Love And Money In The Time Of COVID

(Click on image to enlarge)

Growth stocks, crypto, and hookups. YOLO. If only I was Dan Bilzerian.

Online dating leader Match (MTCH) and online brokerage Robinhood (HOOD) reported 2Q22 earnings Tuesday after the close. MTCH is the owner of Tinder – the preferred hookup app among the young – as well as a suite of other dating apps including Hinge and the newly acquired The League. (Where Tinder will set you back ~$14/month, The League costs > $100/month. Are you in The League?). HOOD is the preferred brokerage app among the young who love to trade growth stocks and cryptocurrencies.

Unfortunately, The Fed has ruined the party. (Despite his nickname, JPow isn’t that fun). MTCH gave a tepid outlook for 3Q22 with overall revenue of $790-$800 million – about flat with 3Q21 ($802 million). Tinder is maturing, having added only 500,000 users over the last three quarters to 10.9 million total. Hinge and The League are promising growth stories but they’re too small at the moment to move the needle.

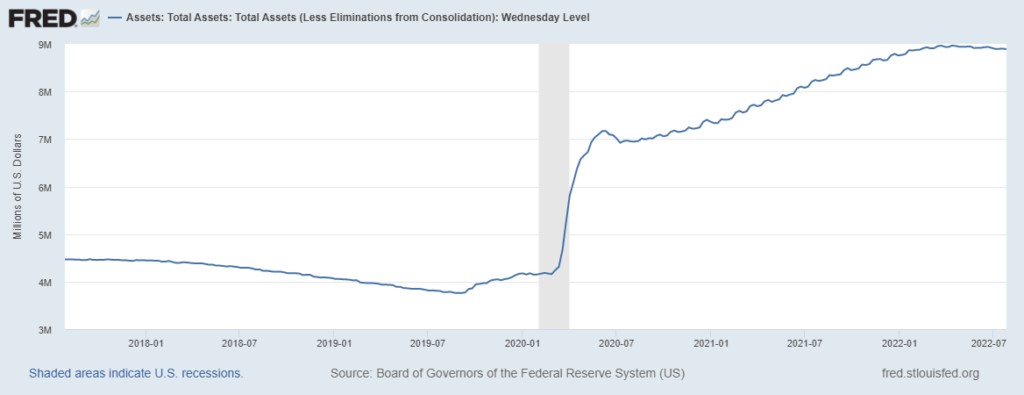

JPow is also to blame for the tough times at HOOD. Monthly Active Users (MAUs) declined from a peak of 21.3 million a year ago to 14.0 million at the end of 2Q22. Assets Under Custody (AUC) fell from $102 billion to $64 billion over the same period. (Gamestop and Dogecoin don’t work as well when The Fed isn’t barreling trillions of dollars into the markets like it was with Quantitative Easing).

2021 was quite the raging party. 2022 is the morning after.

(Click on image to enlarge)

YTD Performance 2022 (through 7/29/22):

— Top Gun Financial (@TopGunFP) August 1, 2022

Top Gun Long/Short: -7.18%

NASDAQ: -20.80%

S&P: -13.34%

More By This Author:

PYPL Is Not Going To $0

Everybody Knows It’s A Bear Market Rally

Is Uber Turning The Corner?