Major Benchmarks Flat At Midday As Bitcoin Plummets

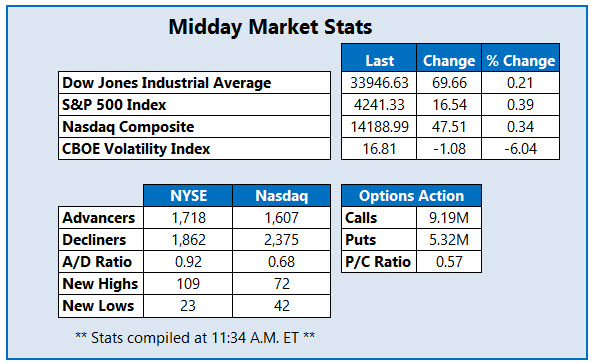

The major benchmarks are flat at midday, as investors wait for Fed Chairman Jerome Powell's appearance before the House of Representatives later today. Powell is expected to discuss lifting some of the emergency measures the central bank put in place during the pandemic. The Dow Jones Industrial Average (DJI) is modestly higher, erasing this morning's losses to add roughly 70 points, after notching its best day since March in the previous session. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are also registering slight gains, as the former sits less than 1% away from an all-time high.

Elsewhere, traders are closely monitoring Bitcoin (BTC), after the cryptocurrency fell to its lowest level in over five months, briefly slipping below the $30,000 mark and turning negative for the year, amid a crackdown from Chinese authorities. The crypto has since recouped some of these losses and was last seen testing the $32,000 level.

One stock attracting an unusual amount of options activity today is Huntsman Corporation (NYSE: HUN), up 3.5% at $26.64 at last check, after Scotiabank raised its price target to $34 from $33. So far, 8,233 calls and 165 puts have crossed the tape, or 26 times what is typically seen at this point. Most popular is the July 28 call, followed by the 27 call in the same series, with new positions currently being opened at the former. On the charts, the equity has careened lower since hitting a May 10 two-year high of $32.35. The 10-day moving average pressured shares lower, too, though today's pop has the stock eyeing a close above that trendline. Year-over-year, HUN has added 46.2%.

Near the top of the Nasdaq today is County Bancorp Inc (Nasdaq: ICBK), last seen up 45.3% to trade at of $33.98, after earlier hitting coming within striking distance of its 2017 record high -- just below the $36 level. The major bull gap came after news that Nicolet Bankshares (NCBS) will acquire the company for approximately $219 million. The transaction, which is expected to close in the fourth quarter, will form a company with pro forma total assets of $7.5 billion. Digging deeper, the equity has now broken through overhead pressure at the $26 mark, and is pacing for its biggest single-day percentage jump ever. In the last nine months, ICBK has risen 83.8%.

Meanwhile, New Concept Energy, Inc. (NYSE: GBR) is at the bottom of the New York Stock Exchange (NYSE) today. Shares are down 29.8% at $13.99 this afternoon, though a reason for this negative price action was not immediately clear. The equity has made some volatile moves this year, surging to a Jan. 28 of $30.99, after it became the target of Reddit traders. Shares pulled back to the $5 level shortly after that, and have stuck close to the level until yesterday's rally to the $9 mark. Longer term, the GBR carries a 441.6% year-over-year lead.