Jushi Holdings' Q3 Financial Results Were Impressive

Editors' note: This article discusses one or more penny stocks and/or microcaps. Such stocks are easily manipulated; do your own careful due diligence.

Jushi Holdings, Inc. (JUSHF), a constituent in the munKNEE Pure-Play Pot Stock Index, announced its Q3, 2020 financial and operating results on Tuesday for the period ended September 30, 2020, as follows:

Q3 Financial Highlights

(All results are presented in USD and compared to the previous quarter.)

- Revenue: increased 67% to $24.9M

- Gross Profit: increased 64% to $12.3M

- Net Profit (Loss): loss increased by 222.3% to $(30.0)M

- Net Profit (Loss) per Share: loss increased to $(0.31) from $(0.10)

- Adj. EBITDA: improved to $1.9M from $(1.2)M

- Cash Equiv. on Hand: $43.2M

Q3 Operational Highlights

- Closed equity acquisition of Pennsylvania grower-processor permit holder

- Closed on an approximate $33 million debt financing of 10 percent senior secured notes and warrants

- Opened 10th BEYOND/HELLOTM retail location and the 8th Pennsylvania Medical Marijuana dispensary in Reading, Pennsylvania

Management Commentary

Jim Cacioppo, Chief Executive Officer, Chairman, and Founder, said that Jushi has:

- “...achieved Adjusted EBITDA profitability for the first time in the Company’s history,...

- continued to see strong momentum in the business as we exited the third quarter, and as a result, we expect to see further expansion in revenue and profitability through the balance of the year.

- continued to optimize our operations by:

- allowing more transactions to be fulfilled through our online reservation system at BEYOND-HELLO.com,

- adding additional point-of-sale stations in our stores in Illinois and Pennsylvania, and

- leveraging data analytics to offer more targeted promotions.

- upgraded our talent by adding several new hires in the third quarter with expertise in retail, cultivation, and security...

- and expect to be able to continue to deliver strong results in the fourth quarter and full-year 2021.”

Outlook

Mr. Cacioppo commented:

- “As a result of our expectation for continued strong operating results for the remainder of the year, we

- are increasing our fourth quarter 2020 revenues guidance of from $25 to $30 million to from $28 to $30 million

- and expect fourth-quarter 2020 Adjusted EBITDA to be between $2.5 and $3.0 million.

- For the first quarter of 2021, we expect

- revenues to be between $37 and $40 million and

- adjusted EBITDA to be between $4.0 to $5.0 million.

- We are also maintaining our

- 2021 revenue guidance of from $205 to $255 million and our

- 2021 Adjusted EBITDA guidance of approximately $40 to $50 million...”

Stock Performance

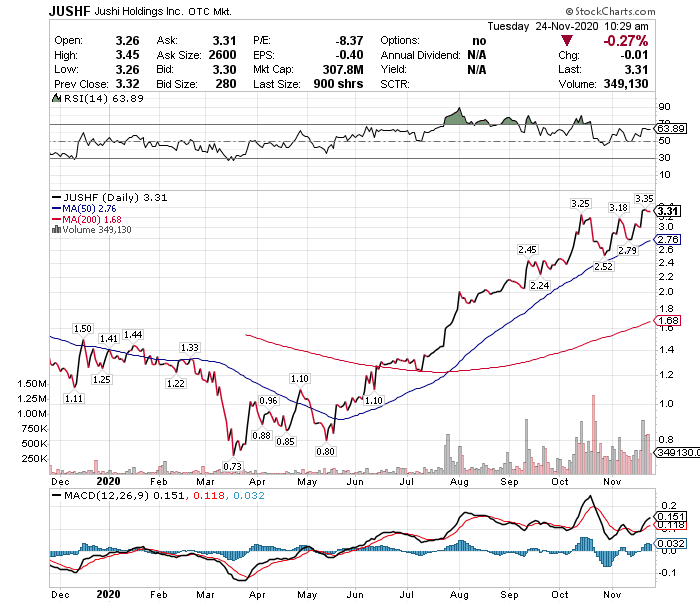

The Jushi stock price is UP 140.6% YTD and continues to appreciate UP 36.1% since the end of September and UP 27.2% so far in November as illustrated in the chart below:

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more

An interesting article and an interesting application of "sunshine) by the CEO.