Macro Briefing - Tuesday, March 25

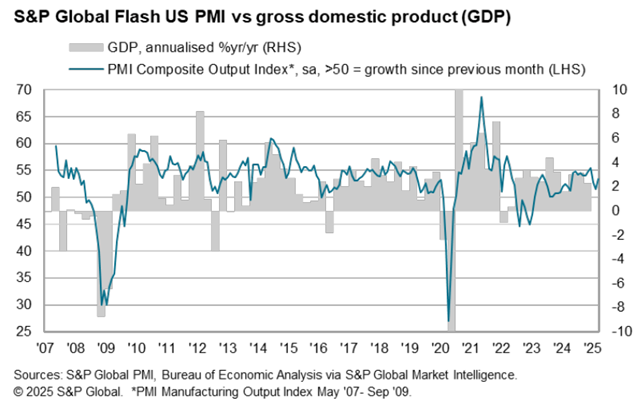

US business activity growth strengthened in March, rising to a 3-month high, according to US PMI Composite Output Index, a survey-based GDP proxy. A pickup up in growth for the services industry drove the improvement as activity in the manufacturing sector weakened. “A welcome upturn in service sector activity in March has helped propel stronger economic growth at the end of the first quarter,” says the chief business economist at S&P Global Market Intelligence. “However, the survey data are indicative of the economy growing at an annualized 1.9% rate in March and just 1.5% over the quarter as a whole, pointing to a slowing of GDP growth compared to the end of 2024.”

US economic activity rebounded in February, based on the Chicago Fed National Activity Index. “Three of the four broad categories of indicators used to construct the index increased from January, and two categories made positive contributions in February,” the bank reports.

The number of workers at government agencies targeted by DOGE looking for new jobs has surged, according to the job listing website Indeed. ““We’ve never seen something like this after a presidential administration and inauguration,” says Cory Stahle, an Indeed economist.

Atlanta Fed President Bostic says he expects only one rate cut this year. He tells Bloomberg he changed his forecast because inflationwill be “very bumpy” this year and likely to move sideways.

Barriers to open trade are rising across the world at the fastest pace in decades. As of March 1, there were 4,650 import restrictions in force among the Group of 20 leading economies, according to data from Global Trade Alert, a Switzerland-based nonprofit that tracks international trade policy. “We do seem to be on the threshold of a much broader if not all-out trade war,” says Eswar Prasad, professor of trade policy at Cornell University and a former International Monetary Fund official.

The recent surge in US stock market volatility may give way to a period of relative calm for the near term, based on the VIX Risk Indicator, a proprietary metric at TMC Research, a unit of The Milwaukee Company, a wealth manager. The current reading implies a muted period of stock market volatility for the immediate outlook.

More By This Author:

US Economy Is Slowing, But Recession Risk Remains LowMacro Briefing - Monday, March 24

Energy And Healthcare Stocks Are Big Winners This Year

Disclosure: None.