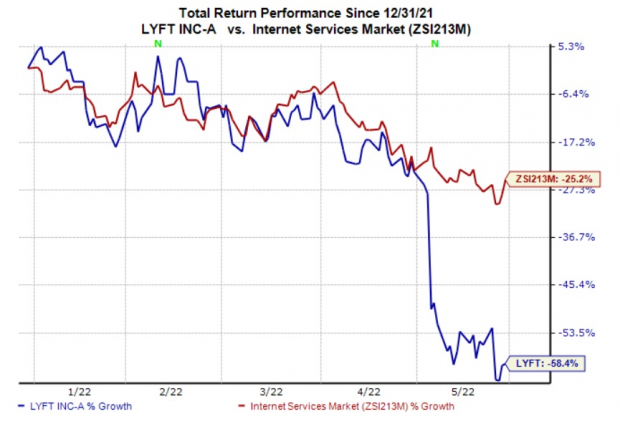

LYFT Shares Plunge Nearly 60% YTD Amid Multiple Headwinds

Shares of Lyft (LYFT - Free Report) have fallen 58.4% in the year-to-date period compared with the industry’s decline of 25.2%. The downside is primarily due to the prevalent pandemic-related woes and high costs associated with boosting driver supply.

Image Source: Zacks Investment Research

Despite improving from the coronavirus-induced slump, ride volumes continue to be significantly below the pre-pandemic level. During the first-quarter 2022 conference call, Lyft stated that its ride volumes were still down 30% from the fourth quarter of 2019. In certain key U.S. markets, it was down more than 50%. Omicron-induced woes hurt the company’s ride volumes significantly in January. Consequently, the company’s total revenues decreased 10% sequentially in the first quarter with a 5% decline in Active Riders.

Despite better-than-expected first-quarter results, Lyft’s shares slumped nearly 30% following the earnings release on May 3, primarily due to its bleak second-quarter guidance. Management announced that due to increased investments in drivers and marketing, it estimates adjusted EBITDA to be only $10-$20 million in the second quarter. Adjusted EBITDA was $54.8 million in the first quarter.

Lyft shares suffered a setback recently following news that it will slow down hiring and trim costs at some of its departments. Shares fell as much as 17.3% on May 24.

Rising gas prices amid the Russia-Ukraine war have also weighed on the LYFT stock. To help drivers combat escalating gas prices, the ride-hailing company collaborated with Payfare in March to launch a cash-back rewards program for its drivers on fuel purchases. With this partnership, Lyft drivers who use Lyft Direct debit card for purchasing fuel will receive increased cash back rewards of 4-5% until Jun 30, 2022. The company has levied a temporary fuel surcharge on rides, all of which is going to drivers.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more