Makeup (Stock) Market (And Sentiment Results)

Key Market Outlook(s) and Pick(s)

I joined Jared Blikre and Sydnee Fried on Yahoo! Finance to discuss past picks and current stock picks. Thanks to Jared, Sydnee, and Taylor (Smith) Clothier for having me on.

Last week, I joined David Lin on his show “The David Lin Report” to discuss investment implications following Trump’s inauguration, market sentiment, and stock picks. Thanks to David for having me on. My conversations with David tend to go viral and get a lot of attention. This one’s no different! Watch here to see why:

This morning I joined Ade Nurul Safrina Nasution on CNBC “Closing Bell” Indonesia to discuss President Trumps policies, Jobs, USD, Market Outlook, Economy, Emerging Markets, China, Tariffs, Crypto, Energy, Manufacturing and more.You can find it here:

On Tuesday, I joined Sean Callebs on CGTN America to discuss the Department of Government Efficiency (DOGE), Elon Musk, Trump and more.Thanks to Sean and Kamelia Kilawan for having me on:

Bank of America Fund Manager Survey Update

On Tuesday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed institutional managers with ~$513B AUM:

Here were the 5 key points:

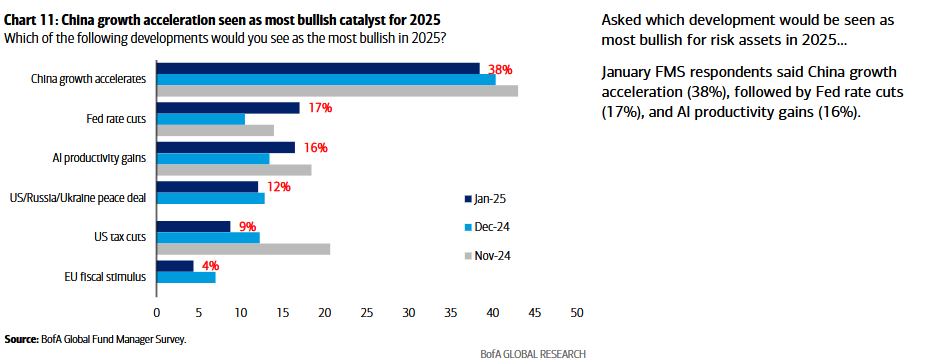

1) Most bullish catalyst for 2025 remains “China growth acceleration”.

(Click on image to enlarge)

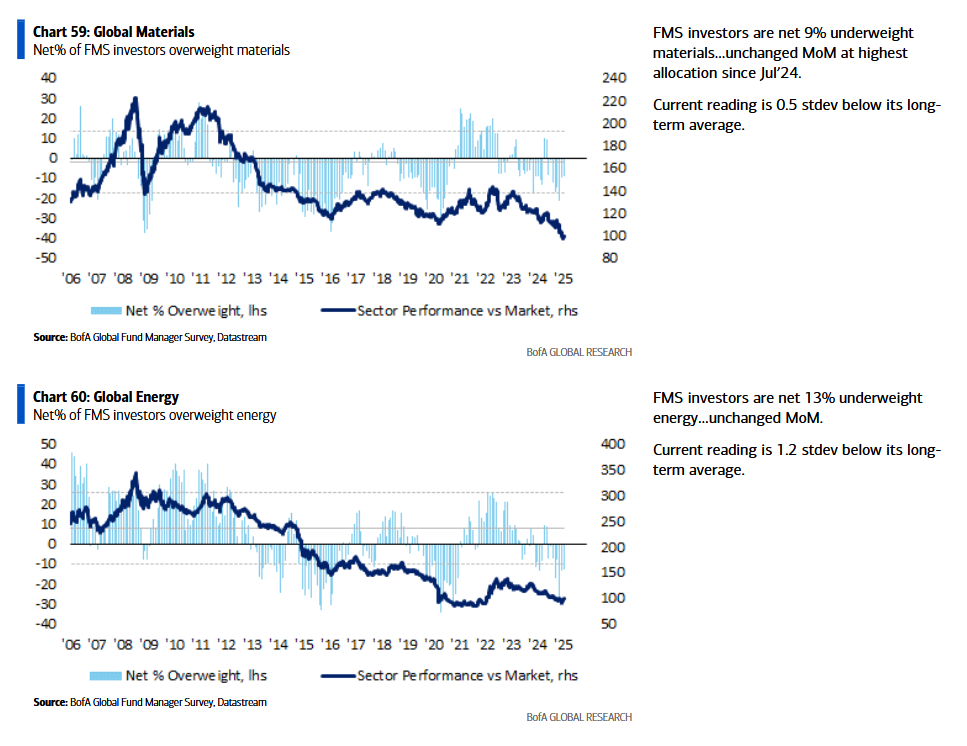

2) Managers are dramatically underweight Materials and Energy:

(Click on image to enlarge)

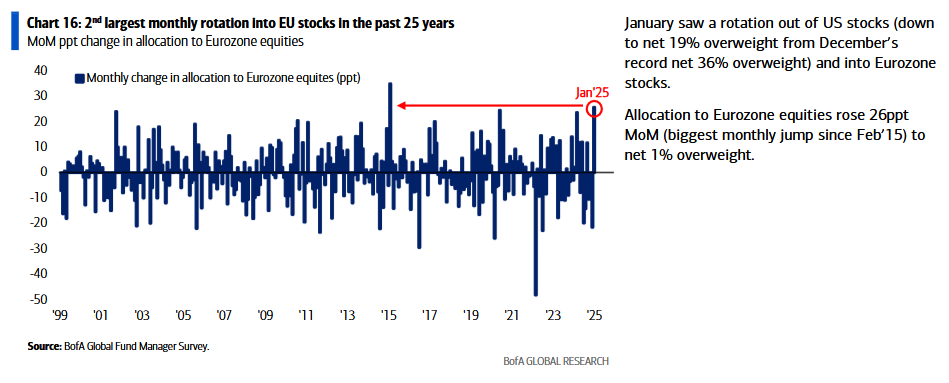

3) 2nd largest monthly rotation into EU stocks in the past 25 years:

(Click on image to enlarge)

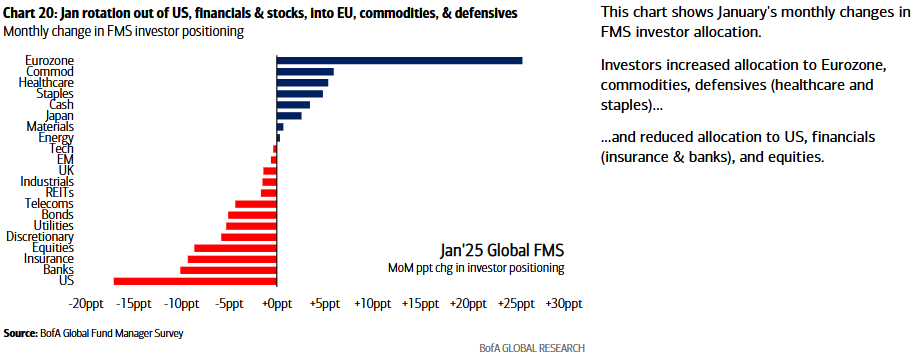

4) Rotation into Healthcare and Commodities starting in 2025:

(Click on image to enlarge)

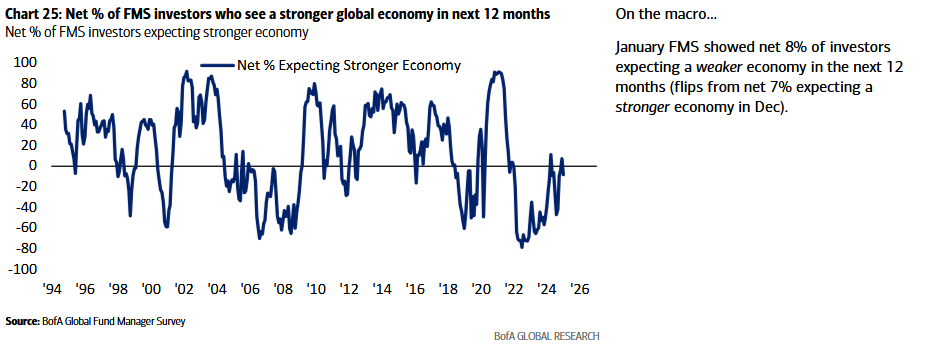

5) Macro outlook still has plenty of room to improve:

(Click on image to enlarge)

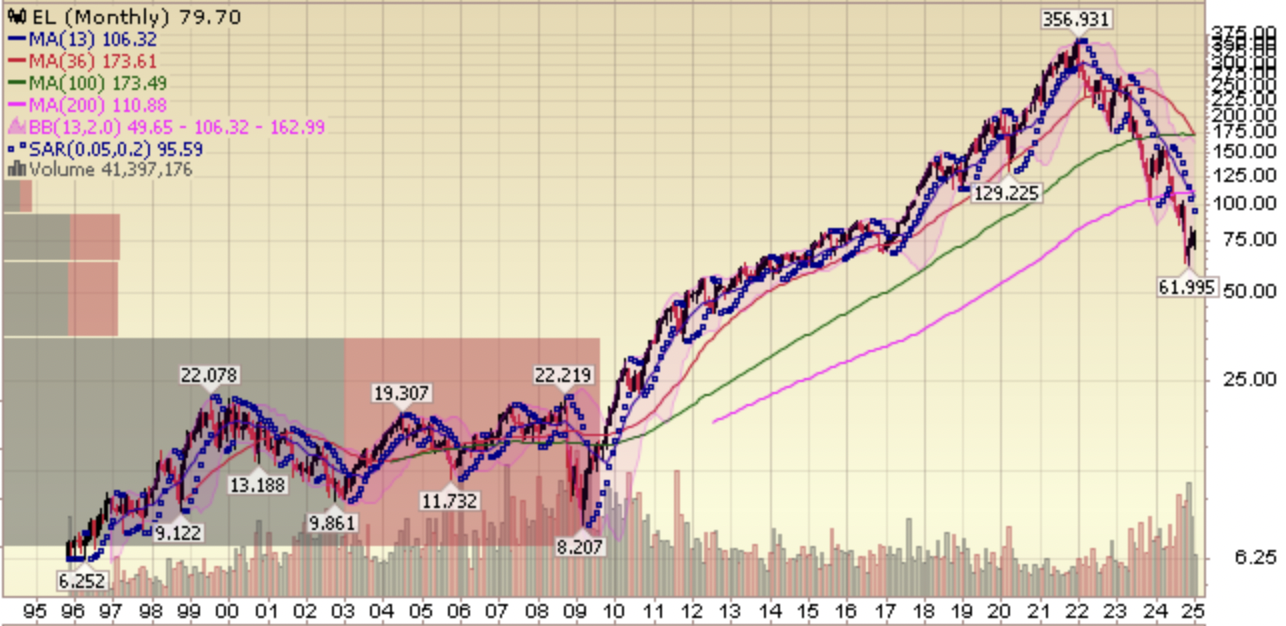

Estee Lauder (EL) Update

(Click on image to enlarge)

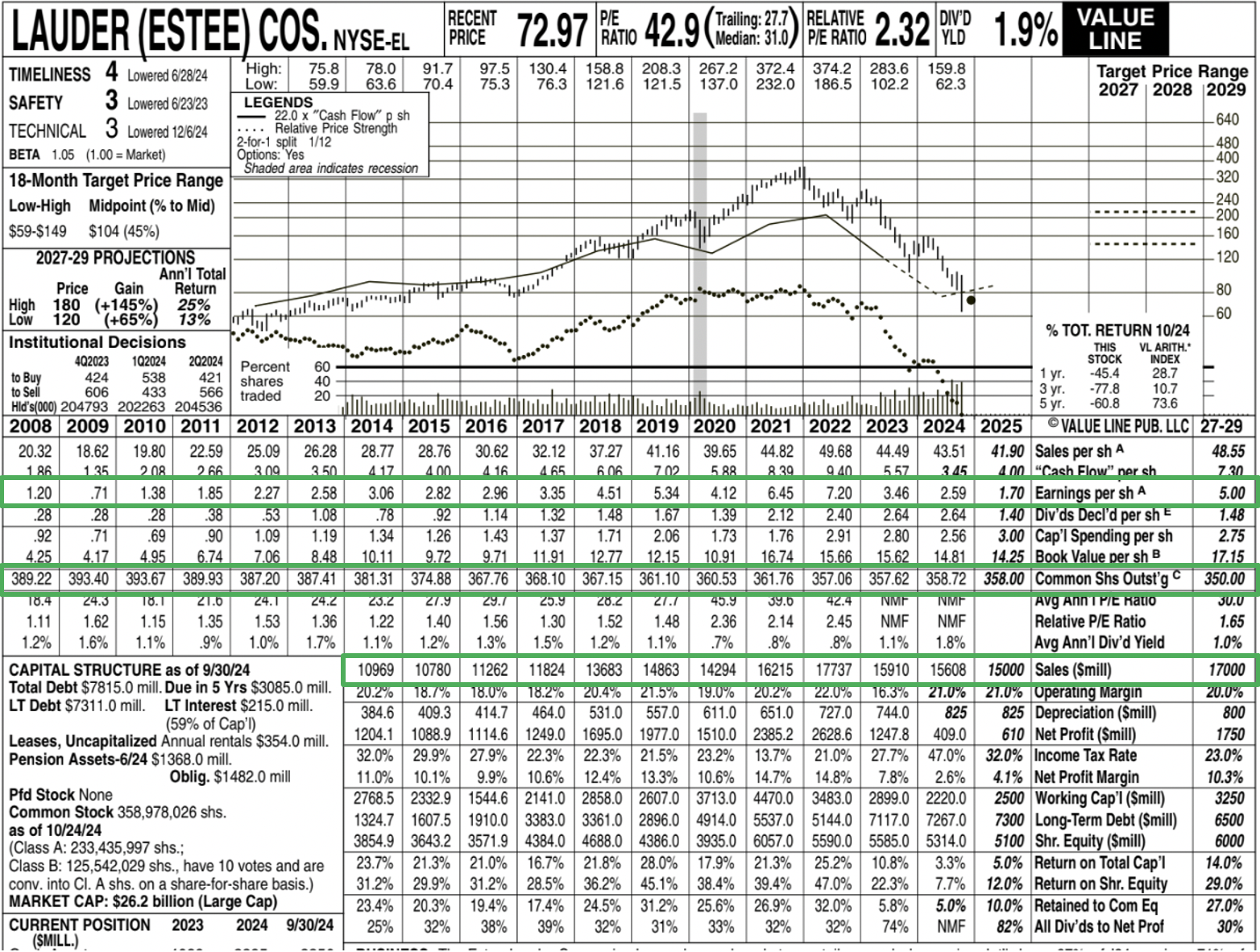

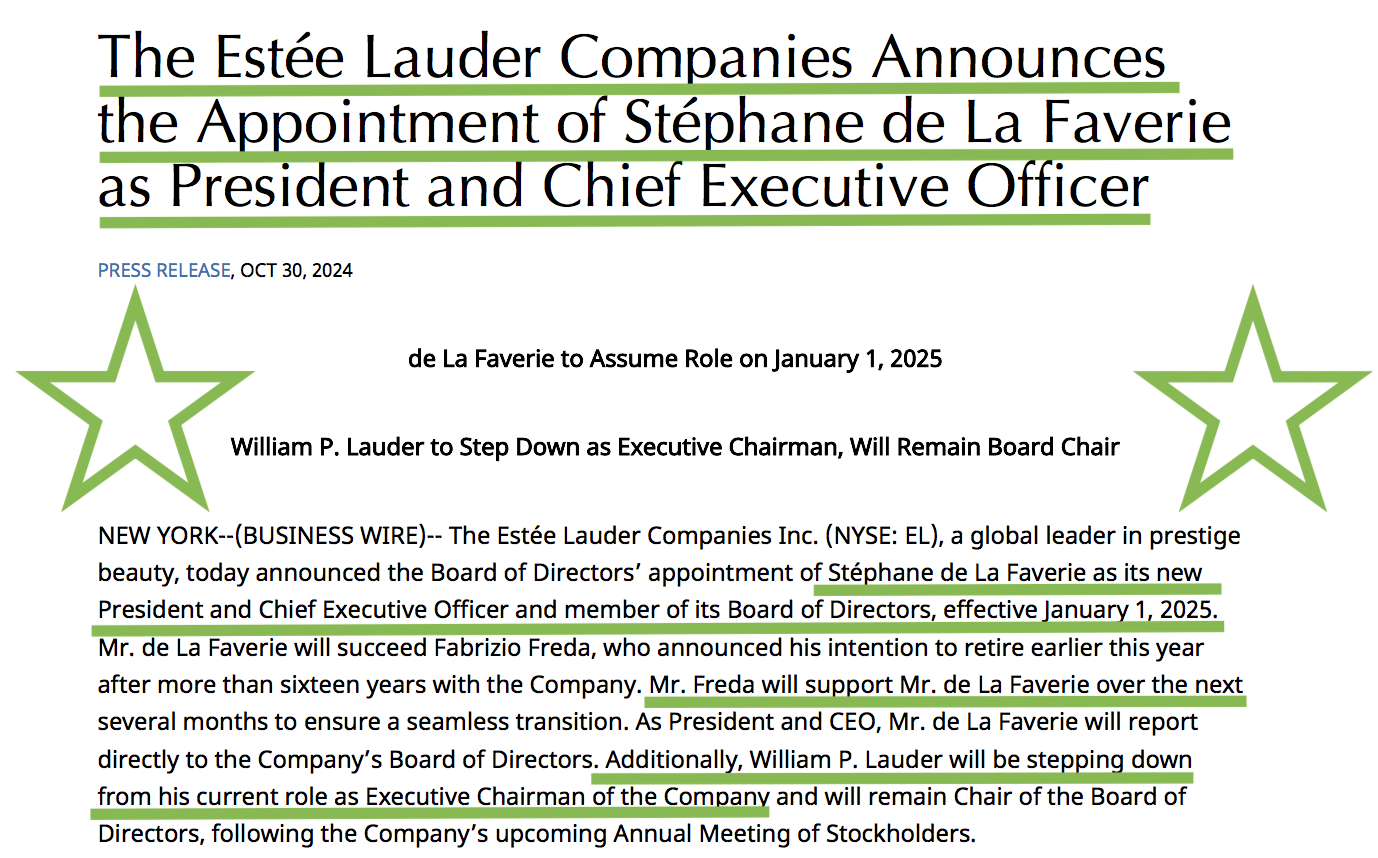

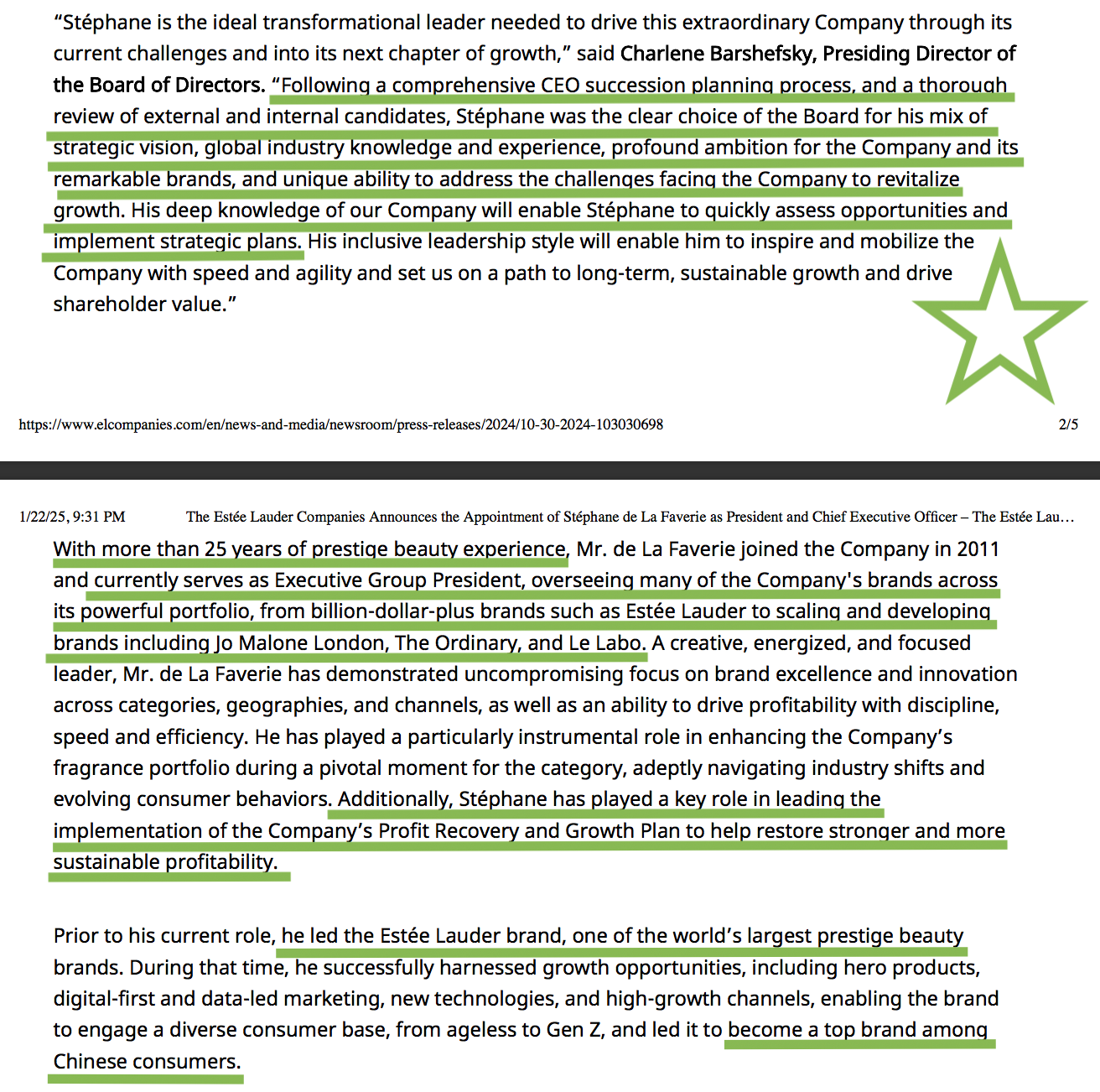

KEY CATALYST: NEW CEO STÉPHANE DE LA FAVERIE

(Click on image to enlarge)

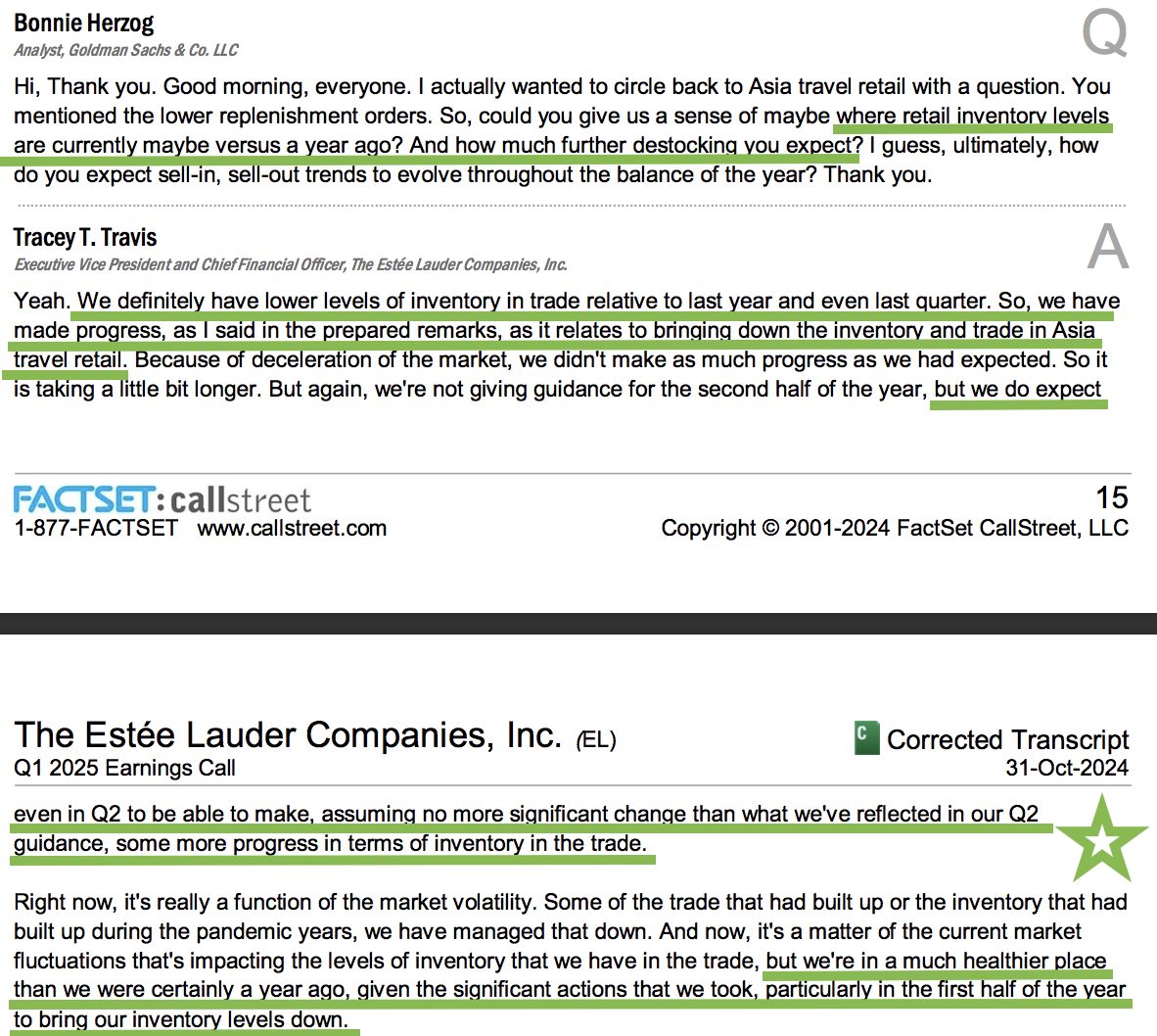

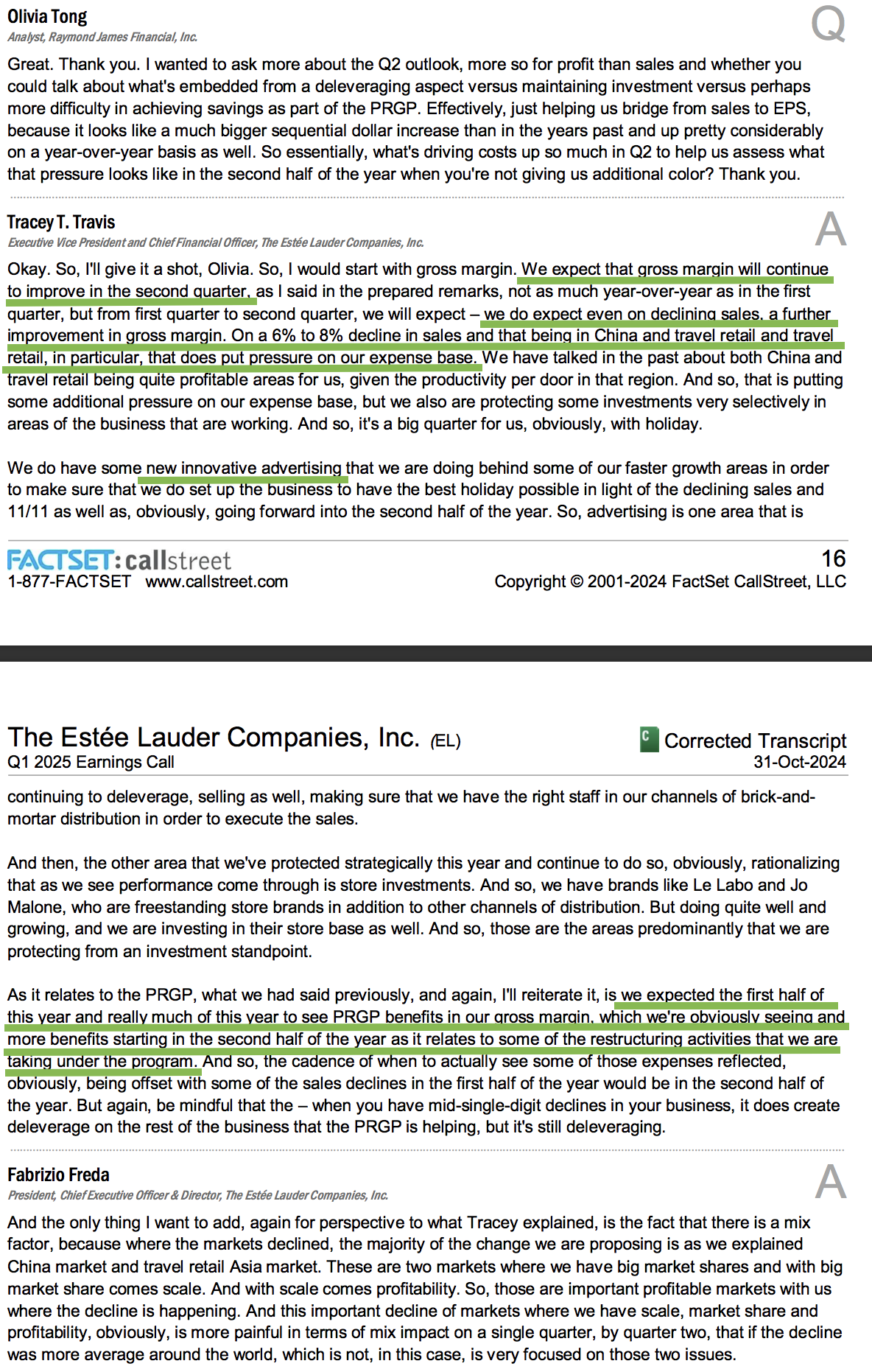

5 KEY POINTS FROM ESTÉE LAUDER’S Q1 2025 EARNINGS CALL

1) Beat Earnings Expectations: Adjusted EPS increased to $0.14, exceeding last year’s $0.11 and the high end of the outlook range by $0.04.

2) Improved Operational Efficiency: Gross margin improved by 310 basis points, supported by better inventory alignment and reduced obsolescence charges. Operating income rose by 33% to $144 million, with operating margin expanding 120 basis points to 4.3%.

3) Commitment to High-Growth Channels: Increased exposure to high-growth channels (Amazon Premium Beauty store, TikTok Shop).

4) China Stimulus Opportunity: New economic stimulus measures present medium to long-term potential for stabilization, and then ultimately growth in prestige beauty

5) Strategic Restructuring: Plans under the previously communicated PRGP are on track and advancing well, expected to deliver $1.1 to $1.4 billion of incremental operating profits by 2026.

(Click on image to enlarge)

General Market

The CNN “Fear and Greed” ticked up from 29 last week to 43 this week.You can learn how this indicator is calculated and how it works here: (Video Explanation)

(Click on image to enlarge)

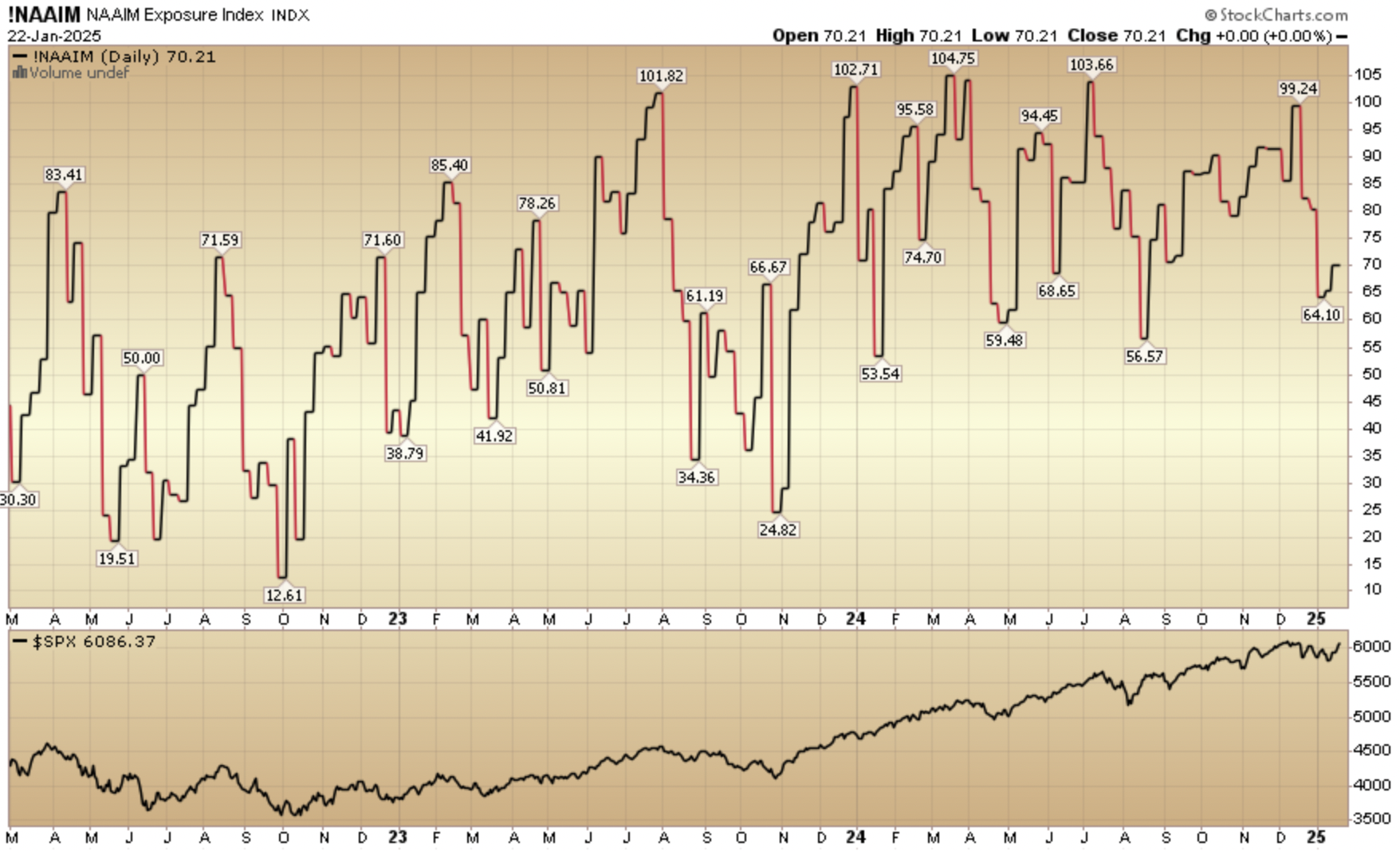

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) flat-lined to 70.21% this week from 65.38% equity exposure last week.

(Click on image to enlarge)

More By This Author:

Top Picks 2025: Boeing Co.

“Top Shelf” Stock Market (And Sentiment Results)

Power Up – 2025 Stock Market (And Sentiment Results)

Long all mentioned tickers

Disclaimer: Not investment advice. For educational purposes only: Learn more at more