Jeld-Wen IPO Opens A Window For Investors

Jeld-Wen Holding (Pending:JELD) filed its S-1/A with the Securities and Exchange Commission for its upcoming IPO that is planned for January 27, 2017. The company plans to sell 25 million shares at a marketed price range of $21 to $23. Of those 25 million shares, 2.73 million, or approximately 11%, are being sold by company insiders. Company insiders are offering an additional 3.75 million shares as an over-allotment option for its underwriters.

The underwriters for the IPO are Barclays, Citigroup, Credit Suisse, J.P. Morgan, Deutsche Bank Securities, RBC Capital Markets, BofA Merrill Lynch, Goldman Sachs & Co., Wells Fargo Securities, Baird, FBR and SunTrust Robinson Humphrey.

Assuming JELD-WEN Holding prices at the mid-point of its price range, it would command a fully diluted market cap of $2.39 billion.

Business overview

According to its filing, JELD-WEN Holding is the world's largest window and door manufacturer. Its customers include: wholesale distributors, retailers as well as individual contractors and household consumers.

The company designs, produces and distributes vinyl, aluminum and wooden windows as well as an extensive range of interior and exterior doors. The company operates 115 manufacturing facilities that are located in 82 countries. JELD-WEN Holding Inc. was founded in 1960 in Oregon and has over 20,000 employees today.

(Source)

Executive management overview

Mark Beck has been the chief executive officer and president of the company since November 2015 and a director of the company since November 2016. Before that, Beck was the executive vice president of water quality and dental platforms at Danaher Corporation. He joined JELD-WEN in April 2014. Prior to Danaher, Beck worked at Corning Incorporated for 18 years, serving in a variety of management and executive-level positions of increasing responsibility. Beck holds a Master of Business Administration from Harvard Business School and a Bachelor of Arts in business management from Pacific University.

L. Brooks Mallard is the chief financial officer and executive vice president of JELD-WEN Holding Inc. since November 2014. Prior to that, he worked at TRW Automotive Holdings Corporation as the finance director of its global brakes business from March 2013 until October 2014. Previously, he worked at Cooper Industries PLC, serving in a variety of roles with increasing responsibility. Mallard holds a Master of Business Administration and a Bachelor of Business Administration from Georgia Southern University.

Financial highlights and risks

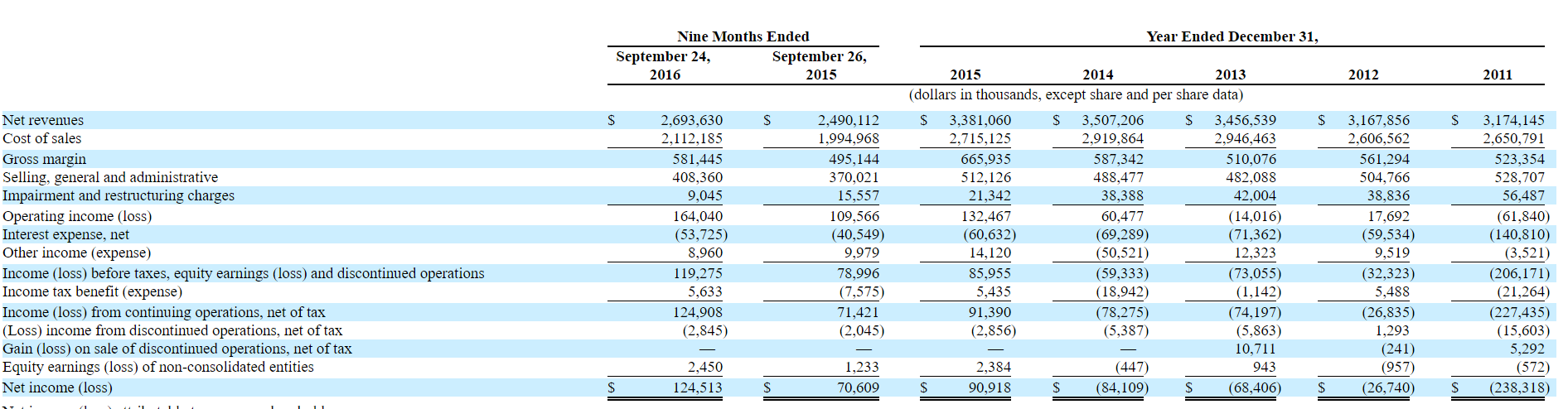

JELD-WEN reports that it had total revenues for the year that ended on December 31, 2015, of $3.381 billion and net income of $90.918 million. Revenue has been decreasing slightly for the company, declining 3.5% from 2014 to 2015. The company reports negative economic trends have led to a slowdown in demand for some of its products. However, 2016 is on track to be a better year with revenue up 8.1% for the nine months ending September 24, 2016, compared to the same period the previous year. Net income was $90.9 million in 2015 and a net loss of $84.1 million in 2014, $68.4 million in 2013, and $26.7 million in 2012.

(Click on image to enlarge)

(Source)

The company plans to use its proceeds to repay its debts, increase its capitalization, improve its financial flexibility and to increase its visibility.

Competitors

JELD-WEN Holding identifies numerous competitors both regionally and internationally. Among its competitors in the North American market, the company identifies: Pella, Anderson, Milgard, Marvin and Ply-Gem as its top competitors, all of whom are private.

Assuming JELD-WEN Holding prices at the mid-point of its price range it would command a fully diluted market cap of $2.39 billion and trade at a price/sales multiple of 0.66x. This is slightly below the average price/sales multiple for the household durable market of 1.06x.

|

TKR |

Market Cap |

Price/Sales |

|

JELD |

$2.39 billion |

0.66x |

|

Household Durable (Avg.) |

$3.37 billion |

1.06x |

(Source)

Conclusion: Consider A Modest Allocation

JELD-WEN has a long operational history and a talented management team heading its business. It has a global geographic presence and leading market position in most countries it competes.

In addition, we hear the deal is already oversubscribed.

At the same time, negative economic trends and a decline in revenue in recent years make us hesitant.

We recommend investors consider a modest allocation in this IPO.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in JELD over the next 72 hours.

more