KBW Bank Index Extended Correction

The KBW Bank Index is an economic index consisting of the stocks of 24 banking companies delivering a direct exposure to the banking sector and offering a targeted view to a unique corner of the U.S. financials sector. The top banks of the index are among the biggest financial institutions in the world and three of them reported earnings this week (Citigroup, JPMorgan Chase, Wells Fargo). These companies have a big influence on the financial sector that can be measured by the ETF XLF, which was up 30% from last year until last month. We mentioned in a previous financial article that XLF was reaching an inflection area which provided the expected pullback.

How is this move is affecting the banking sector? Let’s find out by using the Elliott Wave Theory to analyse BKX.

KBW Bank Index Elliott Wave View

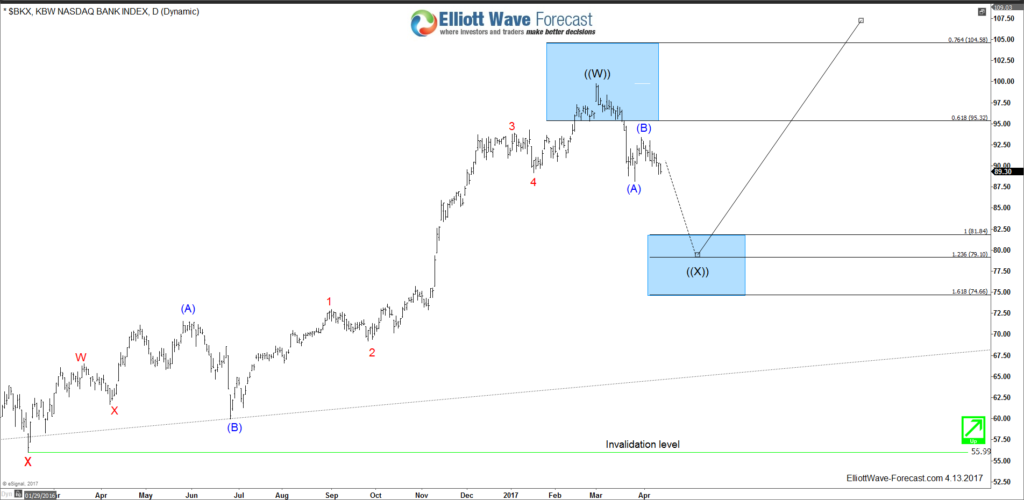

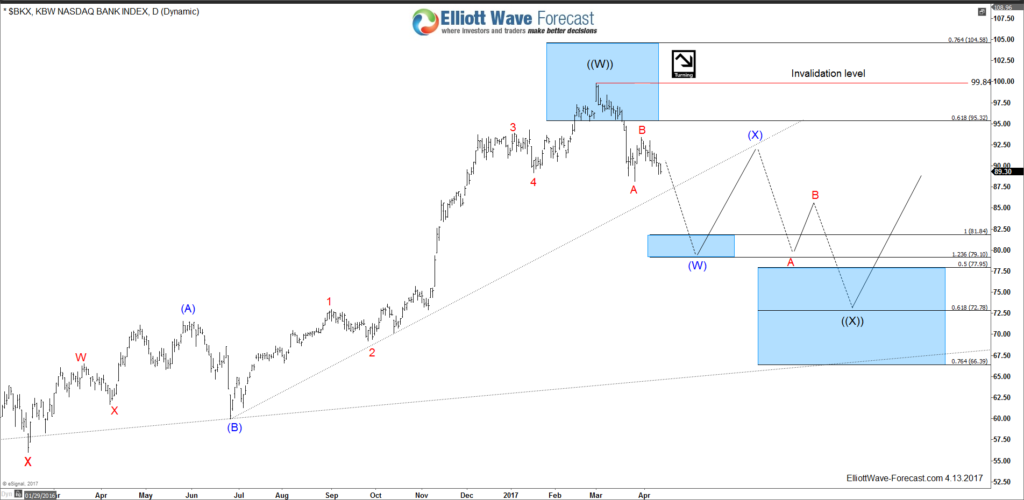

BKX made 5 swings in a bullish sequence from a 2009 low which is different from the 5 impulsive waves used in Elliott Wave Theory. The advance is a part of the double three structure that the KBW Bank Index is doing and after reaching the 61.8 – 76.4 fib ext area it started the 6th swing pullback against the 2016 low. The retrace in wave (X) would ideally reach the 50%-61.8% Fibonacci retracement around 78.11 – 72.94 area before BKX can resume its move to the upside. However the market isn’t perfect and we can’t determine how the pullback will unfold exactly, so even a small 3 waves pullback can be enough to end it there.

To determine the potential pullback area, we take a look at the daily chart as the Index ended the 2016 cycle at the 03/01/2017 peak from which it started a Zigzag structure. So BKX can still extend lower toward the equal legs area of 81.84 – 79.10 from which it can resume higher or bounce in 3 waves at least.

If the bounce is not strong enough and the Index fails to break above 99.84 peak, then it will have the possibility of a double three correction lower toward the 61.8%-76.4% area and retesting the 2009 trendline before it is able to resume its uptrend.

Recap

The KBW Bank Index longer term technical structure remains bullish while it’s holding above the 2016 low of 55.99. But we need further data before we can determine if the index will be able to rally to new highs after this current shallow daily correction or if it needs more time to consolidate. This decline will affect the whole Financial sector. Its stocks may be fading the so-called Trump rally so you need to be careful about holding a bank stock during this pullback.

Disclosure: None.