Laird Superfood Inc. Capitalizing On Rapid Growth In Plant-Based Foods

The plant-based beverage market was valued at $11 billion in 2017 and is expected to reach $19.7 billion by 2023, growing at a CAGR of 12%, and Laird Superfood Inc., a plant-based food company, is capitalizing on that growth.

Consumer preference is evolving away from traditional beverages laden with products that have high sugar content and significant amounts of processed and artificial ingredients toward healthier beverage products. Laird, driven by its mantra “Better Food, Better You”, is leading the way in that regard with a range of healthy alternative plant-based food products (made from coconut and aquamin, a mineral-rich, calcified sea algae harvested in Ireland) in the form of coffee creamers (67% of total revenue); coffee, teas and hot chocolate products (16% of total revenue); and hydration & beverage enhancing supplements.

Consumption of coffee and tea is a daily ritual for many consumers and Laird has benefited from such habits with 61% of its total revenue in H1/2020 coming from repeat business from subscription-based customers. Sales are mainly driven through online and wholesale distribution channels, which accounted for 57% and 41% of Laird’s total revenue in H1/2020, respectively.

Financial Highlights

Since launching its first product, the Original Superfood Creamer, in 2016, Laird's revenue has grown to $18.8 million (annual) with its H1/2020 revenue coming in at $11.1 million, a 104% increase from the prior year's comparable period, increasing at a CAGR of 185%. In the same period, gross margins have expanded from 25% to 39%.

Source: Laird S-1 Prospectus

While Laird’s sales have proven to be highly recurrent and resistant to economic downturns - it reported record revenues in its most recent quarter amid the COVID-19 pandemic as consumers increased at-home coffee consumption while decreasing purchases at coffee retail stores - the pandemic has increased expenses related to shipping and distribution resulting in lower margins. In addition, the company is currently investing significantly in sales and marketing to expand its customer base. These events resulted in a net loss of $5 million in H1/2020 (versus $3.9 million in the prior year’s comparable period) and has increased the loss over the past twelve months to $9.5 million.

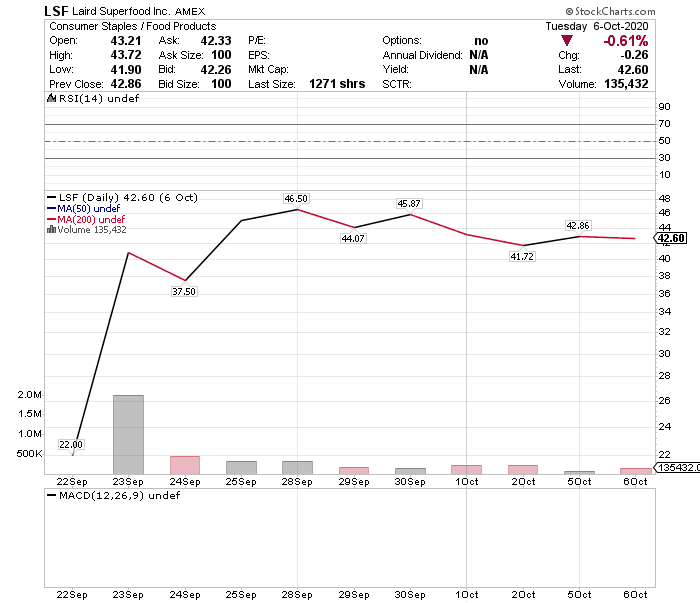

Stock Performance

On September 23rd Laird listed publicly on the New York Stock Exchange under the symbol LSF and started trading at $40.96 per share, after pricing its Initial Public Offering (“IPO”) at $22 per share. Its stock price has ranged from $37.50 to $46.50 since then and closed at $42.60 on Tuesday, September 6th.

This article will be followed by more articles on the plant-based food category with the latest news on Beyond Meat Inc. (BYND); Else Nutrition Holdings Inc. (BABYF); Modern Meat Holdings Inc. (CSE: MEAT); Burcon NutraScience Corp. (TSX: BU); Better Plant Sciences Inc. (CSE: PLNT) and The Very Good Food Company Inc. (CSE: VERY)

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more