KARO: A Singapore Tech Name With A Top-Notch "Zen Rating"

Image Source: Unsplash

Headquartered in Singapore, Karooooo Ltd. (KARO) provides subscription-based telematics and AI-powered analytics to help businesses manage mobility more efficiently. While it hasn’t attracted a lot of attention from Wall Street, the stock has two analysts that cover it and are quite optimistic.

Thus far, KARO has flown under the radar. Only two analysts issue ratings for the stock — one has deemed it a Strong Buy, while the other issued a Buy rating. With that said, the average 12-month price forecast for Karooooo, currently pegged at $55.50, implies upside of 16.2%.

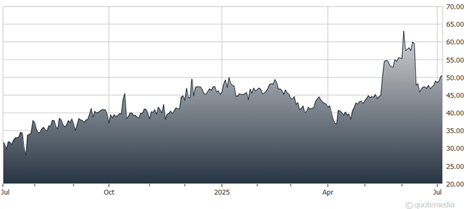

Karooooo Ltd. (KARO)

In addition, both of the aforementioned Wall Street analysts are highly rated. Morgan Stanley’s Roy Campbell (a top 23% rated analyst) recently maintained a Strong Buy rating, and hiked his price target from $43 to $53.

In mid-May, Alexander Sklar of Raymond James (a top 9% rated analyst) reiterated a Buy rating and increased his price forecast from $51 to $58. Sklar told readers Karooooo's growth rate over the next one to two years could ramp up, driving multiple expansion.

Our proprietary quant rating system takes into account 115 factors when assigning a rating to a stock. KARO ranks in the top 3% on the whole — giving it a Zen Rating of A, equivalent to an average annualized return of 32.5%.

More By This Author:

JPM: Dimon Gets His Way, Shareholders Get The BenefitsFed Chair Powell Accused Of Lying To Congress About Luxurious HQ Renovations

IVV Vs. RSP: How Do Cap-Weighted And Equal-Weighted Funds Compare?

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more