Making Sense Of Q2 Earnings Season Expectations

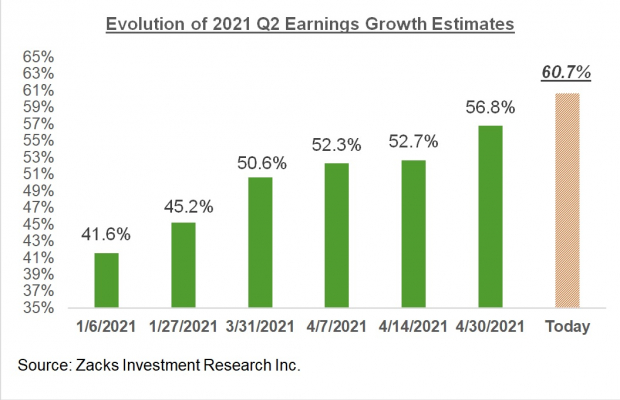

Estimates have been steadily going up, as we have been consistently pointing out in our earnings commentary, though the favorable revisions trend has eased off in recent weeks. The chart below shows earnings growth expectations for 2021 Q2 have changed since early January:

Given how strong earnings surprises turned out to be in the preceding reporting cycle (2021 Q1), the final earnings growth tally for 2021 Q1 could be as high as +80%.

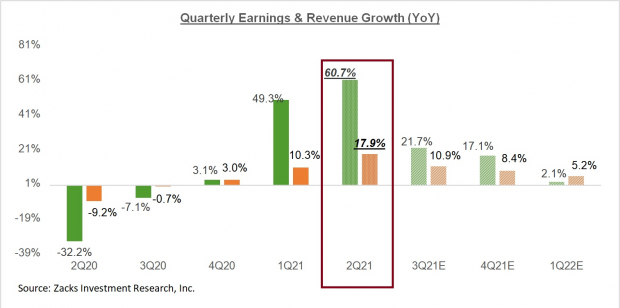

The chart below takes a big-picture view of the quarterly earnings and revenue growth pace:

The chart below presents the big-picture view on an annual basis. As you can see below, 2021 earnings and revenues are expected to be up +35% and +10.5%, respectively, which follows the Covid-driven decline of -13.1% in 2020:

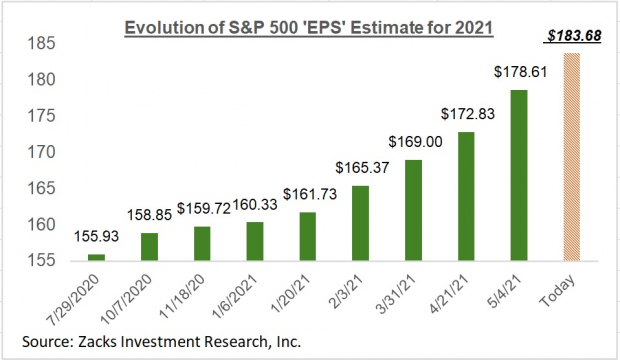

On an index ‘EPS’ basis, the 2021 expectation works out to $183.68, up from $136.04 per ‘Index share’ in 2020.

These full-year estimates have been going up as well, as the chart below shows:

Key Reports This Week

The Q2 reporting cycle will really get going July 13th, as JPMorgan (JPM - Free Report) and the other major banks come out with their fiscal June-quarter results. But we (and other data aggregators) count the start of this and other earnings season(s) a little differently. From our standpoint, the Q2 reporting cycle got underway with companies reporting results for their fiscal quarters ending in May.

We have already seen such May-quarter results from 5 S&P 500 members, including Costco (COST - Free Report) and Oracle (ORCL - Free Report) , with another 7 index members on deck to report results this week. FedEx (FDX - Free Report) and Nike (NKE - Free Report) are the notable reporters this week, both reporting after the market’s close on Thursday, June 24th.

We are off to a great start with the 5 S&P 500 members that have reported results already. Total earnings for these 5 companies are up +32.4% from the same period last year on +19.6% higher revenues, with all 5 companies beating EPS and revenue estimates.

It is too early to draw any conclusions from this very small sample of results. But for what it’s worth, this is a better performance from these 5 index members than we have seen in the recent past.

Q2 Earnings Growth Isn’t Solely Because of Easy Comparisons

One unique aspect of all current economic and earnings data is the distortion caused by comparisons to last year’s numbers, when most economic and business activities came to a halt as a result of Covid-driven lockdowns. We saw this ‘base-year effect’ in the recent May inflation reading and other monthly readings related to housing starts, industrial production and even consumer spending.

With respect to corporate earnings, this ‘effect’ was in play to some extent in the March-quarter earnings season as well, but will be most pronounced in the coming Q2 earnings season that will really get underway in a few weeks.

Earnings growth was very strong in 2021 Q1 and is expected to be even stronger in the Q2 reporting cycle, with comparisons to the comparable Covid-depressed periods of 2020 a major source of the growth.

We should keep in mind, however, that the strong earnings growth we saw in Q1 and the even stronger growth expected in Q2 is also reflective of genuine growth in the absolute sense, not just a result of easy comparisons.

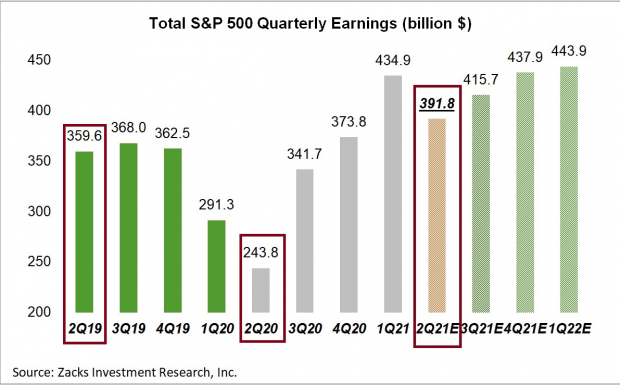

Take a look at the chart below to get a better sense of this reality:

These are quarterly earnings totals, with aggregate bottom-up earnings estimates for 2021 Q2 and the following three quarters and actual results for the preceding 8 quarters. We have highlighted 2021 Q2, 2020 Q2 and 2019 Q2 to make the point about comparisons.

You can see that 2021 Q2 earnings for the S&P 500 index are expected to be up +60.7% from the Covid-hit 2020 Q2 period. But even relative to the pre-Covid 2019 Q2 period, 2021 Q2 earnings are expected to be up +8.9%.

In fact, 9 of the 16 Zacks sectors are expected to earn more in 2021 Q2 than they did in the pre-Covid 2019 Q2 period. These sectors include Basic Materials (+74.1% higher earnings relative to the 2019 period), Construction (+56.9%), Technology (+31.7%), Retail (+24.7%), and Medical (+20.9%). Even the Finance sector is expected to have +5.4% higher earnings in 2021 Q2 relative to Q2 2019.

Transportation, Consumer Discretionary, Energy, Aerospace and Autos are some of the major sectors that are expected to earn significantly less than what they earned in the comparable 2019 period.

The bottom line is that while comparisons to the Covid-affected 2019 period is no doubt giving us the outsized growth pace in 2021 Q2 (+60.1%), growth would still be positive without such a base-year effect.

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>> more