KLAC: A Tech Stock Still Worth Buying

Summary

- 100% technical buy signals.

- 6 new highs and up 1.96% in the last month.

- 47.87% gain in the last year.

I wanted to find out if there were still any tech stocks that were worth buying so I screened the NASDAQ 100 Index stock for the highest Weighted Alpha and technical buy signals and found one.

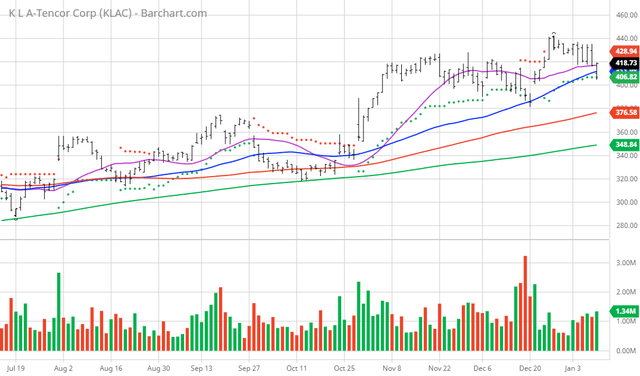

My Barchart Chart of the Day belongs to the semiconductor company KLA-Tencor (KLAC). I used the Flipchart function to review the chart of moving averages and found consistent upward price momentum:

KLAC's Price is Rising

KLA Corporation designs, manufactures, and markets process control and yield management solutions for the semiconductor and related nanoelectronics industries worldwide. The company offers chip and wafer manufacturing products, including defect inspection and review systems, metrology solutions, in situ process monitoring products, computational lithography software, and data analytics systems for chip manufacturers to manage yield throughout the semiconductor fabrication process. It also provides reticle manufacturing products, such as reticle inspection, metrology, and data analytics systems for mask shops; and packaging manufacturing products comprising wafer inspection and metrology, die sorting and inspection, IC component inspection and metrology, data analytics, wafer processing systems, and IC substrate production processes. In addition, the company offers compound semiconductor, power device, light-emitting diode, and microelectromechanical system manufacturing products; data storage media/head manufacturing products; general purpose/lab applications; and previous-generation KLA systems. Further, it provides wafer processing solutions; printed circuit boards, and display and inspection components; and other services. The company was formerly known as KLA-Tencor Corporation and changed its name to KLA Corporation in July 2019. KLA Corporation was incorporated in 1975 and is headquartered in Milpitas, California. Yahoo Finance

Barchart Technical Indicators:

- 100% technical buy signals

- 42.32+ Weighted Alpha

- 47.87% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 6 new highs and up 1.96% in the last month

- Relative Strength Index 50.89%

- Technical support level at 410.32

- Recently traded at 418.73 with a 50 day moving average of 411.98

Fundamental Factors:

- Market Cap $63.21 billion

- P/E 26.75

- Dividend yield .97%

- Revenue is expected to grow 31.70% this year and another 2.50% next year

- Earnings are estimated to increase 44.90% this year, an additional 1.20% next year and continue to compound at an annual rate of 19.63% for the enxt 5 years

Analysts and Investor sentiment - I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts issued 11 strong buy, 4 buy and 8 hold opinions on the stock

- The individual investors following the stock on Motley Fool voted 304 to 36 for the stock to beat the market with the more experienced investors voting 90 to 2 for the same result

- 24,350 investors are monitoring the stock on Seeking Alpha

- Seeking Alpha give the stock a Quant Rating of 4.74 our of 5:

Conclusion: KLAC is currently having very positive upward price momentum driven by favorable Revenue and Earnings projections. The stock has great evaluations by both professional and individual investors with a very sizable following. This might be a good addition to your portfolio if you practice proper diversification and risk management techniques. By the way, Seeking Alpha rate this stock in the top 5% of its overall Quant Ratings.

Disclaimer: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are ...

more