MAR Stock Forecast: Did Marriott Cope With The Tsunami That Covered The Leisure Industry?

Highlights:

- 2Q21 comparable systemwide constant dollar RevPAR increased 262.6% worldwide, compared to the 2020 second quarter.

- MAR’s ROE of 107.76% is higher than 99% in the Travel and Leisure industry.

- Hotel room Revenues are expected up 47% in 2021.

Overview

Marriott International, Inc. is an American multinational company that operates, franchises and licenses housing, including hotels, residences and timeshare properties. It is headquartered in Bethesda, Maryland. The company was founded by J. Willard Marriott and his wife Alice Marriott; the executive chairman of the company is now their son, Bill Marriott, and the Marriott family retains a majority stake in the company. Marriott is the largest hotel chain in the world by the number of rooms available. It has 30 brands with more than 7 600 properties containing 1 423 044 rooms in 131 countries and territories. Of these 7 642 properties, 2 149 are operated by Marriott and 5 493 are operated by other companies under franchise agreements. The company also operates 20 hotel booking centers. Marriott International, Inc. was formed in 1993 when the Marriott Corporation split into two companies: Marriott International, Inc., which franchises and operates real estate, and Host Marriott Corporation (now Host Hotels & Resorts), which owns real estate.

The Impact of Coronavirus on the Hotel Industry

The coronavirus pandemic has had a devastating impact on the global hotel industry. Occupancy rates globally declined sharply, with Europe and North America hitting the hardest. In the US, data from the Bureau of Labor Statistics show that the unemployment rate for leisure and hospitality workers is an unprecedented 28.9%. In 2020, U.S. hotels recorded the lowest occupancy rates on record. The hotel occupancy rate for the year was only 44%, compared to 66% in 2019. The industry surpassed 1 billion unsold rooms for the first time, breaking a record of 786 million back in 2009, during the Great Recession. In such an unfavorable environment, the hospitality industry has changed in one way or another. Many businesses have left the market, while others have gone through the introduction of innovations and increasing customer focus.

Marriott International also did not escape the crisis. Hotel demand dropped significantly in 2020. In April 2020, the comparable systemwide constant dollar RevPAR (Revenue per available room) experienced a record decline, down 90 percent globally from the prior-year period, and 27% of Marriott hotels were temporarily closed. While business at Marriott hotels improved by the end of 2020 from an extremely low level in April 2020, COVID-19 continues to stifle recovery and have a significant negative impact on demand so far.

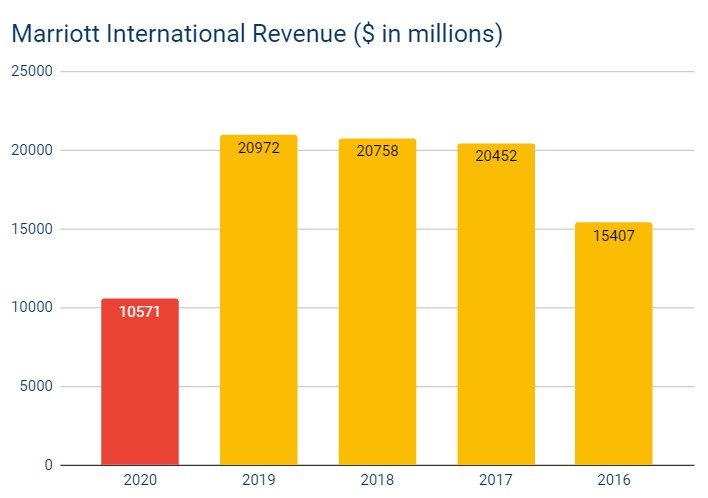

As a result of the pandemic, the company’s annual revenues and profitability dropped dramatically in 2020 compared to 2019.

(Figure 1 – Marriott International Revenue by Fiscal Years Ended in million US dollars)

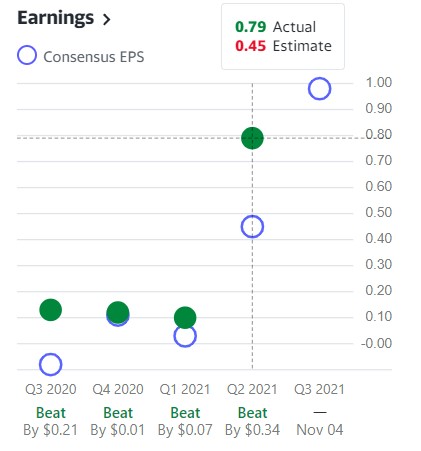

Nevertheless, the company was able to survive the shock of the first wave of lockdowns in 2020. Then, all over the world, the service and leisure sector was left without the opportunity to make money. In 2021, the company’s business began to improve. Revenue in the second quarter of 2021 amounted to $ 3149 million, showing an increase of 35.97% compared to the first quarter of 2021. Also In Q2 2021, EPS significantly exceeded analysts’ expectations.

Second-quarter 2021 comparable systemwide constant dollar RevPAR (Revenue per available room) increased 262.6% worldwide, 274.6% in the U.S. & Canada, and 223.2% in international markets, compared to the 2020 second quarter.

Second-quarter reported net income totaled $422 million, compared to a net loss of $234 million in the year‐ago quarter. The company added nearly 25,000 rooms globally during the second quarter, including roughly 13,000 rooms in international markets and a total of approximately 5,300 conversion rooms. Gross rooms growth was 6.1% for the twelve months ended June 30, 2021.

At the end of the quarter, Marriott’s worldwide development network consisted of 2,750 properties and nearly 478,000 rooms, including approximately 19,000 rooms approved but not yet contracted. As of the end of the second quarter of 2021, there were more than 212,000 rooms in the queue under construction.

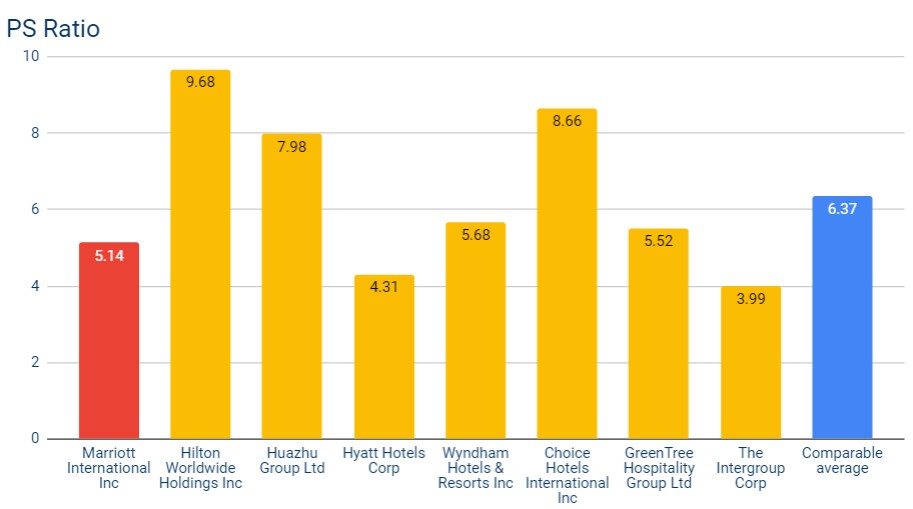

Let’s take a look at some of the fundamental indicators of the company that will help us understand its current financial health and position in the market and industry. First, we can choose several comparable companies of MAR and the Travel & Leisure industry benchmark to evaluate its financial competitiveness. These companies are Hilton Worldwide Holdings Inc, Huazhu Group Ltd, Hyatt Hotels Corp, Wyndham Hotels & Resorts Inc, Choice Hotels International Inc, GreenTree Hospitality Group Ltd, The Intergroup Corp.

According to GuruFocus, MAR’s ROE of 107.76% is higher than 99% of the companies in the Travel & Leisure industry. This can exhibit the company’s excellent profit generation ability from its equity. Net Margin of 3.51% is higher than 67% of its peers in the industry. Operating Margin of 9.72% is also higher than many of its peers’ values. This indicates that a business is pricing its products correctly and is exercising good cost control.

(Figure 2 – ROE, Net Margin and Operating Margin

The current MAR’s P/S ratio of 5.14 is 24% lower than the peer average. This is a good level for the industry and indicates to us that there is upside potential in MAR stock.

(Figure 3 – P/S ratios)

Taking into account the performance of the company, it is also worth considering the general state of the industry. Here are some of the numbers that analysts expect from the industry in the near future.

The global hotel and other travel accommodation market is expected to grow from $673.02 billion in 2020 to $801.9 billion in 2021 at a compound annual growth rate (CAGR) of 19.1%. The growth is mainly due to restructuring by companies of their operations and recovery from the impact of COVID-19, which previously led to restrictive containment measures, including social distancing, teleworking and the closure of commercial activities, which led to operational problems. The market is expected to reach $ 1,052.84 billion in 2025 with a CAGR of 7%.

Hotel room revenues are expected to reach $125.3 billion in 2021. Room revenues are likely to be down $ 44 billion this year from 2019, when 5.3 million rooms nationwide generated more than $ 169 billion in annual room revenues, not counting the additional tens of billions from conference rentals, halls, and other additional sources of income. In 2020, U.S. hotel room revenue fell nearly 50 percent to $ 85.5 billion.

(Figure 4 – Hotel room Revenues in billion US dollars)

Despite the outlined positive dynamics for the company’s business, in its quarterly report, Marriott also pays great attention to the risks associated with COVID-19.

For example, the report states that COVID-19 has had a material detrimental effect on the business and financial results of Marriott, and such an impact may continue and worsen for an unknown period of time. COVID-19 was and continues to be a challenging and evolving situation. Governments, government agencies and other organizations impose or recommend various rules and restrictions. Enterprises and individuals impose restrictions on various activities or other actions to combat its spread at different times and to varying degrees. COVID-19 and its aftermath have dramatically reduced travel and hotel room demand, which has and will continue to impact Marriott’s business and financial performance and the industry as a whole.

Technical Analysis

The daily chart shows the company’s shares moving in a downward channel from late February to September 23rd when the stock broke up from the narrow channel. Now, from September 9, we can draw an uptrend line in the MAR shares. The main confirmation of a persistent bullish trend in stocks will be the consolidation of Marriott shares above a strong resistance level at about $ 153 per share. Nevertheless, all 3 moving averages turned into growth, which is also a good indicator of the strength of these stocks.

(Figure 6 – MAR 1D: January 2021 – October 2021)

Conclusions

In a nutshell, MAR is coping well with the fallout from the Сovid pandemic. The performance indicators for the last quarter have improved significantly, on the one hand, thanks to the fact that the world is getting used to living in conditions of uncertainty, on the other hand, thanks to the competent management of the company. The technical picture in the company’s shares also indicates a good picture, so I am optimistic about the growth of the company’s shares in the next 12 months, as a top pick in the Travel & Leisure industry.

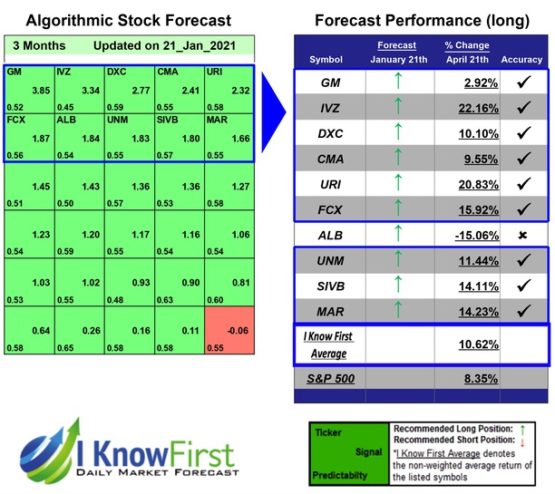

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the MAR stock forecast. The dark green for all forecasts is a strong bullish signal.

Past Success With MAR Stock Forecast

I Know First has been bullish on the MAR stock forecast in the past. On April 22, 2021 the I Know First algorithm issued a forecast for MAR stock price and recommended MAR as one of the best stocks to buy. The AI-driven MAR stock prediction was successful on a 3-months’ time horizon resulting in more than 14.23%.

Please note--for trading decisions use the most recent forecast.

Disclosure: This article originally appeared on more

It cerrtainly appears that the Marriot organization had a great deal of survival skill and resources. So it would be a good long-term investment, I suppose.