Lowe’s Companies Inc: Is It A Buy? - Saturday, Nov. 16

Image Source: Pixabay

As part of an ongoing series, we will take a closer look at one of the stocks from our stock screeners and briefly review why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks on our screens is Lowe's Companies Inc.

Lowe’s Companies Inc (LOW)

Lowe’s is the second-largest home improvement retailer in the world, operating more than 1,700 stores in the United States, after the 2023 divestiture of its Canadian locations (RONA, Lowe’s Canada, Réno-Dépôt, and Dick’s Lumber). The firm’s stores offer products and services for home decorating, maintenance, repair, and remodeling, with maintenance and repair accounting for two thirds of products sold.

Lowe’s targets retail do-it-yourself (around 75% of sales) and do-it-for-me customers, as well as commercial and professional business clients (around 25% of sales). We estimate Lowe’s captures a high-single-digit share of the domestic home improvement market, based on US Census data and management’s market size estimates.

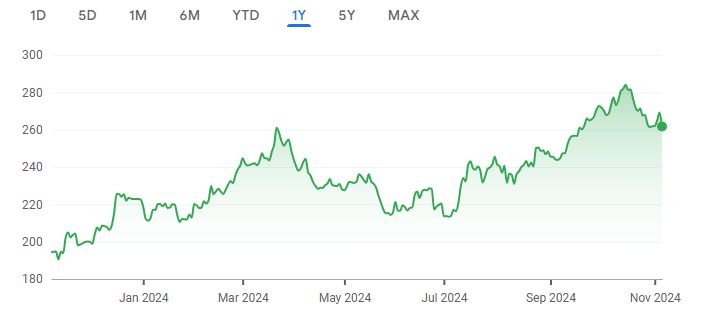

A quick look at the share price history over the past 12 months shows that the price has moved up approximately 34.75%. Here’s a brief review of why the company is undervalued. Note that the numbers provided are as of Nov. 14, 2024.

(Click on image to enlarge)

Image Source: Google Finance

Key Stats

- Market cap: $148.66 billion

- Enterprise value: $184.21 billion

Operating Earnings

- Operating earnings: $10.52 billion

Acquirer’s Multiple

- Acquirer’s multiple: 17.50

Free Cash Flow (TTM)

- Free cash flow: $7.58 billion

FCF/MC Yield Percentage

- FCF/MC yield percentage: 5.10

Shareholder Yield Percentage

- Shareholder yield percentage: 4.10

Other Indicators

- Piotroski F score: 7.00

- Buyback yield percentage: 2.40

- ROA (five-year average percentage): 5

More By This Author:

Knot Theory Meets Private Equity: The Takahashi-Alexander Model Explained

Lockheed Martin Corp (LMT) DCF Valuation: Is The Stock Undervalued?

Equinor ASA: Is It A Buy?