Mag 7 Earnings And DeepSeek: What Should Investors Know?

Photo by Steve Johnson on Unsplash

DeekSeek appears to have put a big dent in what everyone believed was a source of competitive advantage in the AI race for Tech leaders like Microsoft (MSFT - Free Report) , Alphabet (GOOGL - Free Report) , Amazon (AMZN - Free Report) , and others. And if we go by how Microsoft and Meta described the evolving AI competitive landscape on their respective Q4 earnings calls last week, we will most likely hear comparable commentary from Amazon and Alphabet as they come out with their December-quarter results this week.

Market participants have all along been skeptical of the investment case for the extraordinarily heavy spending by Microsoft, Alphabet, Amazon, and others on AI-centric data centers and related infrastructure. The issue all along has been these companies’ inability to articulate a clear case for how these investments will get monetized.

While a lot about DeepSeek’s actual cost in building and training its model is unknown, notwithstanding the announced figure of a few million dollars, the hundreds of billions of dollars that these companies are collectively pouring into the project appears to be overkill. Microsoft and Meta reiterated their spending plans and see the resulting data center capacity as giving them a strategic advantage in the long run. We can safely assume that Amazon and Alphabet will follow Microsoft and Meta on this crucial question.

While the market’s collective focus was mainly on the AI question for Microsoft and Meta, the former disappointed in its core results, with cloud guidance coming up short, while the latter showed plenty of operating momentum in operating results. Microsoft’s December-quarter earnings were up +10.2% from the same period last year on +12.3% higher revenues, while Meta’s earnings and revenues increased +48.7% and +20.6% from the year-earlier levels, respectively.

Apple and Tesla, the other Mag 7 players that also reported results last week, received favorable market reception. However, the positive market follow-through was likely less of a response to the core results and more of a sigh of relief at better-than-feared numbers.

China has emerged as a major risk in the Apple story, with tepid iPhone demand in that key market and the company’s continuing AI struggles taking center stage. Some anecdotal evidence suggests that some of Apple’s local Chinese competitors are giving it a lot tougher competition than in years past. On top of that is the prospect of tariffs, a far bigger issue for Apple than the rest of its Mag 7 peers.

Apple’s December-quarter earnings were up +7.1% on +4% higher revenues, while Tesla’s earnings and revenues for the period were up +15.7% and +2.1% from the year-earlier level, respectively. Net margins were up at Apple and Tesla, with Apple’s margins up 86 basis points from the same period last year while Tesla’s expanded 105 bps.

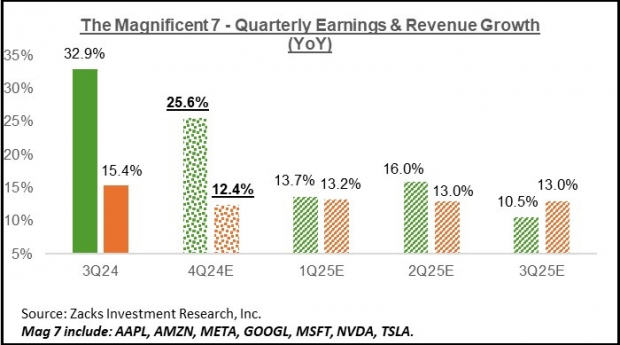

Take a look at the chart below that shows current consensus expectations for the ‘Mag 7’ stocks as a whole for the current and coming periods in the context of what they were able to achieve in the preceding period. The +25.6% earnings growth comprises actual results from the four group members that have reported and estimates for Alphabet, Amazon, and Nvidia (that haven’t reported yet).

Image Source: Zacks Investment Research

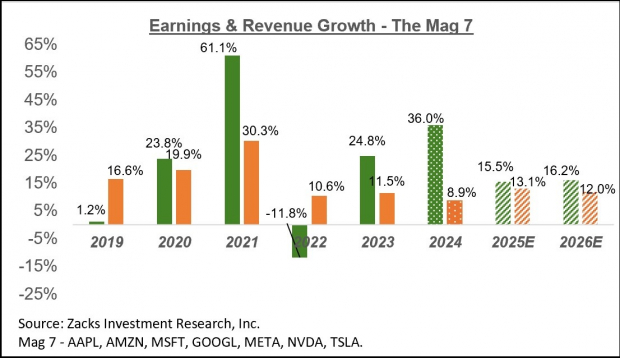

The chart below that shows the group’s earnings and revenue growth on an annual basis.

Image Source: Zacks Investment Research

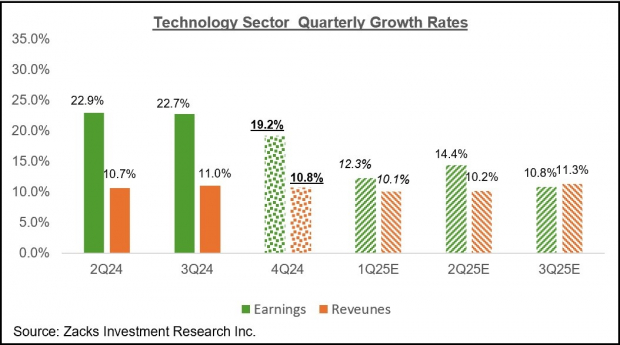

Beyond these Mag 7 players, total Q4 earnings for the Technology sector as a whole are expected to be up +19.2% from the same period last year on +10.8% higher revenues.

The chart below shows the sector’s Q4 earnings and revenue growth expectations in the context of where growth has been in recent quarters and what is expected in the coming three periods.

Image Source: Zacks Investment Research

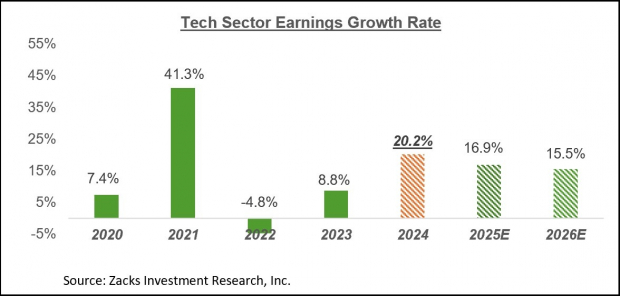

The chart below shows the sector’s growth picture on an annual basis.

Image Source: Zacks Investment Research

The Tech sector has enjoyed a favorable revisions trend for the last few quarters, with the Mag 7 stocks in the fore front of the rising estimates trend. The +16.9% earnings growth expected for the sector for 2025 at present is up from the +15.8% growth expected three months back.

Q4 Earnings Season Scorecard

Through Friday, January 31st, we have seen Q4 results from 179 S&P 500 members, or 35.8% of the index’s total membership. Total earnings for these companies are up +7.4% from the same period last year on +5.1% higher revenues, with 80.4% beating EPS estimates and 67% beating revenue estimates.

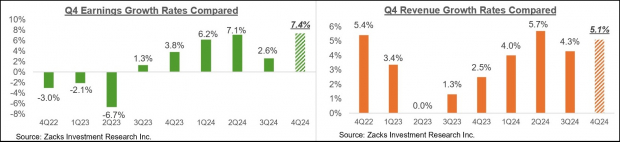

The comparison charts below put the Q4 earnings and revenue growth rates relative to other recent periods for the same group of index members.

Image Source: Zacks Investment Research

The comparison charts below put the Q4 EPS and revenue beats percentages relative to other recent periods for the same group of companies.

Image Source: Zacks Investment Research

Key Earnings Reports This Week

The 132 S&P 500 members on deck to report results this week include several blue-chip operators like Pfizer, Pepsi, Ford, and others, in addition to the aforementioned Mag 7 players (Amazon and Alphabet).

By the end of this week, we will have seen Q4 results from more than 63% of the index’s total membership.

The Earnings Big Picture

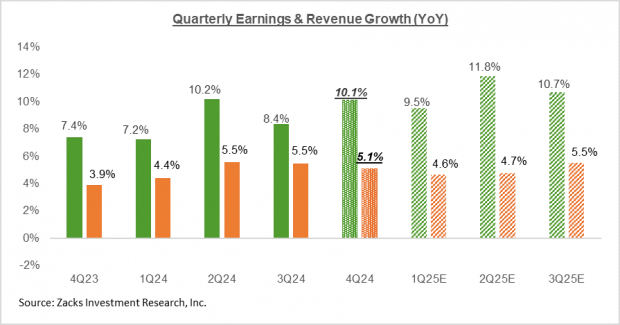

The chart below shows the Q4 earnings and revenue growth expectations in the context of where growth has been in the preceding four quarters and what is expected in the coming four quarters.

Image Source: Zacks Investment Research

Excluding the contribution from the Mag 7 companies, S&P 500 earnings would have been up +5.6% on +4.1% higher revenues.

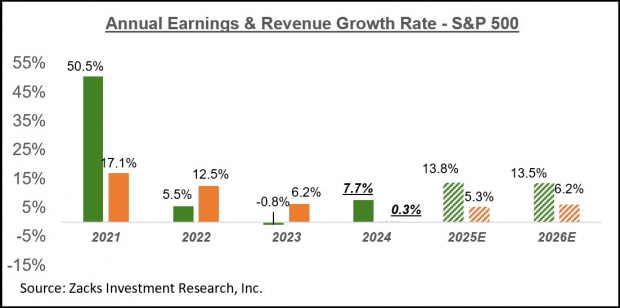

The chart below shows the overall earnings picture on a calendar-year basis, with double-digit earnings growth expected in 2025 and 2026.

Image Source: Zacks Investment Research

Please note that the very strong growth expected in 2025 is not driven by one or two sectors but is rather broad-based. All 16 Zacks sectors are expected to enjoy positive earnings growth in 2025, with 8 of the 16 Zacks sectors expected to achieve double-digit earnings growth.

More By This Author:

Broad-Based Sector Growth Expected For 2025

Mag 7 Earnings On Deck: A Closer Look

Earnings Results And The Trump Administration