Lemonade – Disrupting The Insurance Industry?

A few months ago, just shortly before Lemonade's (LMND) IPO, the company's name crossed my way. At first, I was very adverse about researching the company, digging in the financials, and taking a more in-depth look. The insurance industry is very rigid, and I generally don't invest in markets that only consist of long-established companies. Funnily enough, however, my first investment, Tesla, was in a similar position. It was trying to disrupt the auto sector, an old and never changing industry. Exactly this thought came to my mind a few weeks later when the company crossed my path again. It might not be the most exciting market, and the players are not changing, but precisely this is what makes LMND a stock to look into further. Like the automotive companies, the traditional insurance companies are old, rigid, and slow-moving due to their inherent hierarchies and company structures. The industry was not disrupted in quite a while, and the incumbents are not expecting this to happen. Hence, they continue business as usual. This scenario creates a chance for a fast-moving start-up as LMND.

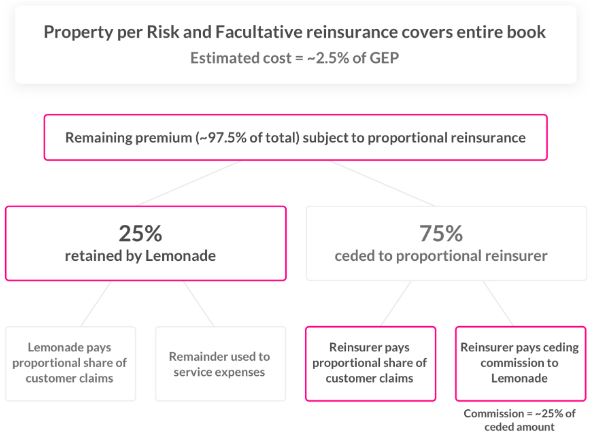

The core problem in the insurance industry is the incentive structure. The companies do not want to pay claims because it leads to lower margins, and the customers might be motivated to get some extra bucks by frequently submitting claims. LMNDs solution to this problem is shown in figure one. Initially, the company takes a fixed fee of 25% of the premium to pay expenses. The other 75% are paid to the reinsurers, which consequently pay the claims. If the claims are lower than expected, leftover money will be donated to the customers' charities.

Figure 1: Giveback

Source: Lemonade

I like the idea of creating a proper incentive structure, and I think this solution does it. As an investor, it is worrisome that some of "our" profits go to charity, and the fee appears to only be at 25%. However, this is not the complete truth. LMND also takes a 25% commission of reinsurers. The exact allocation of the insurance premium can be seen in figure two. When calculating the share of LMND, you do not end up with 25%. Hence, do not let the fixed 25% fee fool you. The actual percentage of LMND is higher.

Moreover, giving a chunk of the profits to charity might be helpful to attract more customers and to improve the brand image.

Figure 2: Premium Allocation

Source: Lemonade

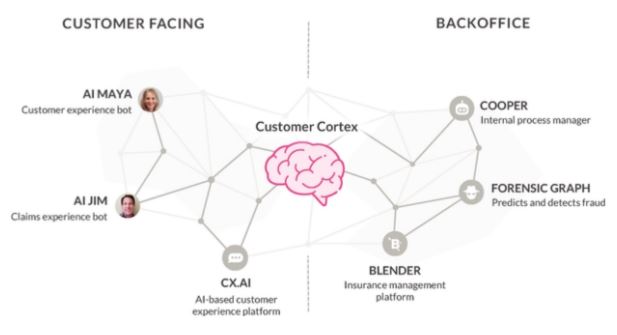

Artificial Intelligence

Some people say LMND is just your standard insurance, and the AI they integrated into their business is nothing unusual compared to traditional insurance companies. I went through the S1 Filing of LMND, their quarterly results, and shareholder letters to answer if the above statement is true. In the S1 Filing, LMND gives the following statement:

"Based on public information from five competing insurance companies in the United States, we estimate that the number of customers per employee for those companies ranges from approximately 150 to approximately 450 customers per employee. We base this estimate on publicly available information, which we have adjusted for comparability. The calculation of "employees" includes insurance agents and brokers because they are a significant cost component for other insurance companies. In comparison to these competitors, our number of customers per employee was over 2,000 as of the date of this prospectus."

This fact alone weakens the statement that LMND is just another insurance company. However, more, LMND states that 30% of all customer claims are handled automatically by AI Jim. LMND is also more convenient in the process of taking out insurance. AI Maya is responsible for this part of the business. By chatting with the customer, she can collect as much as 100 times more information than the competition. Maya is tracking how fast the customer responds, how he writes, when he is taking out insurance, and much more. As in many other industries, data is critical. It enables LMND to offer cheaper insurance than others.

All this is reflected in the app store rating of 4.9 and a net promoter score (NPS) of 70. For reference, this is higher than Apple's current NPS. I also went personally through the chat with Maya to see the advantages. I was surprised by the pace and low price.

Figure 3: Data Advantage

Source: Lemonade

Where could the company be in ten years?

The TAM (total addressable market) is roughly $5 trillion, which indicates that even a small share will lead to a massive revenue stream. So far, LMND is only offering homeowner, renter, and pet insurance and is active in the USA, Germany, and the Netherlands. However, they plan to expand their business to France by the end of 2020. Other countries are to follow during the next years. The vision of LMNDs founders, CEO Daniel Schreiber and COO Shai Wininger, offers more types of insurance and captures a few percentages of the overall market. And they are starting rapidly. The company increased revenue from June 2018 to June 2020, with an annual growth rate of 167% from $4,2M to $29,9M. Even in the last quarter, which was heavily affected by Covid-19, LMND grew revenue by 117% YoY. The firm is clearly in a hyper-growth phase and will likely be so for the next decade to come.

To be somewhat conservative, I assume LMND will have a market share of roughly 0,2% by 2030. Taking a still growing insurance market into account, the respective revenue will be around $11.4bn. To achieve this by 2030, sales need to grow by a CAGR of 61%.

Another important input for my DCF analysis is the operating margin. I expect it to gradually approach the industry average and be around 10% in ten years from now. I think there is room for further improvement, given the data advantage of LMND. However, It is essential to consider that the company intends to grow very quickly in the short & mid-term, so it is better to stick with a low operating margin for now. Putting these assumptions into my DCF model, I come up with a fair value of $117. This value, however, only reflects my story for the company. Your story might be different, so keep that in mind.

I recommend everyone keep an eye on LMND and to follow its growth story. It might be an attractive long-term play.

Disclosure: I am long LMND.

Very interesting. I had not been aware of this company previously. So it may be a good buy and hold one. At least the author seems to be committed to that concept.

Hello William,

You are right. I am mostly a buy & hold investor. Hence, I will add to my position on potential dips and keep it in my portfolio for the long-run. If this growth-story plays out, the upside is pretty attractive.

However, the firm also inherits a significantly higher risk than more mature companies.