Johnson & Johnson Q3 Preview: Can The Earnings Streak Continue?

Image: Bigstock

The Zacks Medical Sector has primarily traded in line with the S&P 500 in 2022, down roughly 22%. A titan in the sector, Johnson & Johnson (JNJ - Free Report), is on deck to unveil quarterly results on Oct. 18 before the market open.

Headquartered in New Jersey, Johnson & Johnson is an American multinational corporation that develops medical devices, pharmaceuticals, and consumer packaged goods. Currently, the company carries a Zacks Rank #3 (Hold) with an overall VGM Score of a C.

How does everything else shape up for the pharmaceutical titan heading into its quarterly print? Let’s take a closer look.

Share Performance & Valuation

Year-to-date, JNJ shares have displayed remarkable relative strength, down just 2% and easily crushing the general market’s performance.

Image Source: Zacks Investment Research

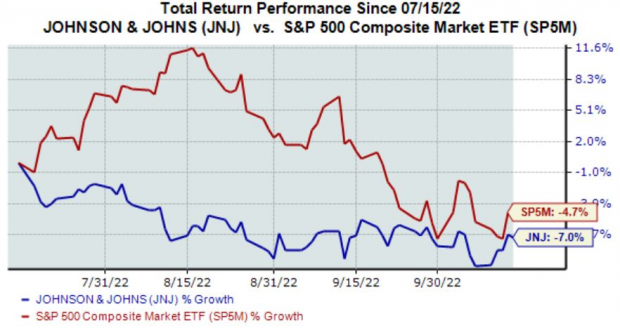

However, over the last three months, the story has been a bit different. JNJ shares have declined 7%, underperforming the S&P 500 by a fair margin.

Image Source: Zacks Investment Research

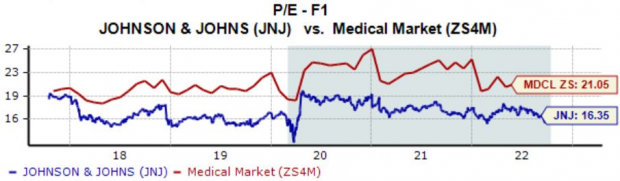

Furthermore, JNJ shares trade at respectable levels, further bolstered by its Style Score of a B for Value. The company’s 16.4X forward earnings multiple sits just a tick below its 16.8X five-year median, reflecting a 22% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been bearish for the quarter to be reported, with three downwards estimate revisions hitting the tape over the last several months. The Zacks Consensus EPS Estimate of $2.51 pencils in a nearly 4% drop in quarterly earnings year-over-year.

Image Source: Zacks Investment Research

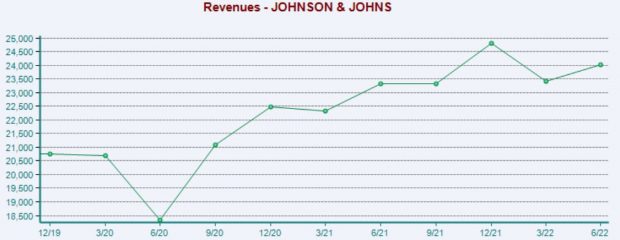

However, the company’s top-line is in better shape; the Zacks Consensus Sales Estimate of $23.5 billion suggests a marginal 0.7% year-over-year uptick.

Quarterly Performance & Market Reactions

JNJ has a stellar earnings track record, exceeding the Zacks Consensus EPS Estimate in each quarter dating all the way back to 2012. Just in its latest print, the company penciled in a slight 0.8% EPS beat.

Top-line results have left some to be desired as of late, with Johnson & Johnson exceeding revenue estimates just once across its last four prints. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

For those that like to trade around the company’s earnings releases, it’s worth noting that JNJ shares have moved upwards following five of its last six quarterly reports.

Putting Everything Together

JNJ shares have been remarkably defensive in 2022, but they have lagged behind the general market over the last several months. Valuation multiples don’t appear stretched, with the company’s forward earnings multiple sitting just below its five-year median and nowhere near its Zacks Sector average.

Analysts have been bearish in their earnings outlook, and estimates reflect a decline in earnings but an uptick in revenue – likely a reflection of margin compression. JNJ has consistently exceeded bottom-line estimates throughout its history, but top-line results have left some to be desired over its last four prints.

Heading into the quarterly print, Johnson & Johnson (JNJ - Free Report) carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of 1.3%.

More By This Author:

Netflix Q3 Preview: Can Shares Stay Hot?Can Bank Stocks Maintain The Recent Momentum?

Netflix Gears Up For Q3 Earnings: What's In The Cards?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more