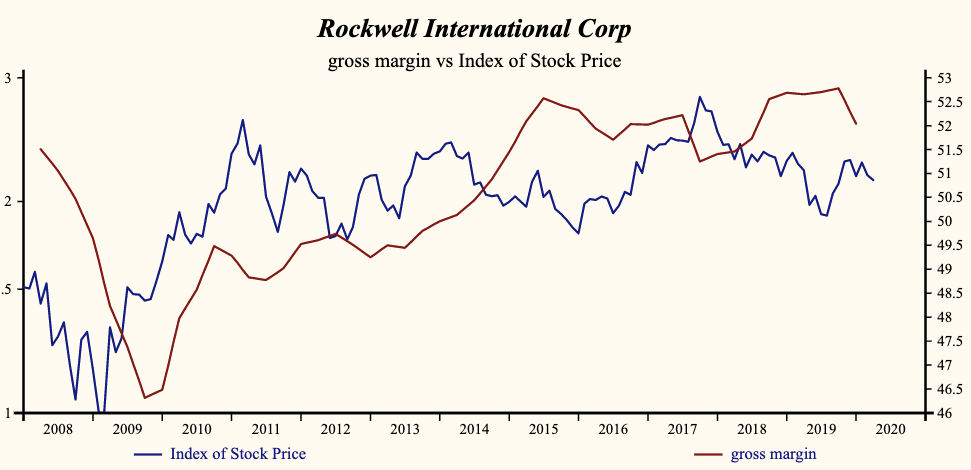

Rockwell Automation (NYSE:ROK) $167.640 SELL this rich company getting worse

(Not an investment recommendation)

Rockwell Automation (NYSE:ROK) is scheduled to report its second quarter fiscal 2020 results on Tuesday, April 28. Rockwell has been an exceptionally profitable company with inconsistently high cash return on total capital of 16.4% on average over the past 15 years. Over the long term, the shares of Rockwell have declined by 4% relative to the broad market index. More recently, the shares of Rockwell Automation have declined by 22% since the October, 2017 high.

The shares have been highly correlated with trends in Growth Factors. The dominant factor in the Growth group is Net Shareholder Wealth which has been 96% correlated with the share price with a four-quarter lead.

Currently, sales growth is 0.2% which is low in the record of the company and lower than last quarter.

The company is recording a high and falling Gross Profit. Gross Profit margin has been 71% correlated with the share price with a one-quarter lead. SG&A expenses are low in the record of the company and rising. That implies that the company has limited scope for further cost containment and rising costs are slowing the EBITDA growth rate relative to sales. Lower gross margins and higher SG&A expenses are producing a deceleration in EBITDA relative to sales which has been 67% correlated with the share price.

The current indicated annual dividend produces a yield of 2.7%. Five-year average dividend growth is 9.0%. Current trailing operating cash-flow coverage of the dividend is 2.6 times. However, the shares are trading at upper-end of the volatility range in a 30-month falling relative share price trend. The current extended share price provides a good opportunity to sell the shares of this decelerating company.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

Pierre Raymond is a 25-year veteran of the Financial Services industry. Driven by his passion for financial technology he has transitioned from being a quantitative stock picker, to an award-winning hedge fund manager, credit risk manager to currently a multipurpose risk IT banking consultant. Pierre is the cofounder of Global Equity Analytics & Research Services LLC (GEARS) and a current partner at OTOS Wealth Systems Inc.

Disclaimer: This article is not an investment recommendation, Please see our disclaimer - Get our 10 free ...

more