It's Not Too Late To Buy Apple

It is generally not easy to find undervalued opportunities among large and well-known companies such as Apple (AAPL). However, when considering the company's fundamental strength, valuation levels, and long-term prospects, it seems like the market is underestimating the quality of the business. In other words, Apple is a bargain hidden in plain sight.

Outstanding Fundamental Quality

Apple is a tremendously valuable brand, in fact, it is considered by Forbes as the most valuable brand in the world, with an estimated value of $206 billion. Brand value and customer loyalty allow Apple to charge premium prices for its products, which is translated into superior profitability for investors.

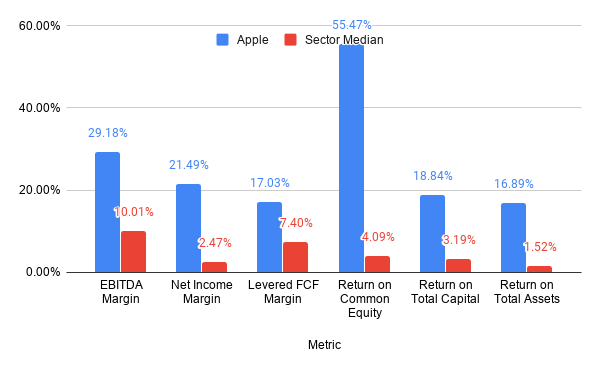

The table below shows key profitability metrics for Apple versus the median values in the industry. When looking at EBITDA margin, net income margin, levered free cash flow margin, return on equity, return on capital, and return on assets, Apple is widely superior to the competition.

(Click on image to enlarge)

Data source: Seeking Alpha

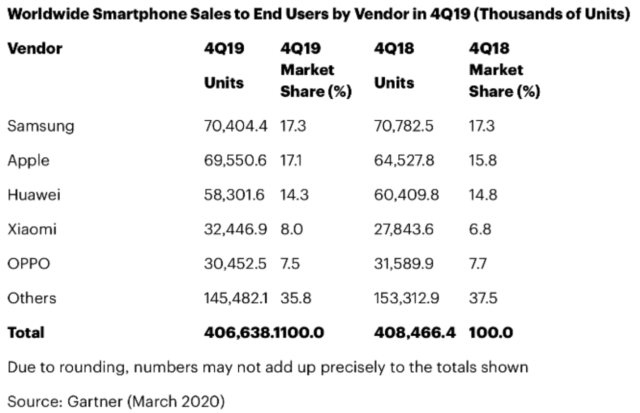

The smartphone industry has clearly matured, especially in the premium price segments where Apple operates. However, the company keeps delivering solid numbers in the iPhone segment and outperforming expectations. According to data from Gartner, global sales of smartphones to end-users contracted in the fourth quarter of 2019, while Apple's iPhone unit sales grew 7.8%.

(Click on image to enlarge)

Source: Gartner

Apple's installed base of devices surpassed 1.5 billion last quarter, up over 100 million in the last 12 months alone. This massive and growing installed base speaks well about customer satisfaction and engagement levels. Importantly, it is also fueling attractive growth opportunities in services.

Apple produced $12.7 billion in services last quarter, growing 17% over last year. The company has over 480 million paid subscriptions across services on its platform, up 120 million from a year ago. Management has recently increased its target to reach 600 million before the end of the calendar year 2020.

Growing engagement in services makes the ecosystem more sticky, and it fosters customer loyalty. Besides, services generate recurrent revenue for Apple, which can be a major plus for investors in terms of growth visibility over the years ahead.

The services segment will account for a larger share of overall revenue over time, and this should have an increased impact on total revenue growth. Besides, services is a notoriously profitable business, and it can be expected to drive expanding profitability for Apple over the long term.

Attractive Valuation

Looking at basic valuation metrics, Apple is currently trading at a forward P/E ratio of 21.26. By comparison, the median value for companies in the Information Technology sector stands at 25.95.

We can reach a similar conclusion by looking at the price to free cash flow ratio. The forward price to free cash flow ratio stands at 16.58 for Apple versus an industry median of 18.17.

The company returned nearly $81 billion to investors via dividends and buybacks over the past 12 months. This represents a total shareholder yield of 5.75% versus the market capitalization value of $1.2 trillion. In the December quarter alone, Apple distributed $25 billion to shareholders. Annualizing this rate provided a total shareholder yield of 8.3%.

In simple terms, Apple is priced in line and even at a slight discount versus other companies in the industry. Smaller companies can outperform Apple in terms of revenue growth, but Apple comes second to none in terms of profitability and fundamental strength, so we could say that investors are buying a high-quality business for an average valuation.

Cash distributions can be a key driver for Apple in terms of valuation. It is one thing to say that the stock is cheap in comparison to the earnings and cash flows that the business is producing. However, when the stock is undervalued in comparison to cold hard cash distributions via dividends and buybacks, then this undervaluation becomes a far more tangible concept.

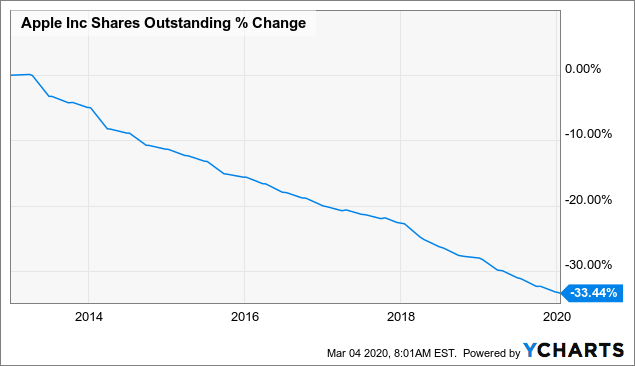

The company's track record in terms of buybacks is downright outstanding, Apple has repurchased over 33% of the shares outstanding since 2013.

(Click on image to enlarge)

Data by YCharts

On a forward-looking basis, the table shows the average earnings estimate for Apple over the coming years and the forward P/E ratio implied by those estimates. It is interesting to note that analysts are expecting double-digit growth over the next 3 years and then a material deceleration afterward.

(Click on image to enlarge)

Source: Seeking Alpha

Future returns from Apple stock will depend on the company's performance in comparison to expectations. It is good to know that growth forecasts assume a substantial slowdown in the years ahead because a low bar is easier to beat.

The iPhone has consistently outperformed expectations in the past and Apple is successfully expanding into wearables and services. Besides, share buybacks reduce the number of shares outstanding, which increases earnings per share. When considering the impact of all these factors together, it is not unreasonable at all to say that Apple is well-positioned to outperform the modest growth expectations currently being priced into the stock.

This is a crucial consideration to keep in mind when analyzing a stock. Many times the most profitable investments are not the companies with low valuation ratios in comparison to current earnings, but those who can deliver future earnings numbers above market expectations.

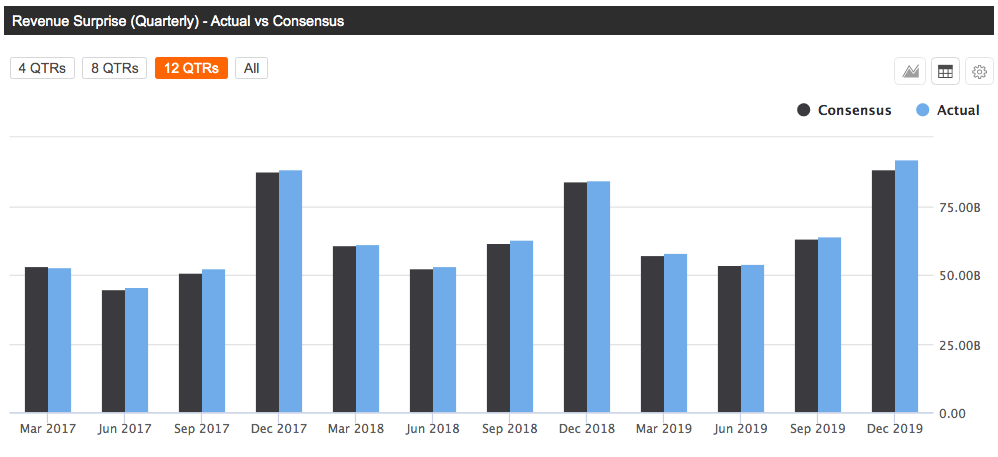

Speaking of which, Apple has delivered earnings above consensus estimates in each of the past 12 quarters. This is quite an impressive display of consistency in a challenging industry, and it shows that management is inclined to under-promising and overdelivering when it comes to earnings guidance.

(Click on image to enlarge)

Source: Seeking Alpha

Valuation should be interpreted in the right context, and investors should always incorporate other return drivers when assessing valuation levels. A company that generates strong profitability and consistently beats expectations deserves a higher valuation than a business with below-average profitability and underperforming expectations.

However, it is not easy to incorporate multiple factors in order to see the complete picture. In that spirit, the PowerFactors system is a quantitative system that ranks companies in a particular universe according to a combination of factors: financial quality, valuation, fundamental momentum, and relative strength.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and the higher the ranking the higher the expected returns.

This bodes well for Apple, as the company has a PowerFactors ranking of almost 99, meaning that Apple is currently in the top 1% of companies in the US stock market when considering valuation, financial quality, fundamental momentum, and relative strength together.

Backtested performance data for these kinds of algorithms should always be taken with a grain of salt. The backtested data shows that a large number of companies with high PowerFactors rankings tend to deliver superior returns over the years, but this does not tell us much about how a specific company such as Apple is going to perform in a particular year such as 2020.

However, it is good to know that Apple is attractively valued when considering valuation levels in the context of other return drivers. If the company executes well, then the stock should still offer attractive upside potential going forward.

The Investment Thesis

Apple is priced like a classic consumer electronics business, but the company's profitability metrics are far superior to those of other companies in the sector. In a sense, we could say that the market is underestimating the company's quality when assigning Apple an average valuation.

Apple is not an average hardware company, it is a world-class consumer technology company with outstanding brand value and other competitive strengths, and that's why Apple generates profitability levels that competitors can only envy or admire.

Most companies in the hardware sector have no pricing power at all, and smartphone manufacturers are always competing on prices, which obviously hurts profit margins. Apple, on the other hand, is a differentiated player that has a unique ability to command higher prices for its products. Importantly, the pricing policy is also a marketing tool for Apple, since it indicates to consumers that this is a product with superior quality.

A critically important area in which the market seems to be underestimating Apple is revenue predictability. Hardware companies usually see declining revenue over time due to growing competition and technological obsolescence.

Apple, however, is proving an ability to transcend not only products but even industries. The company has successfully expanded from computers to music players, then to smartphones and tablets and, finally, to wearables and - much important - services.

As long as the company continues expanding successfully into these areas, investors in Apple should be well rewarded with both growing earnings and expanding valuation ratios over time.

Disclosure: I am/we are long AAPL.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more