Look For These 5 Energy Stocks To Raise Dividends In January

Now that the book is closed on 2019, next up for the stock market will be individual company earnings reports for the fourth quarter and full year. I recommend dividend-paying stocks based on the fundamental strengths if the underlying businesses. Earnings reports are the four times a year when investors get to see real results, including revenue, profits, and free cash flow.

One leading indicator of the actual earnings news will be any dividend announcements that are sent out before the earnings release date. The practice of early dividend announcements is prevalent in the energy midstream sector.

Since I focus on dividend-paying stocks, the early January dividend announcements give me a peek on how individual midstream company management teams feel about their business prospects. The dividends declared by the bellwether companies in the sector give an early snapshot of what to expect when earnings come out a couple of weeks later.

Here are five companies whose upcoming dividend announcements may portend good or not so good news when earnings are released and for the remainder of 2020.

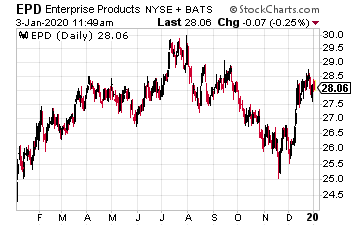

Enterprise Product Partners LP (EPD), with a $61 billion market cap is the largest midstream company organized as a master limited partnership (MLP).

EPD has increased its dividend every quarter for 61 straight quarters. In late 2017, the company lowered its dividend growth rate from a 5% annual rate down to a 2.5% annual growth rate. The move was to retain cash flow to fund growth projects.

A boost in the EPD dividend growth rate would be a strong positive for the MLP sector. The next dividend will be announced on about January 15. EPD currently yields 6.2%.

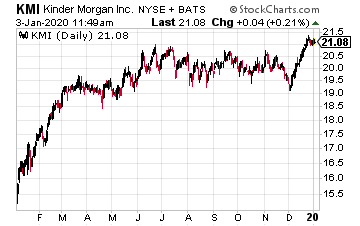

Kinder Morgan Inc. (KMI) slashed its dividend by 75% to start 2016, which was the bottom of the energy sector crash. The company restarted dividend growth in 2018 with a 60% increase.

For 2019, Kinder increased the dividend by 25%. Management has stated they expect a similar increase for 2020. Kinder Morgan was one of the first midstream companies to give up on the MLP business structure.

The KMI dividend announcement will also be around mid-January. The shares currently yield 4.7%.

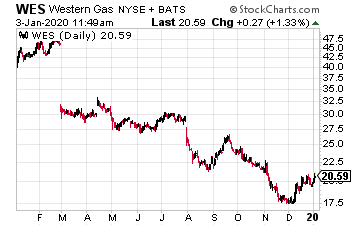

At the start of 2019, Western Midstream Partners LP (WES) cut its dividend by 37%. Then the company proceeded to grow the dividend each of the next three quarters. The trigger for the dividend cut was the merger of Western Midstream Partners and its publicly traded general partner, Western Gas Equity Partners LP (WGP).

Post-merger, the company went with the WGP dividend rate. WES investors received additional new shares that kept their dividend income level.

Through 2019, cash flow and dividend growth were lower than the guidance given with the merger announcement.

The dividend announcement around January 20th will give a good picture of how the company views its growth prospects for 2020. WES yields 12.4%.

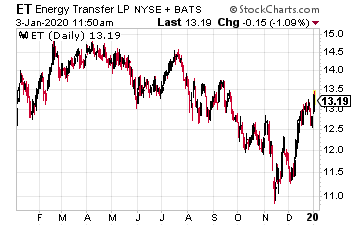

Energy Transfer (ET) has paid a level dividend since the “simplification” merger in 2018 that combined four MLPs under the same management into a single company.

The $0.305 quarterly dividend has been paid for six consecutive quarters. Investor expectation is that ET will start growing its dividend in 2020.

For the 2019 third quarter, distributable cash flow was 1.88 times the dividend rate, giving plenty of room for a dividend increase.

ET will announce its next dividend near the end of January. The shares currently yield 9.5%.

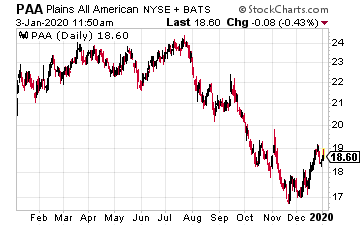

Plains All American Pipeline LP (PAA) will be one of the first MLPs to declare its 2020 first-quarter dividend, with the announcement likely to be released later this week or early next week.

After significant financial restructuring to retain cash flow and pay down debt, Plains announced in April 2018 its first dividend increases after slashing the payout by 45% in Fall 2017.

Last year the dividend was bumped up by 25%. With over two times cash flow coverage of the current dividend rate, I am curious to see if Plains returns to a quarterly dividend growth pattern. PAA yields 7.8%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more

Hi Tim, what do you think of $WES now in light of the global pandemic?