Main Street Capital: A Generous Dividend Payer Being Held Back By Rising Rates

Image Source: Pixabay

The Fed’s tight money policy is finally having its dampening effect on price inflation, stocks, and commodities. The US economy and Wall Street have resisted the Fed’s tight money policy, but they are finally succumbing to the reality of sharply higher interest rates. The action in Main Street Capital (MAIN), the Houston-based private investment firm, shows the impact that it is having, explains Mark Skousen, editor of Forecasts & Strategies.

It didn’t help to see Fitch, a rating service, downgrade US Treasuries to AA due to the excessive deficit spending by the Biden administration. Long-term rates are substantially higher than short-term rates (T-bills are yielding 5.3%). Historically, an inverted yield curve often spells trouble — the possibility of a recession is rising.

Consumer spending is still robust, rising over 6% during the past two quarters, but business spending (B2B) is down 9%. Many of our stocks and mutual funds are in a correction mode right now, but one bull market is still intact in commodities: Uranium.

Meanwhile, the yield on the benchmark 10-year Treasury Note recently topped 4.25%, the highest it has been in 15 years. And the 30-year mortgage rate is over 7%. This spells trouble in the stock market, which now must compete with bonds and money market funds. Stocks may continue to struggle in September, which is a notoriously volatile month.

Main Street Capital (MAIN)

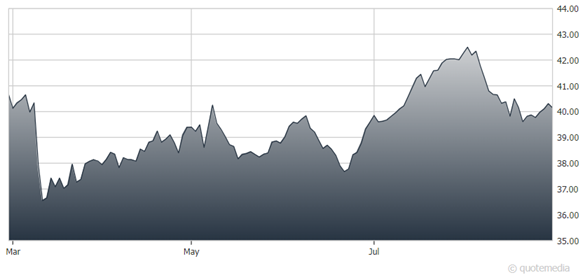

Take MAIN, for example. Last month, it reported quarterly earnings of $1.06 per share, 41% higher than its year-ago earnings of 75 cents for the same quarter.

It also paid its second 23-cents-per-share monthly dividend. MAIN has already paid $1.98 per share in dividends this year. Its total return is 16% year-to-date. Zacks Research recently marked it as a Strong Buy. And yet, the stock’s price was down in August. I see such price action as a buying opportunity.

About the Author

Mark Skousen is a financial economist, university professor, and author of over 25 books. Dr. Skousen was recently listed as one of the top 20 living economists in the world and is known as "America's Economist." In 2018, Steve Forbes presented him with the Triple Crown in Economics for his work in theory, history, and education.

Dr. Skousen is a Presidential Fellow at Chapman University in California, where he received the "My Favorite Professor Award" in 2019. He has worked for the government (CIA), non-profits (president of FEE), and runs FreedomFest, "the world's largest gathering of free minds," every July. He has also taught economics and finance at Columbia Business School and Columbia University.

Since 1980, Dr. Skousen has been editor-in-chief of Forecasts & Strategies, a popular award-winning investment newsletter. His other products include Five Star Trader, Fast Money Alert, Home Run Trader and TNT Trader. Dr. Skousen's bestsellers includeThe Making of Modern Economics, Investing in One Lesson, and The Maxims of Wall Street.

Based on Dr. Skousen's work,The Structure of Production (NYU Press, 1990), the federal government began publishing in Spring 2014 a broader, more accurate measure of the economy, Gross Output (GO), every quarter along with GDP.

More By This Author:

Q2 2023 Earnings: What The Data Showed And What's Coming NextMarket Challenges? Sure. End Of The Bull Market? Nope.

Gas Prices And Inflation Are Picking Up Again - Use These Strategies To Cope

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.