JPM: Dimon Gets His Way, Shareholders Get The Benefits

Image Source: Unsplash

JPMorgan Chase & Co.’s (JPM) CEO Jamie Dimon sued regulators in October 2024 because he felt the powers that be were out of line with what he called overlapping or ill-conceived rules on capital requirements, card payments, and open banking, among other things. Well, what do you know? JPM just got a big regulatory win.

“It’s time to fight back,” he said bluntly at the time. Now, the Federal Reserve has reduced its Stress Capital Buffer (SCB) from 3.3% to 2.5%, lowering the bank’s required CET1 capital ratio to 11.5% from 12.3%.

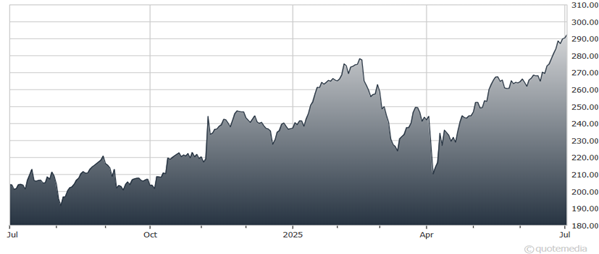

JPMorgan Chase & Co. (JPM)

Hang with me. This frees up about $18 billion in excess capital, giving JPM more firepower for shareholder returns. Not surprisingly, JPM wasted no time, announcing:

- A $50 billion buyback – the largest by any US bank

- A dividend hike to $1.50 per share, a 7% increase over last quarter

JPMorgan is a masterclass in capital management and risk assessment. It’s also very bluntly an excellent case in why I prioritize strong executive leadership when it comes to selecting the stocks I want to own.

Regional banks, which people constantly tell me are worth a look, pale in comparison when you’re playing in the big leagues. Buy the best, ignore the rest!

More By This Author:

Fed Chair Powell Accused Of Lying To Congress About Luxurious HQ RenovationsIVV Vs. RSP: How Do Cap-Weighted And Equal-Weighted Funds Compare?

KOID & HUMN: Two New ETFs To Profit From The Robotics Revolution

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more