Johnson & Johnson: What Should Investors Do Following The Consumer Health Spinoff?

Johnson & Johnson (JNJ) is one of the most popular dividend growth stocks in the entire market. For good reason, as the company has a storied history of growing its payments to shareholders.

J&J has increased its dividend for over 50 consecutive years. As a result, it is on the exclusive Dividend Kings list.

Johnson & Johnson has established itself as a premier dividend growth stock due to the quality of its three business segments. The company’s pharmaceutical, medical device, and consumer healthcare businesses are the leaders in their respective industries.

At the same time, the diversified business model has allowed Johnson & Johnson to be profitable in difficult economic conditions. When one business segment experiences a downturn, the other two frequently provide a lift.

Johnson & Johnson’s business model has allowed the company to prosper for a very long time and has enabled the dividend growth streak to reach 59 years, one of the longest streaks in the stock market.

However, the company recently announced that it would undergo a major change, and spinoff its consumer healthcare segment.

Shareholders are likely questioning how the spinoff will impact the company, what does that mean for the stock and what to do with their positions. This article will attempt to answer these questions.

Recent Events Overview

Johnson & Johnson has resisted calls to separate its businesses in the past, preferring to maintain its diversified nature. That changed on November 12th, when the company announced that it would spin off its consumer healthcare segment into a standalone entity.

The remaining pharmaceutical and medical device companies will remain combined.

Source: Investor Presentation

The “new” Johnson & Johnson company will retain ~84% of its annual revenues and hold in its portfolio a number of drugs and products that are in high demand within the healthcare sector.

The new consumer healthcare company, which accounts for ~16% of annual revenue, will consist of market-leading brands in a number of areas. These brands, such as Tylenol, Benadryl and Band-Aid, have been trusted by consumers for a very long time.

Leadership guided towards a completion of the spinoff of the consumer healthcare segment in 18 to 24 months, putting the spinoff at mid-2023 at the earliest.

How Will the Spinoff Impact Future Growth?

Johnson & Johnson has been in business for 135 years and has avoided such a large shake up before. So, why now?

For starters, many other names in healthcare have spun off their slower growth consumer segment to focus on the higher risk, but higher reward pharmaceutical businesses.

For example, Pfizer (PFE) separated its consumer segment in 2018 before combining it with GlaxoSmithKline’s (GSK) consumer business just a few months later. Now, Pfizer is a near-total play on pharmaceuticals.

Going back further, AbbVie Inc. (ABBV) separated from Abbott Laboratories (ABT) in 2013. This is a slightly different situation, as the drug developing and commercializing portion of the parent company separated from the medical device company. But both the two new companies now have a valuation greater than what it was when they were combined.

The real source of J&J’s future growth will be in the retained businesses, especially the pharmaceutical segment.

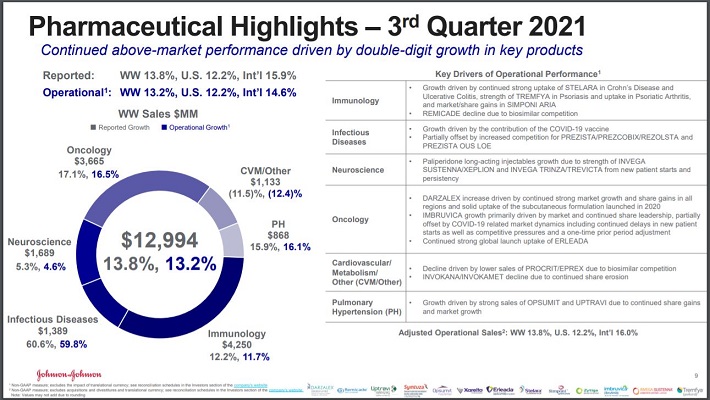

Consider this segment’s performance in the last quarter.

Source: Investor Presentation

Reported revenue grew 10.7% for the company in the most quarter, but much of this growth was a result of the showing in the pharmaceutical business, which was up nearly 14% from the prior year. Medical Devices was up 8% due to higher demand for products. The consumer segment climbed just a little more than 5%.

While baby powder, shampoo and cough medicines have been the face of the company for a long time, it is the other two segments that bring in the bulk of revenue, and most of the growth.

Given the experience of other companies conducting this type of spinoff, the planned separation could allow for a higher valuation for the pharmaceutical part of the company, but the same can be said for the medical device business.

Johnson & Johnson trades at close to 17 times earnings estimates for the year. Leading medical device makers often have a valuation in the low to mid-20 times earnings range.

The motivation behind such a shift in strategy is likely due to the goal of unlocking value for shareholders. By focusing on pharmaceuticals and medical devices, the new Johnson & Johnson company is likely to receive a higher valuation from the market, as these businesses generate higher growth.

How Should Shareholders React?

A sizeable change in direction for one of the country’s oldest companies was probably a shock to many shareholders. Diversification has been a hallmark of Johnson & Johnson and the spinoff will separate what has been the face, if not the driver of growth, for the company.

That said, we feel that investors shouldn’t panic and sell their positions. For one, the breakup isn’t expected for at least another year and a half. And, both new companies will be well-positioned in their respective areas of healthcare.

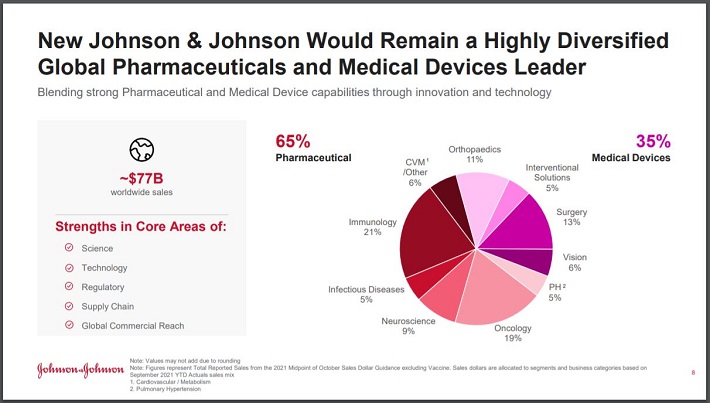

Source: Investor Presentation

There do remain elements of diversification within both companies. The pharmaceutical business will account for almost two-thirds of sales, up from just over 50% previously, with medical devices contributing the remaining. This is still a decent diversification business model, even more so than peers that are strictly focused on developing and selling pharmaceuticals.

Only one business within the new Johnson & Johnson would’ve contributed more than 20% of revenue for the year through the end of September, showing that the new company isn’t overly reliant on any one area even after the separation.

Johnson & Johnson also has a number of products showing high growth rates. The top two selling pharmaceuticals Stelara and Darzalex had revenue growth of 21.7% and 42.9%, respectively, in the last quarter as both products continue to see higher market share gains. Medical devices benefited from a recovery in surgical procedures conducted, though hips and knees still are weak.

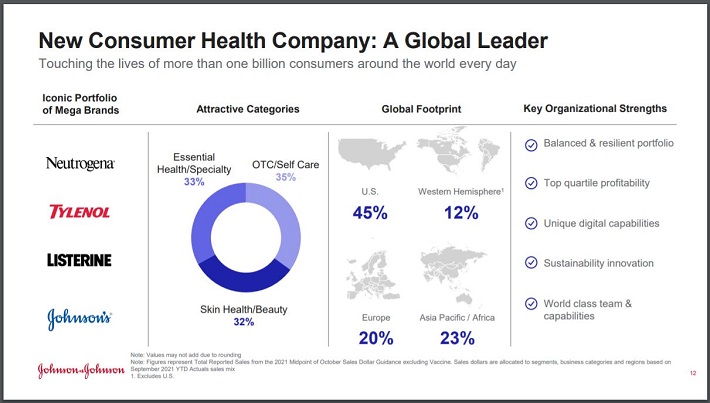

The new consumer healthcare company has a well-established leadership position.

Source: Investor Presentation

The new consumer healthcare company is also very diversified with approximately a third of revenue coming from each of the three main subcategories. Slightly less than half of sales will come from the U.S. Currency exchange will be an issue at times with international markets, but the geographic diversification is a positive in our view as this adds protection to the business in case of weakness in a certain region.

What many shareholders are probably most concerned with is how this will impact the company’s dividend. Johnson & Johnson hasn’t provided guidance on this, but we reiterate that the company has one of the longest dividend growth streaks in the market place. The payout ratio is also low, averaging less than 48% per year from 2011 through 2020.

Investors can look back at other similar separations to see what the future of the dividend holds. Other healthcare companies that have split have continued to raise dividends, with Abbott Laboratories and AbbVie being the most prominent example. The two combined dividends of these companies are greater today than at the time that they were separated. Both companies have continued to raise their dividends as well.

We believe that the eventual separation of the consumer healthcare segment will not result in a lower combined dividend than what shareholders currently receive. There is no evidence that Johnson & Johnson’s dividend is in danger of being reduced in the aggregate at this time.

Instead, it is likely the companies will continue to raise their dividends after the spinoff.

Final Thoughts

Johnson & Johnson has rarely reorganized its business in such a dramatic fashion as the planned spinoff of the consumer healthcare segment. This may have caused some jitters for those who own the name because of its dividend growth history.

After reviewing how the spinoff will make both new companies look, we remain confident that Johnson & Johnson will offer the potential for greater value creation and that the dividend looks very safe.

Both new companies do retain much of the diversification that has defined Johnson & Johnson over the long-term. Both companies will also remain leaders in their respective areas of healthcare.

Therefore, we feel that investors should feel reassured that Johnson & Johnson will remain a top dividend growth stock to own. It is likely the new company receives a higher valuation and the new consumer healthcare company retains its own leadership position in its industry.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more