Key Quarterly Releases To Watch Next Week: TSLA, KO

Image Source: Pexels

The 2024 Q3 earnings season has kicked into a much higher gear, with a nice variety of companies already delivering quarterly results. The period looks to be constructive, with earnings growth expected to be positive again despite recent downward revisions that have contrasted with recent periods.

Let’s take a closer look at a few key companies – Tesla (TSLA - Free Report) and Coca-Cola (KO - Free Report) – that are on the reporting docket for this week.

Tesla Faces Profitability Crunch

As usual, the critical metric for Tesla that commonly dictates price swings is its EV production/delivery numbers. To the likes of investors, the company unveiled its Q3 production and delivery numbers recently; Tesla delivered roughly 463k EVs and produced nearly 470k throughout the period.

As shown below, recent EV delivery results have come in well below our consensus expectations, with Tesla falling short in four consecutive periods.

Image Source: Zacks Investment Research

Still, margin pressures have been the real driver behind any negative sentiment in recent quarterly releases, which have declined quite significantly over recent periods amid higher costs. Below is a chart illustrating the company’s gross margin on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Revisions for the upcoming print have reflected slight bearishness, with the $0.58 Zacks Consensus EPS estimate down modestly since the end of July and suggesting a 12% decline year-over-year. Revenue revisions have followed a similar path, with the EV titan forecasted to see a 10% pop in sales year-over-year.

The revenue growth paired with the earnings decline reflects a profitability crunch, further seen in the margins chart above.

Image Source: Zacks Investment Research

Coca-Cola Shares See Momentum

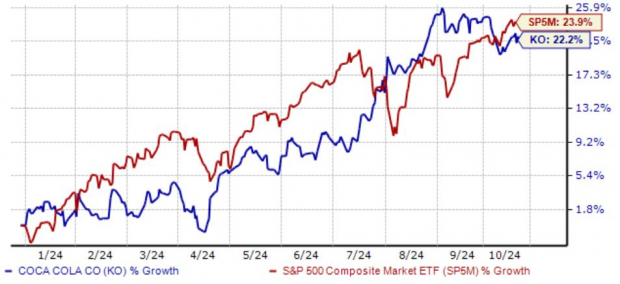

Perhaps to the surprise of some, consumer staples titan Coca-Cola has seen its shares largely track the S&P 500 in 2024, up 22%. The share performance is certainly notable, especially given the risk-on environment that’s been dominated by technology.

Image Source: Zacks Investment Research

A driver behind the strong share performance can be attributed to margins recovering, as shown in the chart below. The beverage titan struggled with high costs throughout 2022 given the economic environment, with the trend now reversing nicely over recent periods.

Please note that the margin chart below is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Earnings and revenue revisions for the quarter to be reported have been essentially flat, with Coca-Cola forecasted to post flat earnings growth paired with a 3% sales decline. Favorable commentary surrounding its profitability and reaffirming its previously raised 2024 guidance could easily provide tailwinds for the stock post-earnings.

The valuation picture for the stock isn’t stretched, primarily in line with historical averages. Shares presently trade at a 23.4X forward 12-month earnings multiple, nearly in line with the 23.8X five-year median and slightly below five-year highs of 26.6X.

The current PEG of 3.8X is certainly steep but still remains in line with historical averages. The stock sports a Style Score of ‘D’ for Value.

Bottom Line

Earnings season is always an exciting time for investors, with companies finally pulling the curtain back and unveiling what’s transpired behind the scenes.

And concerning notable releases coming this week, both companies above – Tesla and Coca-Cola – are on the reporting docket.

More By This Author:

3 Mobile Payments Stocks Worth A Closer Look2 Top Stocks To Buy For Streaming Exposure: NFLX, ROKU

Is Dividend King PepsiCo A Buy Post Earnings?