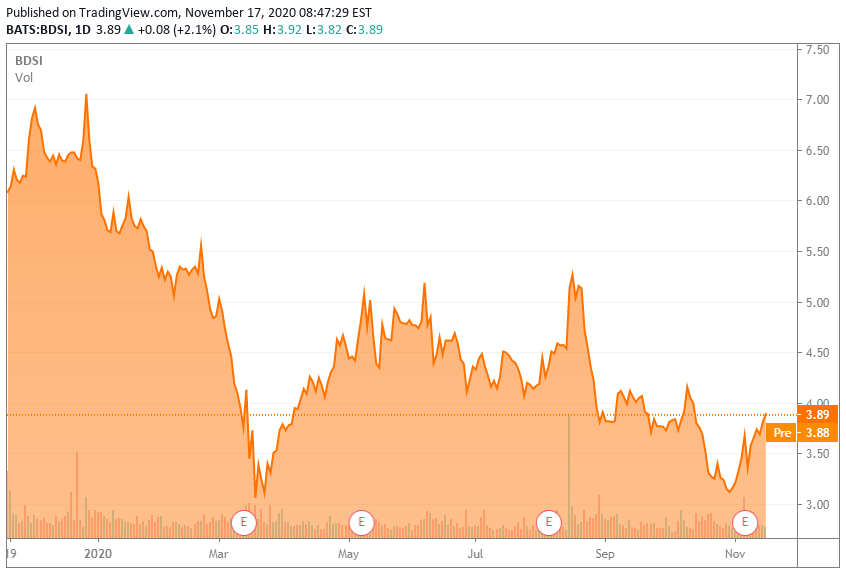

Keep The Faith On This $4 Biopharma Stock

The opposite for courage is not cowardice, it is conformity. Even a dead fish can go with the flow.'- Jim Hightower

It has been awhile since we revisited BioDelivery Sciences (BDSI). The company has seen explosive revenue growth its core flagship product BELBUCA since the end of 2017. Unfortunately, that huge sales ramp up has drawn little applause from Wall Street. This makes BDSI an incredibly cheap growth play. We update our investment thesis on BioDelivery to include our current outlook, analyst commentary and recent quarterly results in the paragraphs below.

Company Overview:

BioDelivery Sciences (BDSI) is a small biopharma concern out of North Carolina. It is focused on pain management and its flagship product is BELBUCA. The compound provides pain relief and has a relatively low risk for developing dependence which is in demand given the opioid crisis in the United States which demand less addictive pain management solutions. In 2019 BioDelivery picked up the rights to opioid-induced constipation med Symproic. The stock currently trades just under $4.00 a share and a market just south of $400 million.

Only 24% of voters identify as liberal, while 38% say they’re conservative, according to CNN exit polls. Another 38% are moderate. Despite the widespread publicity given the left, since 2014—a good year for Republicans—the percentage of self-identified liberals declined 2 points, while the share of conservatives increased 3 points.

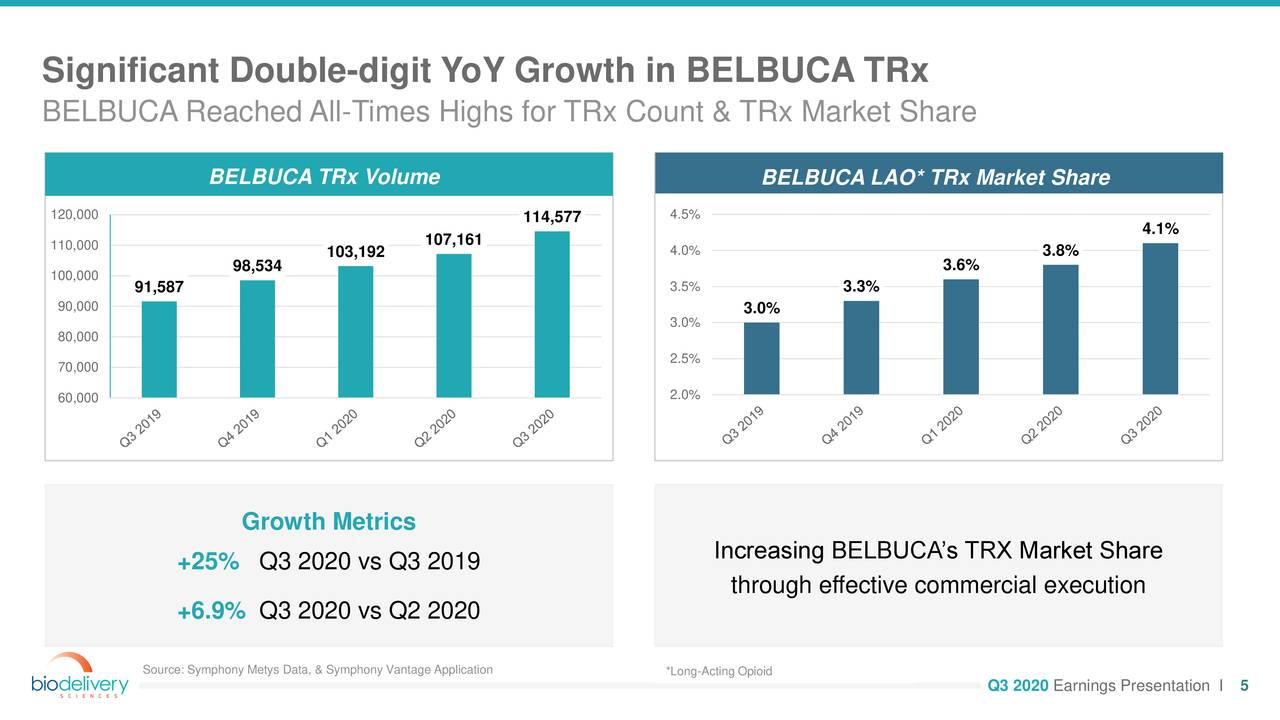

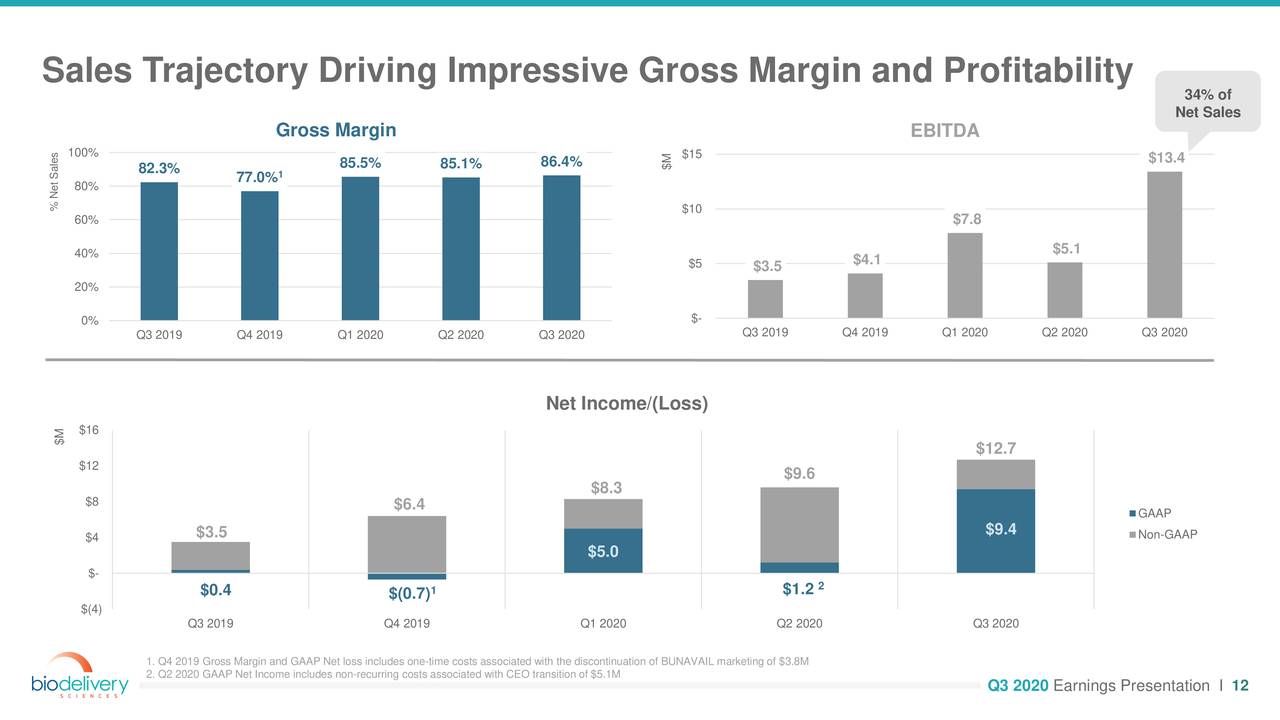

Despite the continuing Covid19 pandemic, BELBUCA continues to deliver solid sales growth as well as garnering an increasing market share in its niche. Earlier this month this growth helped BDSI post earnings of nine cents a share or $9.4 million worth of profits. This was four cents a share above estimates and far above the $400,000 profit the company posted in the same period a year ago. Revenue growth came in at 30% on a year-over-year basis to $39.4 million.

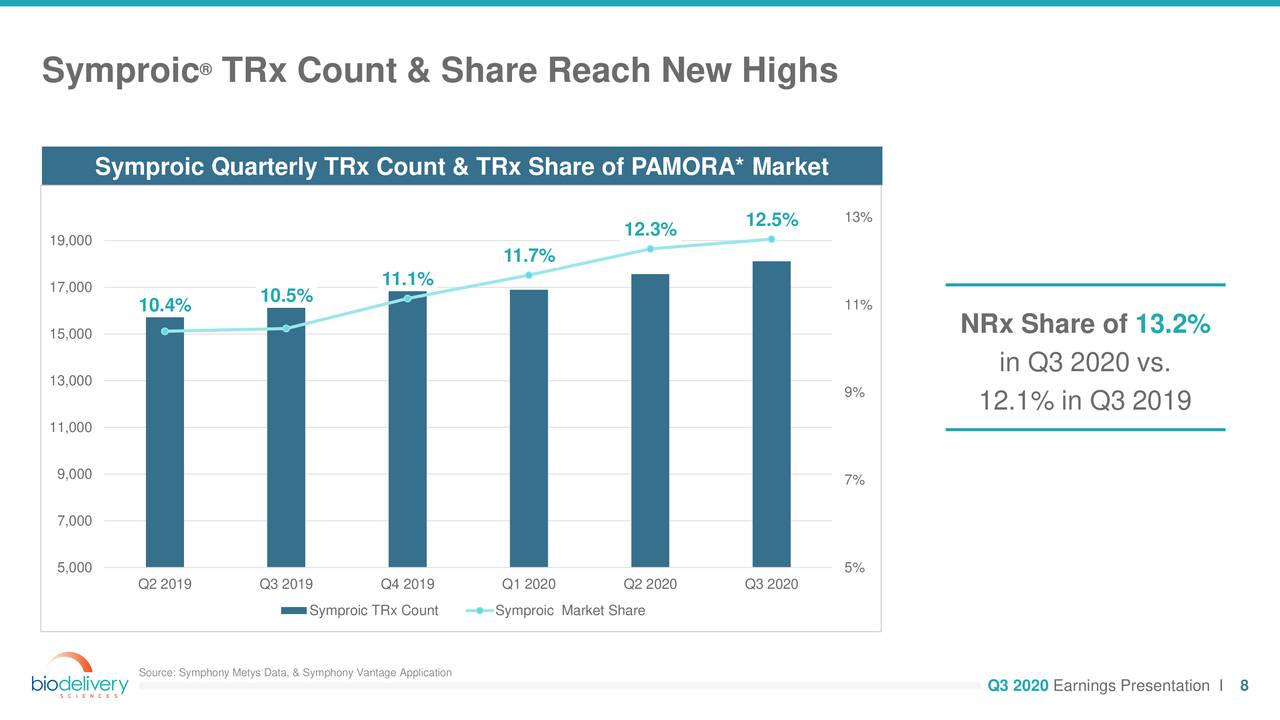

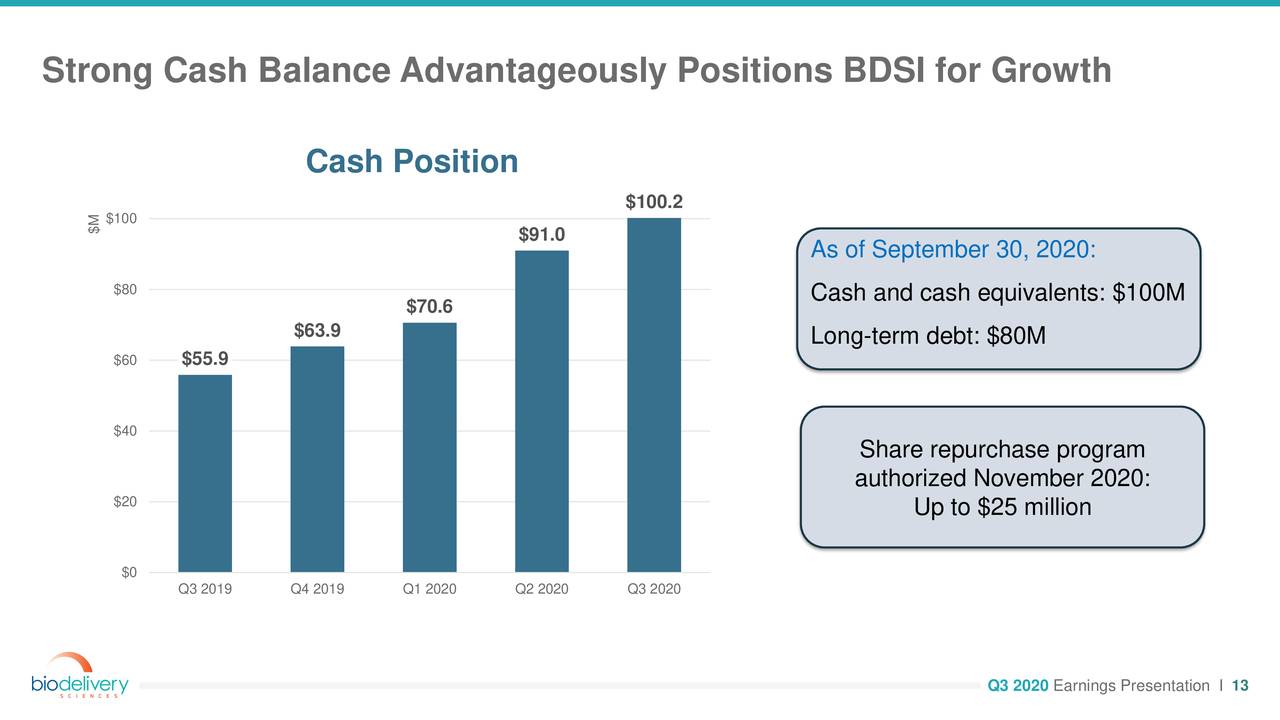

BELBUCA net sales came in at $34.8 million, an increase of 31% versus the prior year period. Symproic delivered net sales of $3.5 million which was an increase of 59% compared to the same period a year ago as that compound also is gaining market share (see above). The company announced a new CEO during the quarter and also authorized an additional $25 million to its stock buyback program. At current trading levels, that would remove just over six percent of the outstanding float from circulation.

Analyst Commentary & Balance Sheet:

BioDelivery ended the third quarter with approximately $100 million on the balance flow and is just starting to produce significant free cash flow. This is showing up in improved margins and a big rise in EBITDA. The company has approximately $80 million in debt.

The analyst community is sanguine on BioDelivery's prospects and has a median analyst price target of $8.00 on the shares, just over twice their current trading levels. Post Q3 results, both H.C. Wainwright ($7 price target) and Northland Securities ($9 price target) reiterated Buy ratings on the stock.

Verdict:

Thinks are heading in the right direction with BioDelivery. The company continues to garner market share and sales growth with both of its product offerings, despite the challenging environment of the continuing pandemic. Its balance sheet is rock solid and its margins and cash flow are improving significantly. The company has done a fantastic job growing its BELBUCA franchise since it reacquired the rights to this compound from previous marketing partner Endo International (ENDP) at the end of 2017.

BioDelivery's long term risk/reward profile remains very attractive even as the stock's performance over the past year has not reflected its improving metrics. This is why I continue to hold most of my core stake in BDSI within covered call positions.

When you disarm the people, you commence to offend them and show that you distrust them either through cowardice or lack of confidence, and both of these opinions generate hatred.' - Niccolo Machiavelli

Subscribe to the Insiders Forum by clicking here.