Macro Briefing - Monday, Nov. 24

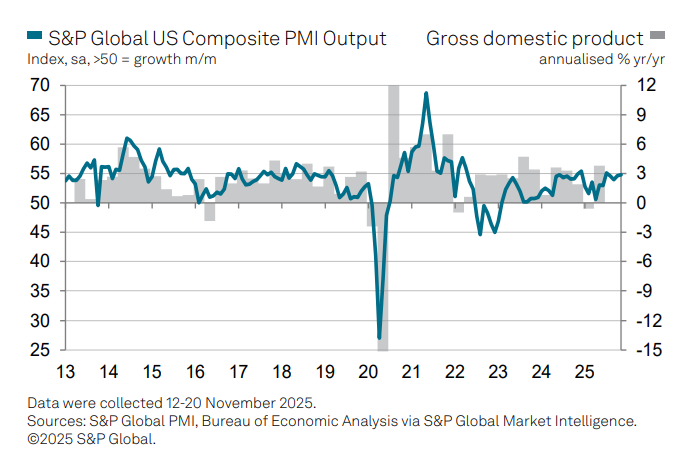

US business activity accelerated for a second successive month in November, according to the US Composite PMI Output Index, a survey-based GDP proxy. “The upturn looks encouragingly broad-based for now, with output rising across both manufacturing and the vast services economy,” said Chris Williamson, chief business economist at S&P Global Market Intelligence. “A marked uplift in business confidence about prospects in the year ahead adds to the good news.”

US consumer sentiment is near a 3-year low November as Americans expressed concerns about high prices, weaker incomes, and mounting layoffs. Year-ahead inflation expectations inched down from 4.6% last month to 4.5% this month. This marks three consecutive months of declines, but short-run inflation expectations still remain above the 3.3% seen in January.

New York Fed President John Williams said he expects the central bank can lower its key interest rate as labor market weakness poses a bigger threat than higher inflation. “I view monetary policy as being modestly restrictive, although somewhat less so than before our recent actions,” he said in remarks for a speech on Friday. “Therefore, I still see room for a further adjustment in the near term to the target range for the federal funds rate to move the stance of policy closer to the range of neutral, thereby maintaining the balance between the achievement of our two goals.”

The government will not publish standalone data for US inflation in October, the Bureau of Labor Statistics announced. Instead, the agency will publish partial Octeober CPI numbers, to the extent they’re available, in the November CPI report on Dec. 18.

“I view monetary policy as being modestly restrictive, although somewhat less so than before our recent actions,” Williams said in remarks for a speech in Santiago, Chile. “Therefore, I still see room for a further adjustment in the near term to the target range for the federal funds rate to move the stance of policy closer to the range of neutral, thereby maintaining the balance between the achievement of our two goals.”

Treasury Secretary Bessent said the US is not at risk of entering a recession in 2026. “I am very, very optimistic on 2026,” Bessent said in an interview on NBC News’ “Meet the Press.” “We have set the table for a very strong, noninflationary growth economy.”

Investors are pondering if bitcoin’s recent sharp decline is a risk-off signal for stocks. The cryptocurrency’s slide “soured the mood again on Thursday, and stocks quickly followed,” FT reports. “The big beast of crypto is now mainstream investors’ go-to barometer of vibes and speculative exuberance. “This could prove to be a very valuable tool for investors as we move on from the debate around whether we are in an artificial intelligence investment bubble,” writes FT columnist Katie Martin. Analysis by TMC Research shows a rising correlation between stocks and bitcoin in recent years, which offers a degree of support for using bitcoin as an input in monitoring risk appetite generally.

(Click on image to enlarge)

More By This Author:

Recession Risk Is Low, But Softer Labor Market Raises Red FlagsMacro Briefing - Friday, Nov. 21

Hiring Rebounded In September, But The Trend Is Still Weakening