Linde Plc: Value-Added Merger For Investors

Summary

- Merging with Praxair to become a $90B leader.

- Operating margin and profits increasing, bringing positive outlook for 2019

Several months ago, Linde plc (LIN) announced that will become a massive player in the gas industry with Praxair. The business has done relatively well in the past quarter with profit increasing, pleasing investors. Historically, LIN has distributed good payouts to its shareholders, to reach a 2% yield. While this figure isn’t the shiniest one, management does intend to continue rewarding its investors, with both payouts and good governing. Many are still awaiting on the merger’s results to make a decision regarding whether they want it or not, but if everything goes right, investors might just increase the cost of their investment!

Understanding the Business

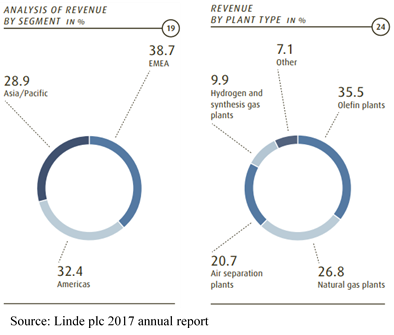

Linde PLC is based in the United Kingdom and built a reputation into the industrial gases and engineering industry. In 2017’s exercise, the company reported revenue of €17.113B with operating margins of 24.6%. That revenue figure came primarily from its gases division taking 87% and engineering segment taking the remaining 13%. On a geographical scale, sales are remarkably balanced: 39% from EMEA, 29% from Asia/Pacific area and 32% from the Americas.

Through its 2018 year, LIN merged with Praxair, taking their market capitalization to €78B (or $90B). This new alliance took over the existing leader, Air Liquide (EPA: AI), which gained the top spot after its Airgas takeover back in 2016.

Today, LIN expands its activities through more than 100 countries, employing an impressive 80,000 workers.

Growth Vectors

Source: Ycharts

One of the major growth vectors that LIN possesses at the moment still relies on its recent merger with Praxair. With a fairly new deal, bringing together billions in revenue, I believe there will still be many synergies to realize, including cost reduction, distribution network efficiency, technology implantation and so on.

In addition, with such consolidated market shares, LIN benefits from many growth opportunities in emerging markets. As a result, the company is easily able to expand its activities. Recent examples include the new Hannover hydrogen facility going into operations, or being awarded a huge contract, for the largest LNG plant in China.

Latest quarter in a flash

On November 14th, the company reported the following results:

- Non-GAAP EPS of €32

- Operating profit was €301B, a 4.2% increase

- Declared dividend of 0.825/share

Dividend Growth Perspective

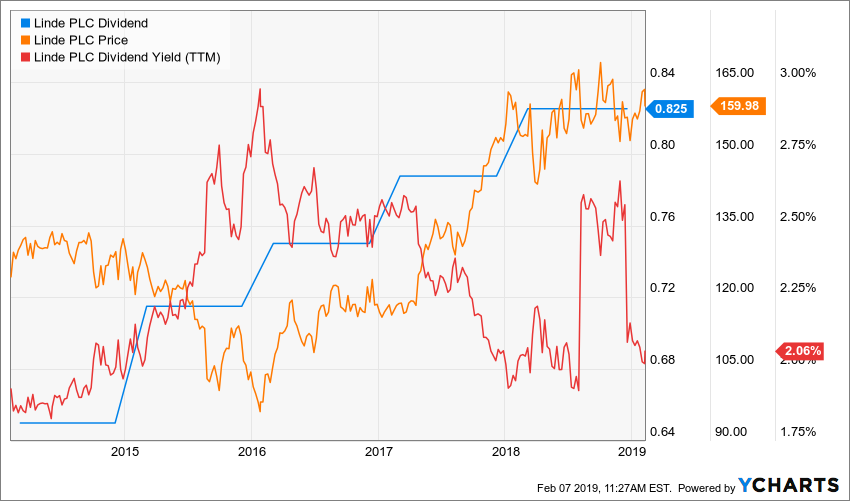

LIN’s stock is in its 26th year of dividend increase. Management’s intention looks favorable to investors as to their efforts of keeping this figure up. While increases might not be substantial, they’re still appreciated!

Source: Ycharts

As you can see on this chart above, the dividend yield is not going through the roof. At a 2% yield level, LIN is right in the middle of the Production/exploration and the distribution industries. I would not expect this figure to fluctuate much going forward, but with a recent merger, investors can anticipate a bit more volatility.

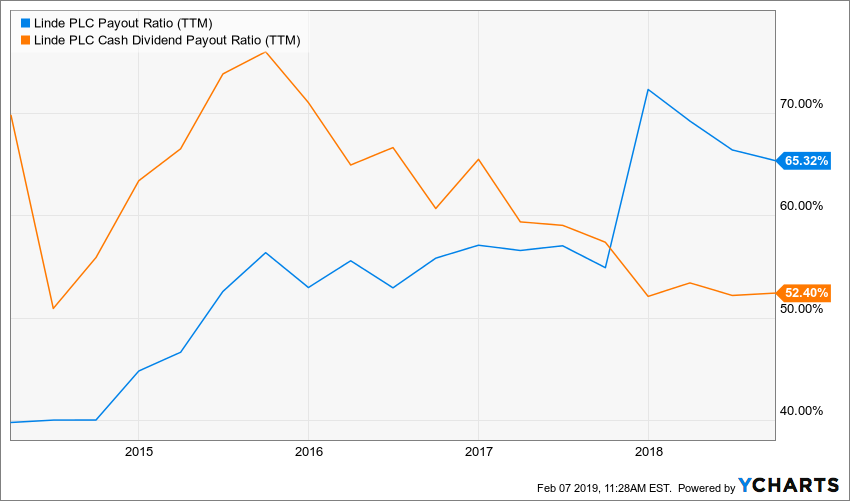

Source: Ycharts

The payout figure does not ring any alarms either. We see the same result, being in the middle of the 2 previously mentioned industries regarding payout levels. Around half of their available cash is distributed, while the other half is reinvested through their operations.

Potential Downsides

Now flipping the medal over, a merger is a risky business. A lot can happen while trying to combine two entities together. Whether it’s regulatory (ie: Competition Bureau or Federal Trade Commission), environmental or plainly from two different ways of doing business, many factors come into play when considering a merger.

In addition to those factors, keep in mind that every action, possible lawsuits, and negative publicity will be transposed to the other business once merged. This is where thorough due diligence is needed, which in turn, puts pressure on cash available and transaction fees.

Valuation

Of course, when looking at the below chart, one could guess it is due to the merger. The good thing is, investors seemed to be pleased with the announcement. Bad thing is, the opportunity is probably gone by now.

Source: Ycharts

To find out a bit more about its real value, we’re using a DDM. The model uses a $3.30 annual payout, with a 5% growth over the course of its activities. A Standard 9% discounting rate is applied to the figures.

| Input Descriptions for 15-Cell Matrix | INPUTS | ||

| Enter Recent Annual Dividend Payment: | $3.30 | ||

| Enter Expected Dividend Growth Rate Years 1-10: | 5.00% | ||

| Enter Expected Terminal Dividend Growth Rate: | 5.00% | ||

| Enter Discount Rate: | 9.00% | ||

| Calculated Intrinsic Value OUTPUT 15-Cell Matrix | |||

| Discount Rate (Horizontal) | |||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $138.60 | $103.95 | $83.16 |

| 10% Premium | $127.05 | $95.29 | $76.23 |

| Intrinsic Value | $115.50 | $86.63 | $69.30 |

| 10% Discount | $103.95 | $77.96 | $62.37 |

| 20% Discount | $92.40 | $69.30 | $55.44 |

Please read the Dividend Discount Model limitations to fully understand my calculations.

Intrinsic value given by the model shows an $87 level, which is way lower than what investors are currently paying on the stock market. LIN might indeed be overvalued. Keep in mind that the model is static with its input values and very sensible to them.

Final Thought

Linde is now becoming a pillar in its industry with this recent merger. Management and the business activities seem to be at that breaking point where they needed that boost in order to unlock new potential. Of course, greater returns are to be expected, along with greater risks. Only time will tell us if the synergies and activities successfully merged to unlock value for the business and its shareholders.

Now for the said, investors! While management expressed their will to continue handing out dividends, the next few quarters might be rocky ones. As mentioned earlier, such important transaction puts a lot of pressure on cash available, which in turn might limit possible payouts.

Disclosure: We do not hold LIN in our DividendStocksRock portfolios.

Additional disclosure: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or ...

more