LYFT Stock Is Too Cheap — Shorting Puts And Buying Long-Dated Calls

Photo by appshunter.io on Unsplash

Lyft stock (LYFT) is now very cheap. It’s trading at a near-term low point. This article will discuss a strategy with an expected return (ER) of over +25% in the next year.

LYFT stock last 3 months — Barchart — Jan. 2, 2025

I’ve written two recent articles about this, including this one on Jan. 1, 2025:

Lyft Shows Unusual Call Options Activity - LYFT Stock Looks Cheap to Call Buyers

Before this, I did a deeper analysis in GuruFocus:

Lyft is Gushing Huge Amounts of Free Cash Flow -- Someone Tell W

How to Play This?

LYFT stock is likely to turn around as it gets closer to releasing its Q4 earnings.

This article will show two ways to play this now for a long-term investor.

In essence, the play is two-fold:

- Repeatedly sell short out-of-the-money (OTM) cash-secured put options in near-term expiry periods, while also

- Buying long-dated in-the-money (ITM) call options, over one year out in expiration.

Shorting OTM Cash-Secured PUTs

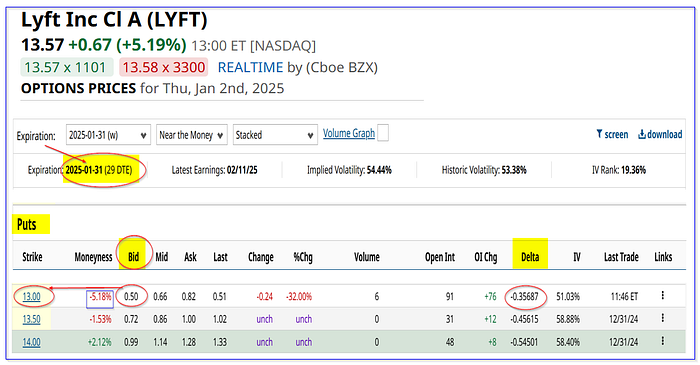

For example, today (Jan. 2, 2025) put options that expire on Jan. 31, 2025, expiration put option offer good yields:

LYFT puts expiring Jan. 31, 2025 — as of Jan. 2, 2025

The $13.00 strike price put options, which are 5% below today’s price of $13.57, have a bid-side premium of $0.50.

That means the short seller will make an immediate yield of 3.85%:

$0.50/$13.00 = 0.03846

On a practical level, this means the investor must first secure $1,300 in cash or buying power with their brokerage firm.

That acts as collateral if LYFT stock falls to $13.00 and the account is assigned to buy 100 shares at $13.00 on or before Jan. 31, 2025.

Then, after entering a trade to “Sell to Open” 1 put contract at $13.00 for expiration on Jan. 31, 2025, the investor’s account will receive $50.

$50 / $1,300 invested = 3.85%

So, for the next 29 days, as long as LYFT stock stays over $13.00, the account will not be assigned to buy (with the $13K secured as collateral) to buy 100 shares.

Note that if the account can do this for the next 3 months, the investor stands to make $150 or 11% on the trading price:

$150/$1,357 = 0.11

That is the same as buying 100 shares and seeing LYFT stock rise to over $15.00 per share:

$13.57 x 1.11 = 15.06 per share

Buying Long-Dated In-the-Money Calls

Another way to play this, including simultaneously with shorting OTM puts, is to buy call options that expire over one year out.

It’s best to do this at a strike price that is well below today’s price. That way, if the stock falls, there is still some intrinsic value left in the price you pay.

Moreover, the upside is much greater than simply owning the stock. Another advantage is that if you hold the call option for over 1 year and 1 day, your capital gains taxes are only 20%.

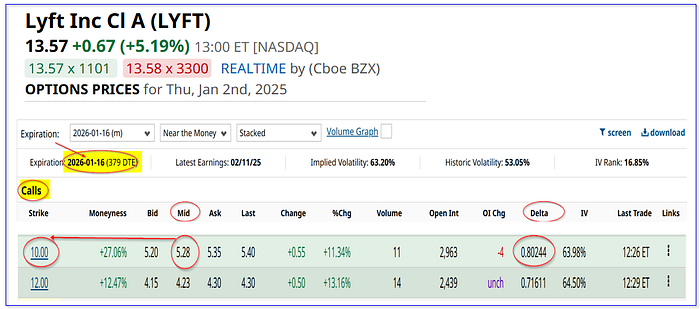

For example, look at the Jan. 16, 2026, expiration date call options.

The table above shows that the $10.00 strike price calls have a good premium:

LYFT calls expiring Jan. 16, 2026 — Barchart — as of Jan. 2, 2025

It costs just $5.28 in the mid-price. That means for a little more than $1,357 you would pay for 100 shares, you can buy 3 call options:

3 x 100 x $5.28 = 300 x $5.28 = $1,584

That gives your account exposure to 300 shares for just 16.7% more than 100 shares of the common stock

$1,584 / $1,357 = 1.167–1 = +16.7%

Leverage Effect

Upside. You get a huge leverage effect, on the upside and downside. But, since we believe that LYFT will rise, let’s look at that first.

Let’s say that LYFT reaches $18.00 in one year.

That means the intrinsic value of these $10.00 strike price calls will be at least $8.00 (i.e., $18.00–$10.00).

But, at least one month before these calls expire they will still have some extra value. That might be as much as 20% more:

$8.00 x 1.20 = $9.60

Therefore, here is the potential gain for the long-dated call investor:

$9.60 — $5.28 price paid for the calls = $4.32 profit

Given that the investor paid $5.28, the ROI is +81.8%.

In other words, the investor would make a potential gain of almost $1,300:

$4.32 x 300 = $1,296.

That is much greater than the rise in the stock price:

$18.00 / $13.57 -1 = 1.3264 = 0.3264 = +32.64%

Downside. If LYFT falls or stays flat, the intrinsic value of these calls will be equal to the trading price — $10.00.

So, if it stays at $13.00 by Jan. 16, 2026, or one month before, the call price will be slightly over $3.00, say $3.50.

That means the downside is $5.28-$3.50, or -$1.78, which is a loss of 33.7%.

300 x -$1.78 = -$534, or -33.7% of the $1,584 invested.

However, note that if you sell OTM puts you can improve your situation.

For example, shorting puts for 3 months and making $150 reduces this loss to just $384, or -24%. If you can get 10 months' worth of short puts your loss would be minimal:

$50 x 10 = $500 -$534 capital loss = -$34 = -2.15%

Summary — Expected Return

Note that shorting puts and also buying calls require two sets of capital. You need $1,300 to short the puts and $1,584 to buy the long-dated calls — $2,884 total.

So, one potential upside ROI is

$500 short put income (10 mo x $50/mo) + $1,296 = $1,796

$1,796 / $2,884 invested = +62.3%

A likely downside potential is this:

$500 short put income — $534 capital loss = $-34 / $2,884 invested = -1.117%

Obviously other scenarios could occur, but this might the highly likely possibilities. As a result, let’s assume that there is a 40% likelihood that the +62.3% upside occurs, and a 60% possibility that the -1.1% downside occurs:

Expected Return: (0.40 x 0.623) + (0.4 x -0.117) = 0.2493 -0.00468 = 0.254 = +25.4%

In other words, following this strategy leads to an ER of 25% over the next year. That is a pretty good return.

More By This Author:

Stock Market Surges 25% YTD in 2024: How Has Your Account Performed?Ammo, Inc. Cancels Its Planned Split Into Two Companies And Reaches Agreement With The Urvan Group

Ammo, Inc's Upcoming Spin-Off Of Its Ammo Manufacturing Business Presents A Value Opportunity

Mark R. Hake, CFA, does not provide financial advice and you should not rely on my analysis to buy or sell any stock. I am not undertaking to induce you to buy or sell any securities. I am ...

more