Jagged Peak Energy: A Strong Buy For Event-Driven Investors

Jagged Peak Energy (NYSE: JAG) - Strong Buy Recommendation

The 25-day quiet period for the Jagged Peak Energy is scheduled to expire on February 21, 2017. This will allow the underwriters for the IPO to release their reports, analyses and recommendations on February 22, 2017. Studies have found quiet period expirations resulting in temporary price increases and our own firm has found similar results. Given Jagged Peak Energy's relatively flat opening, we see an additional opportunity for a boost for shares around the event.

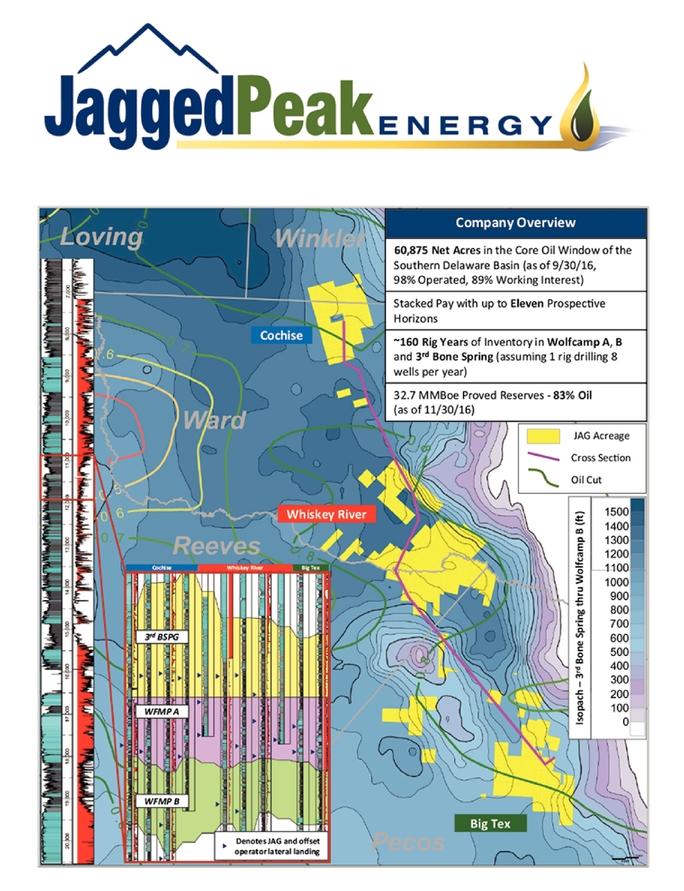

Business overview

An independent oil and gas company that is based in Denver, Colorado, Jagged Peak Energy was founded in 2013. The company is focused on the development of unconventional oil and natural gas reserves in Texas's Southern Delaware Basin. As of Sept. 30, 2016, the company reported that it held an 89 percent working interest in 68,121 gross acquired and leased acres in contiguous blocks that are located in Pecos, Winkler, Ward and Reeves counties.

(Source: SEC Filings)

Management team highlights

The chief executive officer, chairman and president of Jagged Peak Energy LLC since Aug. 2013, Joseph N. Jaggers has served in these positions since Sept. 2016. Previously, he worked as the CEO and president of Ute Energy LLC from July 2010 until Aug. 2012, when it was acquired. He has more than 35 years of industry experience and holds a Bachelor of Science from the United States Military Academy at West Point.

The chief financial officer and executive vice president of Jagged Peak Energy since Nov. 2016, Robert W. Howard has also served as the chief financial officer of Jagged Peak Energy LLC since April 2016. Prior to joining the company, he served as the CFO of the Bill Barrett Corporation since 2007. His experience dates back to 1984, and he has held numerous executive positions in several companies during his career. Howard has a Bachelor of Business Administration in accounting that he obtained at the University of Wisconsin - Eu Claire.

Competitor comparison

Extraction Oil & Gas (XOG) is another Denver-based oil and gas company that went public in 2016. It has a market cap of $3 billion and a price to sales ratio of 10.6. Shares of XOG were trading at $17.75 as of mid-morning trading on Feb. 10, 2017. By contrast, JAG has a market cap of $3 billion with a price to sales ratio of 49.5. Both companies are trading below their IPO price.

Financials overview & early market performance

The company priced its shares at $15, which was lower than its marketed range of $16 to $18. It opened on its first day of trading at $14.10, which was 6 percent lower than what it priced at. During the first day of trading, it dropped to $13.83 before recovering to close at $14.33. At the Feb. 10, 2017 close it was trading at $14.44, and it has hovered around that amount ever since its market debut. The share price has not reached the amount it was priced at since its market debut.

(Click on image to enlarge)

(Nasdaq.com)

For the 12 months that ended on Sept. 30, 2016, JAG reported $62 million in sales. During the nine months that ended on Sept. 30, 2016, the company reported total revenues of $51.381 million and a net loss of $7.8 million. In the nine months that ended on Sept. 30, 2015, JAG reported total revenues of $23 million and a net loss of $699,000 for a 124 percent increase in revenues year-over-year.

Conclusion: Buying Opportunity For Investors With An Appetite for Risk

Jagged Peak Energy continues to trade below its IPO price. Despite a difficult last few years for oil and gas companies, investors are beginning to view the industry more optimistically.

We view the upcoming quiet period expiration as a potential buying opportunity in shares of JAG as the company's large team of underwriters publish (likely positive) reports and recommendations on 2.22.

The influential joint book-running managers for the IPO were Citigroup, Credit Suisse, J.P. Morgan, Goldman, Sachs & Co., RBC Capital Markets and Wells Fargo Securities. The senior co-managers were UBS Investment Bank and KeyBank Capital markets, and the co-managers were ABN AMRO, Fifth Third Securities, Petrie Partners Securities, Tudor, Pickering, Holt & Co., BMO Capital Markets, Deutsche Bank Securities, Evercore ISI and Scotia Howard Weil.

As we noted previously we have found above-market returns in a one-week window surrounding the event day, particularly for firms like JAG with a large and diverse team of IPO underwriters.

Disclosure: I am/we are long JAG.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not ...

more