KO And The Perennial Philosophy

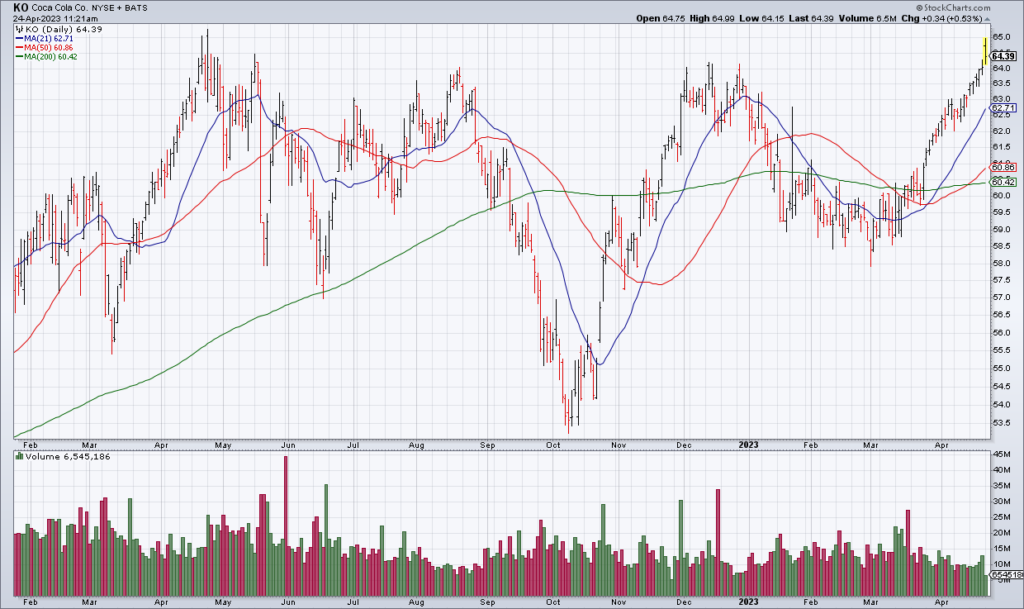

(Click on image to enlarge)

I write about a lot of different things but on Friday I articulated the perennial philosophy: buy high-quality companies and hold them for the long term (“PG And The Investment Lesson You Must Learn”, Top Gun Financial, 4/21). There are qualifications, nuances, and variations but that is the core of a winning investment philosophy.

And I’m going to reiterate it this morning using Coke (KO) which reported 1Q23 earnings this morning. Organic revenue grew 12%, mainly on the back of strong pricing. Margins were solid and Net Income was +5%. KO expects full-year organic revenue growth of 7-8% and EPS growth of 4-5%. They just raised their quarterly dividend to 46 cents from 44 cents.

It’s not exciting but it’s money in the bank. I long avoided KO – like I did PG – because it always seems to trade around 25x earnings – which I thought was too expensive. But like I said Friday: it’s almost always worth paying up for quality. KO shares are up marginally and trading near 52-week highs on the report.

More By This Author:

PG And The Investment Lesson You Must LearnDHI: No Signs Of Housing Weakness

TSLA: Margin Squeeze