Lowe's - A Russell 3000 Star

Summary

- 100% technical buy signals.

- 17 new highs and up 9.62% in the last month.

- 66.52% gain in the last year.

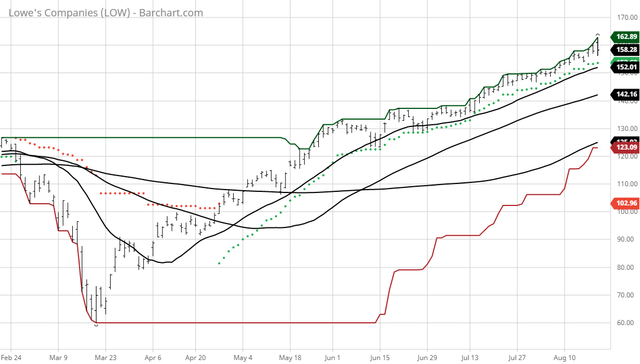

The Barchart Chart of the Day belongs to the home improvement company Lowe's (LOW). I found the stock by using Barchart to sort the Russell 3000 Index stocks by the most frequent number of new highs in the last month, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 4/28 the stock gained 52.96%.

Lowe's Companies, Inc. operates as a home improvement company in the United States, Canada, and Mexico. It offers a line of products for maintenance, repair, remodeling, and decorating. The company provides home improvement products in various categories, such as lumber and building materials, tools and hardware, appliances, fashion fixtures, rough plumbing and electrical, seasonal living, lawn and garden, paint, millwork, flooring, kitchens, outdoor power equipment, and home fashions. It also offers installation services through independent contractors in various product categories; extended protection plans; and in-warranty and out-of-warranty repair services. The company sells its national brand-name merchandise and private branded products to homeowners, renters, and professional customers; and retail customers comprising individual homeowners and renters.

(Click on image to enlarge)

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can, therefore, change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- 71.54+ Weighted Alpha

- 66.52% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 17 new highs and up 9.62% in the last month

- Relative Strength Index 75.01%

- Technical support level at 155.40

- Recently traded at 158.28 with a 50 day moving average of 142.16

Fundamental factors:

- Market Cap $119.22 billion

- P/E 25.26

- Dividend yield 1.39%

- Revenue expected to grow 9.60% this year and another 1.20% next year

- Earnings are estimated to increase 27.00% this year, an additional 5.50% next year and continue to compound at an annual rate of 20.00% for the next 5 years.

- Wall Street analysts issued 8 strong buy, 10 buy, 13 hold and 1 sell recommendation on the stock

- The individual investors monitoring the stock on Motley Fool voted 2,270 to 290 that the stock will beat the market

- 74,610 investors are monitoring the stock on Seeking Alpha

Disclosure: None.

Being stuck at a home is a great time for some DIY projects. No wonder $LOW is doing well.

What about $HD? How's Home Depot performing by comparison?