Lots Of Rhyming History Out There

“History doesn’t repeat itself, but it often rhymes” is a quote attributed to Mark Twain, even though there is no obvious evidence that he actually wrote or said it. No matter – it’s a great one, and quite applicable to the current state of markets and the economy. The debt ceiling, the potential path of Federal Reserve policy, and the current enthusiasm for artificial intelligence (AI) all echo history to some extent.

For better or worse, the latest debt ceiling dance has a wide range of historical precedents. As we noted earlier this month, “most [investors] have decided that they’ve seen this movie before, and remember that it always had a satisfying ending regardless of the suspense.”Yet two weeks on, the likelihood of a truly satisfying ending has diminished. We’re closer to a potential debt D-day then we are to the date when we made that assertion.

That brings a specific historical date into a sharper perspective. Yesterday we pondered whether an eventual debt ceiling resolution would be a “buy-the-rumor, sell-the-news” event, citing the precedent of 2011. During that self-inflicted crisis, a last-minute resolution was reached, but markets sold off anyway. That deal involved spending cuts – something demanded by Republican negotiators – and it is quite possible that investors could decide that the headwinds to the economy from fiscal shrinkage could outweigh considerations about long-term deficit spending.

It is of course important to remember that there are political reasons why we could sell off even after a deal is announced. Even if President Biden and Speaker McCarthy emerge from a meeting singing “Kumbaya” together, a verbal agreement still needs to be approved by both houses of Congress and signed by the President. We don’t have a deal until then. A verbal agreement does not avert a potential default.

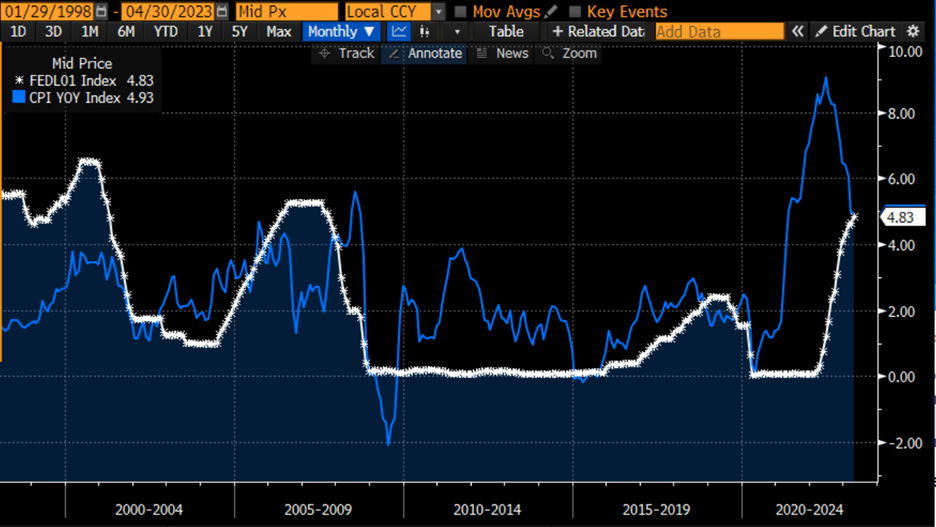

As for the echoes of Federal Reserve policy, while the persistent idea that the Fed would be willing to cut rates shortly after finishing the current hiking cycle does not have precedent in recent history, as shown in the graph below:

25 Years, Monthly Data: Effective Fed Funds Rate (white), CPI Year-Over-Year Change (blue)

(Click on image to enlarge)

Source: Bloomberg

We can see that over the past 25 years, the peak rate reached at the end of a hiking cycle tends to persist for 6-9 months. There is no time this century when the Fed simply reversed course after hiking rates. That does have an unfortunate precedent in the 1970s, which of course was the last time that the Fed had to reckon with a period of persistently high inflation. Consider the following graph:

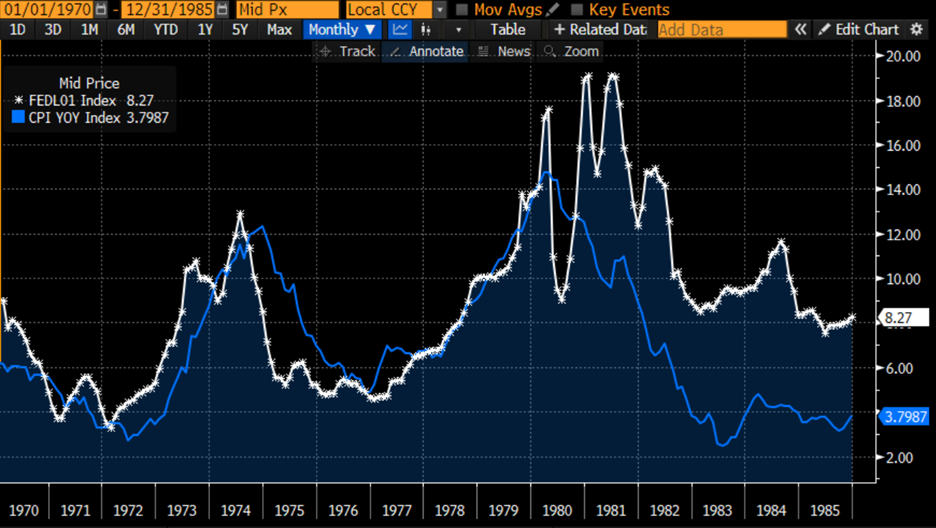

1970-1985, Monthly Data: Effective Fed Funds Rate (white), CPI Year-Over-Year Change (blue)

(Click on image to enlarge)

Source: Bloomberg

The Fed rate cuts of the early ‘70s by the Burns-led Fed are blamed for stoking inflation in the ensuing years, leading to eventual hikes. We can see that the Fed reversed course quickly in 1974, but that was in response to the economic shock caused by the first Arab oil embargo. The dip in 1979 should be the bigger concern. The Fed kept rates relatively low throughout the mid-‘70’s, but that allowed inflation to resurge. In the final months of Miller’s term as Fed Chair, he sharply raised rates, then halved them just before Volcker took office. It is true that he moved rates up and down during the early part of his term, but both the funds and inflation rates were remarkably high by current standards.

It would be disingenuous to think that Chair Powell and his colleagues at the FOMC are unaware of the historical precedents. That’s why it seems more reasonable to think that recent rate history is more likely than the gyrations of the ‘70s-‘80s.

As for the AI craze, it has a long way to run, but it also has resonance with prior history. The most obvious recent precedent is to blockchain and crypto. Nvidia (NVDA) was the poster child for the technology that could power the computers used in crypto mining and blockchain. When that petered out, so did NVDA and a host of others. Now NVDA is in a similar role as we discuss AI advances, only this time it is accompanied by a host of mega-cap technology stocks like Microsoft (MSFT), Alphabet (GOOG, GOOGL), AMD, and others. It has also become almost mandatory for companies, regardless of industry, to discuss their plans for incorporating AI into their business.

The latter feature reminds me of the heady days of the internet bubble. There were of course that era’s mega-cap winners, but there became a point when every company began to announce its plans for websites and internet commerce. The logic wasn’t simply commercial – a stock could get a quick bump simply by announcing an upcoming website.

In an era when almost every company, large and small, operates a website, it may seem crazy that a stock could be propelled by enthusiastic investors simply on the prospect that one could be planned. Perhaps when AI writes this daily note, it will look back to the days when simply announcing AI plans were a benefit to one’s stock price. The internet lived up to its perceived promise, even if some of the early beneficiaries did not. The same could easily be true for AI, which is likely to be valuable even if the hype might be overblown in the short-term.

As we see, there is no shortage of currently rhyming history affecting the markets.

More By This Author:

Would A Debt Ceiling Resolution Be A “Sell-The-News” Event?

Asymmetric Risks And VIX

Expectations Of Bipartisanship Rise On The Back Of A Seasoned President Biden

Disclosure: DIGITAL ASSETS

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to ...

more