KBR: A Value Play With Construction, Defense, And Energy Exposure

Image Source: Unsplash

What a difference two months can make. On April 8, the Nasdaq had plummeted into bear market territory and the S&P 500 was on the cusp of joining it. Fast-forward to today, and it’s a totally different picture. I like KBR Inc. (KBR) here, writes Chris Preston, chief analyst at Cabot Value Investor.

Small-caps were faring even worse during the sell-off. Volatility had spiked to multi-year highs. And everyone was certain a recession or high inflation – or both – were imminent.

Now, tariffs are on a 90-day pause. Volatility has evaporated. Inflation is at four-year lows. The economy is doing just fine, with unemployment holding steady. And in Q1, US companies posted a second consecutive quarter of double-digit earnings growth.

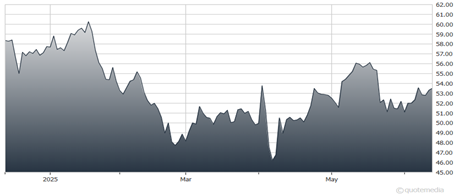

KBR Inc. (KBR) Chart

Granted, the coast isn’t totally clear – not by a long shot. But as investors, we have to go with the evidence in front of us, and right now, it’s quite good.

As for KBR, it’s an industrial conglomerate that has its hand in a lot of big, revenue-generating pies – aerospace, defense, energy, engineering, and intelligence. Its Government Solutions segment provides support for agencies including NASA, militaries in the US, UK, and Australia, and infrastructure projects from Indonesia to the Middle East.

Its Sustainable Technology Solutions segment helps engineer energy projects, helps companies and governments transition to more sustainable forms of energy, and provides energy security solutions in markets like the Middle East. KBR also dabbles in cybersecurity, national security solutions, surveillance, global supply chain management, data analytics, and much more.

As with most industrials, business slowed to a crawl in the aftermath of Covid-19 due in large part to supply-chain issues. Last year, however, brought a new record high of $7.74 billion. This year, analysts see revenues at $8.76 billion, a 13% improvement. Then they expect it to hit $9.5 billion next year.

After failing to turn a profit in 2023, the company is on track for a record $3.85 in EPS this year (up 15% from 2024) and $4.27 next year.

My recommended action would be to consider purchasing shares of KBR Inc.

About the Author

Chris Preston is an investment analyst and web content editor for the Cabot Wealth Network website. He is also a news writer for Cabot's free Wall Street's Best Daily e-newsletter, and contributes to other Cabot advisories and special projects. He was previously an analyst and assistant managing editor with Wyatt Investment Research. Mr. Preston has been a professional writer for over 10 years, picking up two writing awards along the way.

More By This Author:

AAPL: Investors Asking "Is That It?" After WWDC EventOracle: A "Sleeper" Play In Tech After Monster Quarter?

Toronto Dominion: A Canadian Bank Stock With Powerful Technical Momentum

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more