Lilly Shares Tumble As Weak Weight-Loss Pill Data Overshadows Strong Earnings

Image Source: Pexels

Eli Lilly shares plunged in premarket trading after disappointing results from its new weight-loss drug (a pill, rather than an injection) overshadowed strong second-quarter results and raised full-year guidance.

Starting with the bad news: The topline data from the 72-week trial of orforglipron was underwhelming. Patients on the highest dose lost 11.2% of their body weight, compared to 2.1% for placebo. For comparison, Novo Nordisk's Wegovy demonstrated an average of 15% weight loss over 68 weeks in late-stage trials, while Lilly's Zepbound was around 20%.

Orforglipron's results fall short of the current standard set by Wegovy and others, overshadowing strong second-quarter results and an increased full-year guidance.

Here's a summary of Lilly's second-quarter results:

Adjusted EPS: Came in at $6.31, a sharp increase from $3.92 a year ago. This shows strong profit growth.

Revenue: Tops $15.56B, up 38% year-over-year, and beat the $14.7B Bloomberg Consensus estimate.

Product Highlights:

Zepbound (obesity drug): Generated $3.38B, up 46% quarter-over-quarter, and beat the estimate of $3.07B.

Verzenio (cancer drug): Revenue was $1.49B, up 12% y/y, slightly misses the $1.52B estimate.

Mounjaro (diabetes/obesity): Brought in a massive $5.20B. It remains a blockbuster.

Other Notables:

- R&D Expenses: Spending rose to $3.34B, up 23% y/y, slightly above the estimate of $3.2B, indicating continued high investment trends in pipeline development.

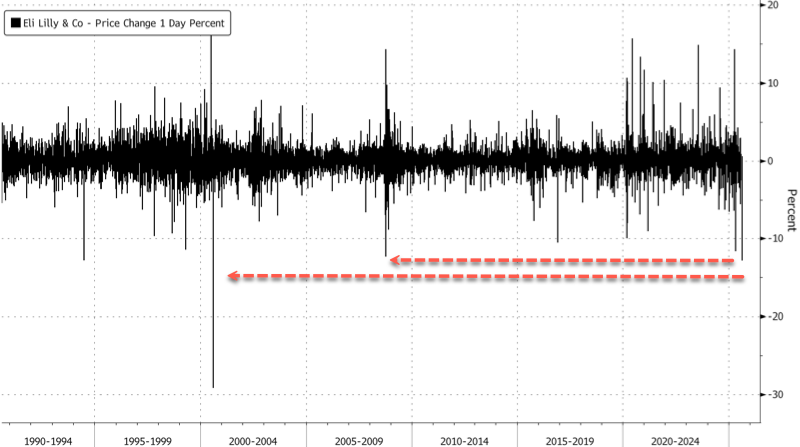

In markets, Lilly shares in New York plunged as much as 12% in premarket trading. If the losses hold through the cash session, sustaining at least a 12.35% decline (last seen on Oct. 9, 2008), then it would mark the largest single-day drop since the 29% crash on August 9, 2000.

Wall Street also overlooked Lilly lifting both sales and profit forecasts for the year:

- Revenue: Lilly now expects to bring in $60B to $62B this year, up from its previous forecast of $58B to $61B. Bloomberg Consensus estimate: $60.07, so the new guidance is slightly more optimistic than what Wall Street was expecting.

- Adjusted EPS: Raised to $21.75 to $23.00, up from $20.78 to $22.28, signaling higher expected profitability.

Lilly's decline sparked a bid in Novo shares.

More By This Author:

Trump To Impose 100% Chip Tariffs, But Will Exempt US Investors Like AppleVery Ugly, Tailing 10Y Auction Sees Slide In Foreign Demand, Plunge In Bid To Cover

WTI Prices Hold Post-India Decline Despite Big Crude Draw, Production Drop

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more