Kroger To Combine With Albertsons In $24.6 Billion Grocery Mega-Merger

After endless years of speculation about an eventual deal for grocery giant Kroger, it looks as though the chain is doing a deal of its own. Except, in this deal, Kroger isn't the acquiree, it's the acquirer, announcing this week a $24.6 billion combination with grocer Albertsons.

The combination puts Kroger on a par - in size and sales - with names like Walmart. The tie up results in Kroger having almost 5,000 stores and annual revenue of about $200 billion, according to Bloomberg.

Albertsons investors will get $34.10 per share in cash, which includes a special dividend, a statement this week said. It marks a premium of about 33% to its closing price on October 12. About 375 stores are planned to be sold in a spinoff, the Bloomberg report says.

With Kroger growing in size, the merger offers "increased buying power and an opportunity to save on costs as brick-and-mortar retailers invest heavily to enhance their online offerings," the report says.

In a joint statement, the two companies collectively said: “This combination will expand customer reach and improve proximity to deliver fresh and affordable food to approximately 85 million households.”

They continued: “Consistent with prior transactions, Kroger plans to invest in lowering prices for customers and expects to reinvest approximately half a billion dollars of cost savings from synergies to reduce prices for customers.”

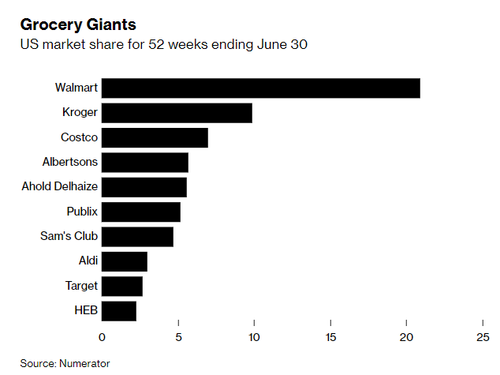

It marks one of the largest deals in retail in years, Bloomberg noted, and it also gives Kroger a spot in the Northeast market, one of the few places it doesn't have an established footprint. The company currently has a 9.9% market share and is in the number 2 seller in the U.S., the report says. Walmart has a nearly 21% market share.

The merger will also almost certainly face regulatory scrutiny. Bloomberg Intelligence analyst Jennifer Bartashus commented on the merger: “A combination could offer substantial synergies and cost-savings, revenue and earnings-growth opportunities. But significant operations overlap may make gaining approval difficult, forcing potential divestitures.”

Simeon Gutman, an analyst at Morgan Stanley, commented that grocery sellers are a tough spot to create shareholder value because of their low margins.

“Perhaps the industry has reached a point of consolidation such that a potential merger of this magnitude could result in structurally higher margins. The industry may be closer to oligopoly than we think,” he commented.

More By This Author:

US Heating Costs Expected To Surge This WinterCue Dollar Squeeze Panic: Fed Sends A Record $6.3 Billion To Switzerland Via Swap Line

Morgan Stanley Slides After Equity Trading, Investment Banking Revs Miss

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more