Keep An Eye On This Historically Hot Retail Stock As Earnings Approach

With its fiscal third quarter results approaching on Monday, March 11, investors will certainly want to watch Casey’s General Stores (CASY - Free Report) stock. Casey's General Stores' locations have continued to pop up throughout the Midwestern United States which has correlated with its stock outperforming the broader market for much of the last decade.

Highly profitable in its convenience store and gas station combinations, Casey's General Stores is planning to open at least 150 new locations this year.

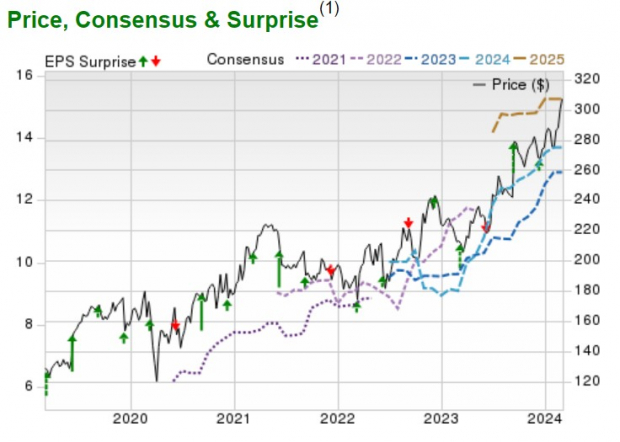

As illustrated in the EPS surprise chart below much of the opportunity in CASY shares comes when the company can beat earnings expectations but most importantly, offer positive guidance.

Image Source: Zacks Investment Research

Most recently, Casey’s General Stores' Q2 earnings of $4.24 per share beat expectations by 13% in December and forecasted that fiscal 2024 EBITDA growth of 8%-10% would be in line with its long-term strategic plan. Forecast of 3.5%-5% same-store inside sales growth and the repurchase of $100 million shares also helped extend the rally in CASY which is up +38% over the last year.

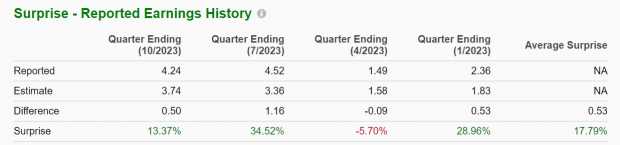

Image Source: Zacks Investment Research

The Zacks ESP

Retail earnings have been solid so far with many important omnichannel players such as Walmart (WMT - Free Report) and Target (TGT - Free Report) able to surpass their bottom line expectations. Notably, the Zacks ESP (Expected Surprise Prediction) indicates Casey’s General Stores could top its Q3 earnings expectations with the Most Accurate Estimate at $2.25 per share and 2% above the Zacks Consensus of $2.20 a share.

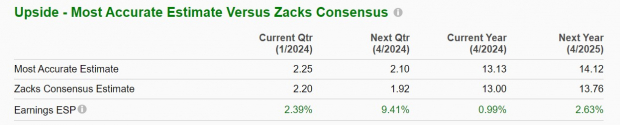

Image Source: Zacks Investment Research

Increased Profitability

Zacks projections would represent a -7% decline in Q3 earnings but Casey’s General Stores' annual EPS is expected to jump 12% this year and climb another 6% in FY25 to $13.76 per share. Furthermore, Casey’s General Stores' stock has registered 110% EPS growth over the last five years with earnings at $5.51 a share in 2019.

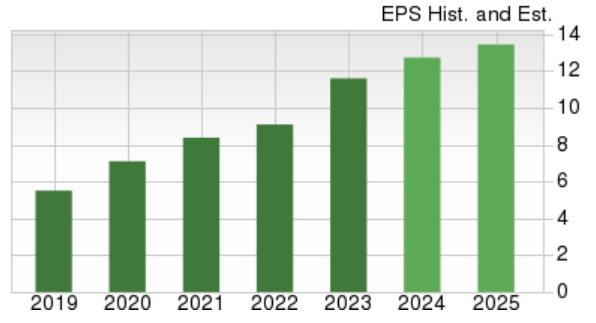

Image Source: Zacks Investment Research

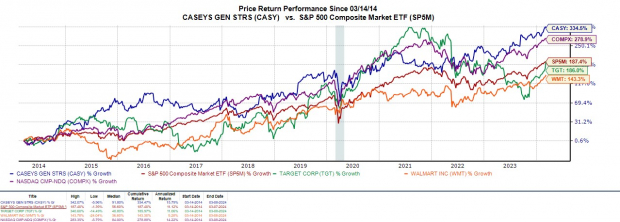

Strong Historical Performance

Casey’s General Stores’ stock is up a very respectable +53% in the last three years to outperform the S&P 500’s +32% and the Nasdaq’s +23%. As a loose comparison to retail leaders, this has also topped Walmart’s +40% and Target’s -5%.

More impressive, over the last decade, CASY has now soared +324% to beat the Nasdaq’s +279% while easily outperforming the benchmark along with Target’s +186% and Walmart’s +143%.

Image Source: Zacks Investment Research

Bottom Line

Undoubtedly, Casey’s General Stores will be a stock to watch next week and currently sports a Zacks Rank #2 (Buy). Historically, CASY has been an ideal buy-the-dip prospect if the opportunity is given although history suggests if the company’s outlook is favorable shares will rally.

More By This Author:

Dividend Watch: 3 Companies Boosting Their PayoutsInsiders Are Buying These 5 Stocks

3 Stocks To Buy For Post-Earnings Momentum

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more