It's Not Just Soaring Inflation: Here Are The 4 Main Themes On This Quarter's Earnings Calls

By now everyone - except a very special group of idiots residing at the Marriner Eccles building and their media propaganda lackeys - is aware that inflation in the US is soaring to the point where some such as BofA, are speculating that the US is facing a period of "transitory" hyperinflation (if BofA is right it would be remarkable, as it would be the first-ever case in human history of "transitory" hyperinflation that does not result in a monetary reset).

Those most aware of the soaring prices - in addition to those who have to pay them - are corporations themselves, who as we profiled earlier this week, have been hit with surging input costs and have been quietly and not so quietly passing them on to consumers.

As Goldman notes, rising prices and the implications of rising input costs for profit margins was among the primary topics of discussion in many of the just concluded Q1 earnings calls, including those of ALLE, AVY, CAG, CARR, CAT, CHD, CL, CLX, CMG, CTAS, F, FAST, FBHS, FCX, GPC, GWW, HAL, IEX, IP, KHC, KMB, KO, LKQ, LW, MAS, MHK, NWL, ORLY, PH, PNR, SHW, SNA, TAP, TFX, TXT, WHR.

But it's not just inflation. As Goldman writes in its latest quarterly Beige Book publication, in which the bank gathers anecdotal evidence of fundamental and thematic trends from the earnings transcripts of S&P 500 companies, there were three other themes in addition to inflation, namely the COVID recovery; buybacks; and labor trends (incidentally, of the companies that have already reported which is 85% of total S&P 500 market cap, 70% beat estimates by 1 standard deviation or more vs. the 15 year average of 48%).

Here is a snapshot of Goldman's key observations:

- COVID recovery. Many firms are optimistic that pent-up demand will drive upcoming growth, while others have already seen notable strides in recovery.

- Inflation. Companies discussed their varying approaches to profit margin protection in the face of rising costs. Many firms are relying on price increases to combat inflation. Meanwhile, other firms indicated they will prioritize cost-management strategies to preserve margins.

- Buybacks. As a result of stellar earnings results and the strong economic outlook, many companies have increased or reinstated share repurchase programs.

- Labor market. Firms are having difficulty finding labor, particularly in transportation and hospitality. In response, some companies plan to ramp up hiring or bring recalled employees back to work sooner than expected. Few companies commented on the potential implications of a minimum wage hike, and sentiment varied on this topic.

There was one bonus theme: cryptocurrency. According to Goldman, a handful of companies discussed cryptocurrency in earnings calls this quarter, and following strong public interest, some companies (mostly within Financials) are already offering services that provide exposure to cryptocurrency or accepting it as payment, either through internal platforms or through third party cryptocurrency ventures.

We go down the list of observations, starting with...

Theme 1: The COVID recovery

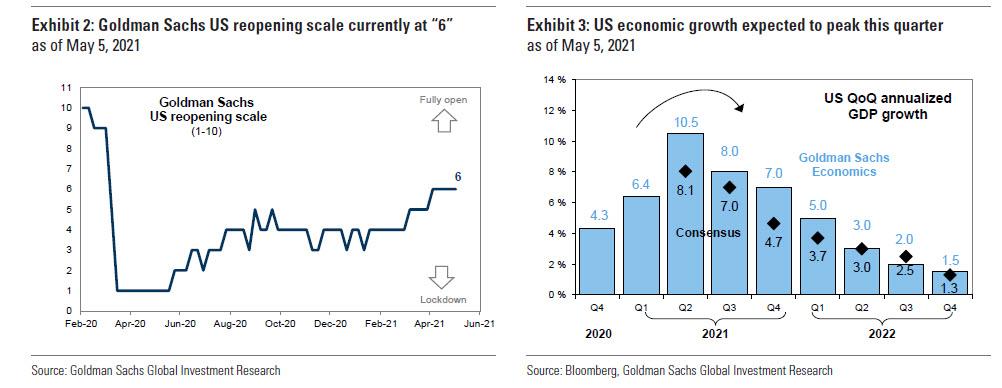

The US economy is recovering from the pandemic on almost all fronts, with Goldman economists’ latest recovery tracker showing the unemployment rate falling to 6.0% and consumer spending rising to 105% of pre-pandemic levels. Furthermore, 40% of the US population has already received at least one vaccine dose, which should support the gradual reopening trend shown below. All of these factors contribute to Goldman economists’ view that US GDP growth should peak at 10.5% this quarter.

(Click on image to enlarge)

This improvement in economic and business outlook has been a common theme in management earnings commentary. Many firms are optimistic that pent-up demand will drive upcoming growth, while others have already seen notable strides in recovery. In particular, companies in COVID-sensitive sectors, such as travel and real estate, are confident that demand will return once lockdown restrictions are lifted. New consumer trends have also emerged, such as changes in spending behavior, which may persist even post-pandemic

Pent-up demand

- Delta Air Lines, Inc. (DAL): Pent-up demand is also evident, with domestic leisure bookings 85% recovered to 2019 levels and leisure markets more than fully restored. Beyond our own bookings, we see encouraging data points in the broader economy. This includes accumulated savings, restaurant dining, credit card spend, hotel occupancy rates, web search data on travel and corporations announcing more concrete office reopening plans.

- McDonald’s Corporation (MCD): There’s pent-up demand that we’ve seen when we are able to get a market open or even last year when we had some reopenings that then resulted in closures not too long thereafter as the second and third wave came about... there’s nothing that gives us any concern that as we reopen that we’re going to see the same pent-up demand come back and get the European business moving forward.

- Domino’s Pizza, Inc. (DPZ): And with COVID loosening up certainly in some places, not as much in others, as it loosens up, it really gives those franchisees the opportunity to release some of that pent-up demand for unit-level investment and growth.

- Comcast Corporation (CMCSA): We’re also encouraged by the trends we’re seeing across NBCU. Our Parks segment broke even, excluding Beijing, for the second consecutive quarter, driven by remarkable attendance at Universal Orlando. We can see firsthand the pent-up demand for high-quality entertainment and family fun outside of the home, and we remain incredibly bullish on the Parks business.

- Lamb Weston Holdings, Inc. (LW): I expect at the end of the calendar year, based on some of the data we look at, we’re projecting Foodservice to be back to pre-pandemic levels. And as we’ve seen markets in the U.S., not all of them opened up and just lift restrictions, we’ve seen them approach or get pretty darn close to pre-pandemic levels. Now we need some time to work through overall, the consumer behavior of going back to eat restaurants over a longer period of time. But that gives me confidence that there’s some pent-up demand for the restaurants in our Foodservice segment. And I think we’ll get back to pre-pandemic levels by the end of the calendar year.

- IQVIA Holdings Inc (IQV): Excluding that fast-burning work that we had in the first quarter, the R&DS business grew mid-double digits and the TAS business grew high single digits, excluding the COVID-related work. The rest of the year, obviously, will be higher than that, again, because we have the trailing impact of COVID we think well into ‘22 and the pent-up demand that needs to be caught up. So all of that helps build momentum.

Signs of recovery

- American Airlines Group, Inc. (AAL): Small business demand, which was roughly 17% of our system revenue has been improving steadily as vaccination rates have increased and as markets reopen. An increasing number of our largest corporate accounts are coming back to the office and indicating that they’ll be traveling in the third quarter and confirming in-person board meetings, conferences and events for this year.

- Alaska Air Group, Inc. (ALK): As momentum with vaccine has picked up and travel restrictions have eased, there has been a strong return of leisure demand. We have seen passenger employments move from being down 65% in January to down 35% in April. Today, sustained future bookings are roughly 80% of pre-COVID levels.

- American Express Company (AXP): We are seeing a faster pace of spending recovery in the U.S. versus other regions. The total volumes from our U.S. consumer and SME customers are recovering faster than other customer types and were up 1% versus 2019 levels in the month of March, even with the continued drag of T&E spend not yet fully recovering.

- Archer-Daniels-Midland Company (ADM): We continue to see strong demand. I think that as some restaurants and some places are reopening, we started to see food services coming back a little bit. To be honest, we saw that across the company, not only in soybean oil. I would say March orders were significantly better than January and February. And I think we see that continuing in April.

- Colgate-Palmolive Company (CL): If you start with Asia, the categories are coming back, although still not back to where we were pre-COVID due to some of the store closures that we continue to see across Asia, particularly China and Southeast Asia coming back in terms of a category development standpoint.

- Starbucks Corporation (SBUX): We are seeing recovery though in those metropolitan areas. I think that’s going to take a little longer for businesses to bring employees back to work and sort of reshift those traffic patterns. But I think very, very positive progress on dayparts and continued progress in terms of both in dense metropolitan located stores.

- General Electric Company (GE): Healthcare equipment and services continue to be a strength. We saw increased demand as global procedure volumes recovered to pre-pandemic levels.

- Las Vegas Sands Corp. (LVS): March, we started to experience a pretty meaningful rebound in visitations versus January and February. And as you’ve seen from the figures released by MGTO, that has continued on a similar momentum in April with visitations reaching post-pandemic highs in the mid of April.

- AvalonBay Communities, Inc. (AVB): We expect a more rapid recovery in move-in rents over the next couple of quarters as people are called back to the office, urban universities announce on-campus learning and the quality of the environment improves when retail, restaurant, entertainment and other services reopen for in-person experiences. We’re starting to see some of that demand already, which is reflected in our asking rents.

- American Electric Power Company, Inc. (AEP): As we look towards the future, we are seeing our communities starting to rebound from the shadow of the pandemic. Job growth and electric consumption show continued improvement, supporting our view that the economy within our service territory will continue to rebound.

New consumer trends

- Amazon.com, Inc. (AMZN): Grocery has been a great revelation during the post-pandemic period here. I think people really value the ability to get home delivery. And we’ve seen that as numbers go up considerably pre and post-pandemic.

- Cboe Global Markets Inc (CBOE): The biggest observation we see is the change in the size of the contracts that are coming into the SPX complex. Those really large trades that we saw before the pandemic have been replaced with smaller order size... and then in the super short-dated and low premium contracts, huge uptick in what we’ll put in a category of traditional retail.

- Conagra Brands, Inc. (CAG): The adoption of remote work provides a structural increase in the demand for frozen food compared to pre-COVID levels. Importantly, some aspects of the remote workforce adoption are expected to be permanent.

- Clorox Company (CLX): The key takeaway is versus pre-pandemic levels, cleaning behaviors are still significantly elevated. We’re seeing that in their buying habits.

- Automatic Data Processing, Inc. (ADP): Despite the pandemic hopefully fading, there will be increased levels of government activity around employment and incentives...that’s a good environment for ADP and for our downmarket business because most small businesses don’t have the time or the inclination to really focus on these things and to take care of these things.

- Alphabet Inc. (GOOGL): Consumers are spending more time online. They’re buying more online. They were willing to try new brands, and they’re eager to support local businesses, SMBs.

- Carrier Global Corp. (CARR): People are much more in tune with having safe indoor environment. So to make it visible to them and then how you ultimately use AI and ML to anticipate and correct any deficiencies with indoor environments, is a trend that will withstand the test of time.

- American Express Company (AXP): You saw more cash-back cards being acquired. There was a 35% jump in premium cards that we saw in this particular quarter, and acquisition of Platinum and Gold cards was well above pre-pandemic levels.

- LyondellBasell Industries NV (LYB): With government stimulus supporting the U.S. economy and limited options for travel, leisure and public dining, consumers remodeled homes and purchased appliances, home entertainment and vehicles that drove recovery for the industrial economy.

- Weyerhaeuser Company (WY): Feedback from our customers indicates a shifting trend from small do-it-yourself projects to larger professional remodels. We expect repair and remodel demand to remain strong throughout 2021 as project backlogs continue to expand.

- U.S. Bancorp (USB): If you end up looking at some of the other categories, the significant amount of stimulus on the consumer side has allowed consumers to be paying down debt.

Theme 2: Input cost and price inflation

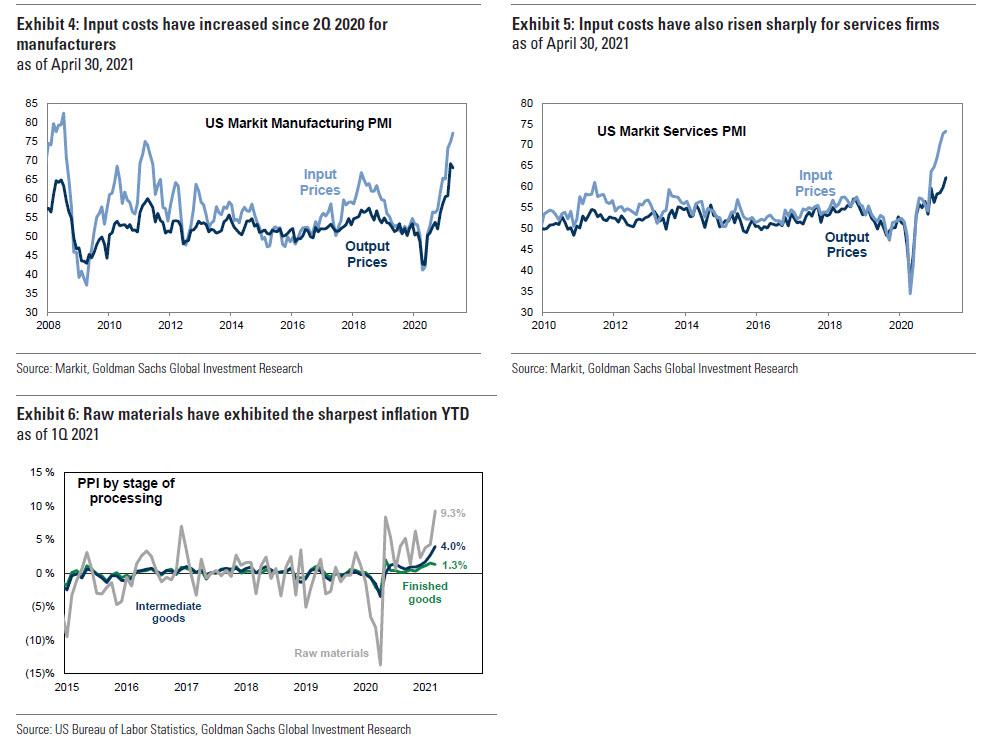

"Inflation was the word on everyone’s lips during 1Q reporting season", according to Goldman, confirming what we already reported. Input costs have risen increasingly sharply in recent months for manufacturing and services firms (Exhibit 4, Exhibit 5). Rising costs are particularly noticeable upstream in the supply chain, with PPI raw materials costs up 9% in March, compared with just a 1% rise in the finished goods component (Exhibit 6). Not helping, Goldman's commodities strategists are bullish on the outlook for 2021, forecasting a further 13.5% rally across the commodities complex in the next 6 months. In particular, they expect the biggest jump in oil demand ever will lead Brent crude oil to appreciate over 15% in the coming 2 quarters. At $69/bbl, Brent trades 656% above its April 2020 trough. Despite this, S&P 500 margins expanded in nearly every sector in 1Q 2021 driven by Consumer Discretionary, Communication Services, and Materials.

(Click on image to enlarge)

Companies discussed their varying approaches to profit margin protection in the face of rising costs and, as Goldman notes, "many firms are relying on price increases to combat inflation." Meanwhile, other firms indicated they will prioritize cost-management strategies to preserve margins. Companies’ expectations about the timing of inflationary risk varies. Our economists expect the most noticeable cost increases will be caused by near-term disruptions to supply chains and should not persist into 2022 (Exhibit 7). A subset of companies indicated that inflation has either proven transitory, manageable or an ancillary concern.

(Click on image to enlarge)

Corporate responses to inflation

Pricing

- Coca-Cola Company (KO): As an overarching principle around the world, we typically look to take pricing in line with inflation. And I would expect that, that principle will continue to be adhered to as we move into the back half of ‘21 and even into ‘22.

- Carrier Global Corp. (CARR): In the current guide [incremental headwinds from inflation] went up by another $70 million or so, so $70 million. And our current guide assumes that we’re offsetting that with about $70 million of incremental pricing.

- Pentair plc (PNR): While inflation remains high, we have instituted a number of selling price increases across the portfolio that we expect to help mitigate inflation in the second half of the year.

- Mohawk Industries, Inc. (MHK): We have raised prices across all product categories and have announced additional increases where material inflation has continued to expand.

- LKQ Corporation (LKQ): We expect to see continued inflation related to freight, labor and cost of goods sold. That said, as witnessed throughout 2020 and in the first quarter of this year, we have a number of levers that we can pull to help offset these inflationary risks, including price.

- Textron Inc. (TXT): There’s no question that inflation is out there. We’re seeing it in a number of cases, but I think what our strategy has been is to try to keep pricing ahead of inflation, and we’ve been successful doing that.

- Allegion PLC (ALLE): This guide incorporates pricing actions to offset direct material inflation as well as reflecting our supply chain capability to mitigate industry challenges on supply and electronic component shortages.

- Caterpillar Inc. (CAT): As we do buy steel forward, we have about a 3- to 6-month full contract normally on steel purchases. So we do expect material cost to move from positive to negative as we move forward. However, we are pricing accordingly. And with geo mix as well becoming favorable, we hope to be able to offset the two. Obviously, there is continued risk, obviously on material inflation as we look out.

- Colgate-Palmolive Company (CL): Consistently across all emerging markets, we’ve been able to take strong pricing given the strength of our businesses, and that really started back in 2020. And you’ve seen a competitive environment is obviously having to offset a lot of the raw material inflation that we’ve seen taking pricing, which has allowed the emerging markets to take a little bit more value in their categories.

- O’Reilly Automotive, Inc. (ORLY): We saw a little bit higher [inflation] than expected here in the first quarter, although we expected that to ease in the back half of the year. To the extent it doesn’t, we are going to remain rational in our pricing, and we would expect the industry to also remain rational.

- Fastenal Company (FAST): We are experiencing significant material cost inflation, particularly for steel, fuel and transportation costs. This did not have a material impact on the first quarter of 2021. Price contributed 60 to 90 basis points to growth and the impact of price cost on margin was immaterial. However, we are instituting broad and material pricing actions in the second quarter of 2021 that will likely lift pricing contribution over the course of the year. Customers never like higher prices, of course, but they are busy in seeing increases throughout the supply chain. …The environment today is receptive.

- IDEX Corporation (IEX): We’ve maintained our historical price cost spread. Where we have seen some businesses, the inflation has ramped up here more quickly. They’ve gone out proactively with incremental prices or surcharges to our customers. So our commercial teams are actively working with their supply chain teams to make sure that we have the ability to continue that spread as we progress through the year.

- Church & Dwight Co., Inc. (CHD): Our outlook for the quarter on gross margin was down 50 basis points. The entire variance was related to the spike in commodities and tight transportation market. The good news is, for the back half of the year, we expect margin expansion behind the pricing and promotional actions we laid out in the release as well as we start to lap some of the higher inflation and tariffs that we experienced in the back half of 2020.

- Avery Dennison Corporation (AVY): To begin the year, supply chains have remained tight, and input costs have been increasing. As a result, raw material and freight inflation were above our initial expectations, and we have continued to see costs rise as we enter the second quarter. We now expect mid- to high single-digit inflation for the year, with variations by region and product category. As we typically do, we will address this through a combination of both product reengineering and pricing.

- Kraft Heinz Company (KHC): In emerging markets, in general, acceptance of pricing is better, right, because inflations are more normal on the local economies. In developed markets, what I can tell you is we’ve already successfully closed negotiations with all our key retail partners, and especially in key countries like France, Germany. And we managed to achieve the pricing and premiumization behind the brands that we needed.

Cost-cutting

- Conagra Brands, Inc. (CAG): We will also leverage our capabilities beyond just pricing to offset margin pressure, including overall mix management, cost savings measures such as our ongoing supply chain realized productivity programs, and the optimization of our fixed cost leverage.

- Clorox company (CLX): In recent months, we’ve also seen a significant resin price inflation. To manage those rising costs, we have announced a pricing action on this brand effective in July. As we’ve mentioned, we’ll manage inflationary pressures holistically using all the tools in our toolbox.

- Cintas Corporation (CTAS): We’ve got great efficiency in our business. And so many times, we’re able to offset [inflation] with current initiatives that we have within the business. But if we can’t, we certainly can look to pricing changes into the future. ...We have not liked that idea in the last year. We did not think it’s the right thing to do, — and it’s been 2 years really since we’ve done it. But if we see inflation peak, that’s an opportunity that we will certainly have to consider.

- Kraft Heinz Company (KHC): As a matter of practice, we do not forecast pricing. …We see a lot of levers for us to manage inflation through revenue management, through savings.

- Fortune Brands Home & Security, Inc. (FBHS): We’re going to offset [inflation] with a combination of cost actions, and where necessary, price over the balance of the year. I think you should expect that across all 4 quarters.

- International Paper Company (IP): We expect margins to improve, even as we manage through the impact of higher input costs for recovered fiber, energy and transportation. In addition, we expect productivity and other cost initiatives to offset general inflation.

- Freeport-McMoRan, Inc. (FCX): As time goes by and copper prices rise, we’ll have to deal with inflation. But we have such strong margins, we have a great supply group team that works with our suppliers to offset costs wherever we can. We’re working really aggressively to do that.

- Halliburton Company (HAL): As certain components of our input costs rise, we are working with our suppliers and our customers to adjust our gross pricing in line with cost inflation we are seeing in the market. While improving U.S. economic activity and winter weather disruptions led to increases in sand, chemicals, cement additives and raw materials costs, Halliburton’s purchasing power and technology have allowed us to procure and deliver these materials in a cost-efficient manner such that both Halliburton and our customers are more competitive.

- W.W. Grainger, Inc. (GWW): We’re seeing some inflation in the market. We took some pricing actions earlier in the year. We continue to work with our supply base on any increases. We have a pretty rigorous cost process that we work with our suppliers on based on facts. And from an outlook perspective, if we continue to see any more inflation that we feel — and deem is needed to be passed on to customers, we feel confident in our ability to do that. And that is why from an outlook perspective, we are targeting price cost neutrality for the year.

- Newell Brands Inc (NWL): We expect the combination of productivity, pricing, overhead savings and incremental volume leverage as a result of better top line growth to more than cover the increase in inflationary pressure.

- Molson Coors Beverage Company (TAP): The increase in cost per hectoliter was driven primarily by inflation, including higher transportation and packaging material costs, volume deleverage and mix impact from premiumization partially offset by cost savings.

Varied guidance on timing

- Allegion plc (ALLE): We anticipate that these challenges will persist for the balance of the year, and we will continue to monitor and adapt to changing market conditions.

- Whirlpool Corporation (WHR): The global material cost inflation, in particular, in steel and resins will negatively impact our business by about $1 billion. We expect cost increases to peak in the third quarter.

- Sherwin-Williams Company (SHW): We expect to see significant raw material inflation in our second quarter, which will be the highest of the year. The pace at which capacity comes back online and supply becomes more robust remains uncertain.

- Lamb Weston Holdings, Inc. (LW): Finally, while the pandemic-related effects on our supply chain were the primary drivers of our cost increases, we also realized higher costs due to input cost inflation in the low single digits. We expect that rate will begin to tick up in the coming quarters as edible oil and transportation costs continue to increase.

- Masco Corporation (MAS): We expect raw material inflation in this segment to peak in the third quarter.

- Conagra Brands, Inc. (CAG): We expect the rate of inflation to continue to accelerate over the next few quarters.

- Kimberly-Clark Corporation (KMB): In terms of input cost inflation that is ramping in the first quarter and the second quarter, we expect that it will peak and then moderate and, in some cases, come down a bit in the second half.

- Teleflex Incorporated (TFX): But overall, I would say that total direct-indirect labor is sub-5% in terms of inflation. The other area that we are seeing heightened inflation rates is in our freight. In particular, our sea freight is up significantly, where it’s up 20% this year. And I think if you follow what’s going on, there just isn’t capacity. So collectively, as we look at all of the different inflation components in manufacturing, we’re up around 3% for the year, is our current expectation.

Inflation as a minor issue

- Sherwin-Williams Company (SHW): This whole area of raw material inflation is a transitory issue for us. It’s not new for us. We’ve demonstrated an ability to manage through this many times in the past, and we’ll get through this as well. ...We have been highly proactive in managing the supply chain disruptions to minimize the impact [of inflation] on our customers.

- Chipotle Mexican Grill, Inc. (CMG): I think everyone’s kind of waiting to see what happens in terms of demand and if there are any disruptions with supply chain. We’re not seeing any that we’re worried about right now.

- Genuine Parts Company (GPC): There was minimal impact of price inflation in our first quarter sales, and this is true for gross margin as well.

- Snap-on Incorporated (SNA): Now who’s to say how the inflation would play out across the country in a lot of different commodities. But I think — I would tell you this, I think we would be going to be one of the last to be affected by it.

- Ford Motor Company (F): It feels like we’re seeing inflation in variety parts of our industry kind of in ways we haven’t seen for many years. On the other hand, it feels like it’s all due to a lot of one-timers as the economy comes out of lockdown. So I think it’s a bit too early to declare the run rate of where it’s going to be. It’s just too hard to tell from my standpoint.

- LKQ Corporation (LKQ): As it relates to inflationary risk, we remain cautious near term. But as we progress through the year, we are expecting a continuing pandemic recovery, which would benefit each of our operating segments.

- Parker-Hannifin Corporation (PH): I was waiting for somebody to ask a question around material cost and pricing. I’m looking at a commodity chart right now, which has got trends year-over-year, quarter-over-quarter, going back to the last big inflation period. It’s a sea of red. But the thing I would say about our team is we saw this coming early on as we did this. And as you know, we’ve got really 2 great internal processes inside the company. It’s how we track our PPI, which is our input cost, and how we track our selling price index to make sure that we always maintain this margin-neutral kind of role.

- Fortune Brands Home & Security, Inc. (FBHS): We’ll show a measure of margin improvement. It will be tightest during Q2, in part just because freight really surged again kind of at the very end of last year and in Q1. And we’re going to be doing things to expedite components and other products for our customers. We’ll be absorbing some unique levels of freight inflation in the second quarter. But we do expect to make margin progress in the second quarter and make margin progress for the full year.

Theme 3: Buyback bonanza

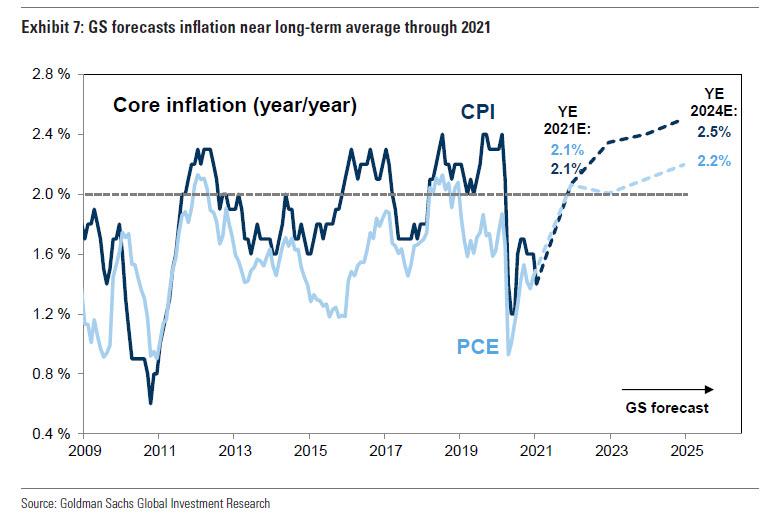

As a result of stellar earnings results and the strong economic outlook, many companies have increased or reinstated share repurchase programs. In Goldman's updated uses of cash forecasts, the bank projects a 35% increase in share buybacks for 2021 and a 5% increase for 2022. According to the GS buyback desk, and as we showed previously, buyback authorizations have surged YTD...

(Click on image to enlarge)

... which is evident in management discussions. Commentary suggests that the main drivers of this increase are excess cash on balance sheets and positive sentiment on the back of strong financial performance.

Excess cash on balance sheets

- JPMorgan Chase & Co. (JPM): We’re buying back stock because our cup runneth over. We’re earning a tremendous sum of money, and we really have no option right now.

- Netflix, Inc. (NFLX): We don’t intend to build up a bunch of excess cash on the balance sheet... and we think that share buybacks are a way to return value to shareholders in a way that is responsible steward of capital, but also maintain a level of balance sheet flexibility for us to continue to be strategic.

- CSX Corporation (CSX): $3 billion of cash is not something that we’re looking long term to keep on the balance sheet, and we’ll move away from that.

- Pool Corporation (POOL): We believe share repurchases remain our best use for excess cash, balanced with our desire to keep a relatively conservative balance sheet, so expect more of this to come in the year ahead.

- Biogen Inc. (BIIB): We still do have a meaningful amount of cash with $3.4 billion on hand at the end of the quarter. And we remain very committed to share repurchases.

Improving outlook is a confidence boost

- Apple Inc. (AAPL): Given the confidence we have in our business today and into the future, our Board has authorized an additional $90 billion for share repurchases.

- Travelers Companies, Inc. (TRV): In recognition of our strong financial position, confidence in our business... our Board also authorized an additional $5 billion of share repurchases.

- Hartford Financial Services Group, Inc. (HIG): With the expectations for strong financial performance and capital generation driven in part by the improving macroeconomic environment, we have increased our share repurchase authorization by $1 billion.

- Otis Worldwide Corporation (OTIS): Our strong performance allows us to create more value for our shareholders... we’re now in a position to increase our planned share repurchases for the year to $0.5 billion after completing $300 million in the first quarter.

- Comerica Incorporated (CMA): With more confidence in the path of the economic recovery, we plan to resume share repurchases in the second quarter.

- Celanese Corporation (CE): We want to make sure that the shareholders benefit from this increased earnings outlook we’re seeing from this year, and so we reflected that as buybacks.

- Omnicom Group Inc (OMC): Given the continuing improvements in our operations, strong liquidity and credit profile, our Board has approved the resumption of our share repurchases beginning in the second quarter.

Plans to opportunistically repurchase shares

- Lockheed Martin Corporqtion (LMT): We saw in the first quarter where our stock was trading, we thought it was grossly undervalued, and we went into this accelerated share buyback plan and deemed to be very successful. And we will opportunistically, in the next 3 quarters, buy back stock where it makes sense.

- Conagra Brands, Inc. (CAG): Given our confidence in the longer-term value creation opportunities of our business, we opportunistically repurchased approximately $300 million of shares in the quarter. Our decision to repurchase shares demonstrates our willingness to capitalize on occasions when we believe we’re undervalued.

- Chipotle Mexican Grill, Inc. (CMG): We also restarted our buyback program in late February when our stock price softened... and we expect to continue to opportunistically use excess free cash flow to repurchase our stock.

- Cabot Oil & Gas Corporation (COG): This excess free cash flow is anticipated to be earmarked for additional capital returns, including opportunistic share repurchases, especially given the recent equity underperformance and/or incremental supplemental dividends as we have provided in the last few years.

- Tyler Technologies, Inc. (TYL): And as it relates to share repurchases, again, we’re opportunistic.

Theme 4: Post-pandemic labor trends

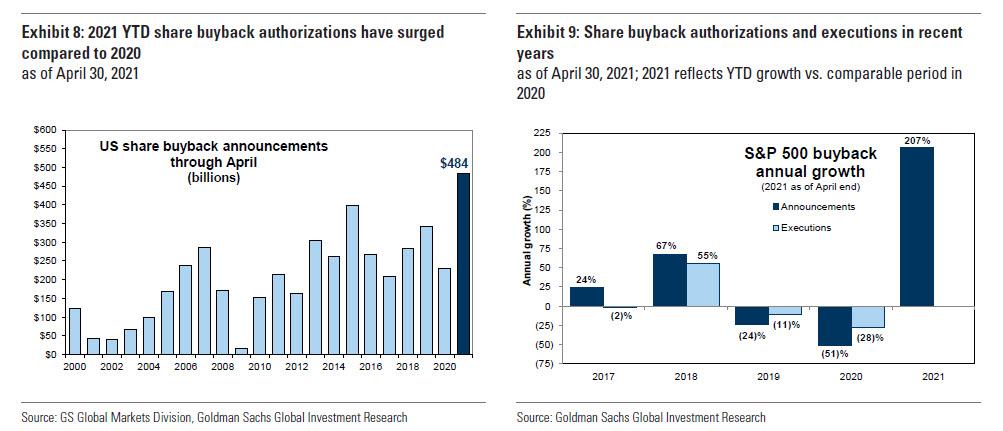

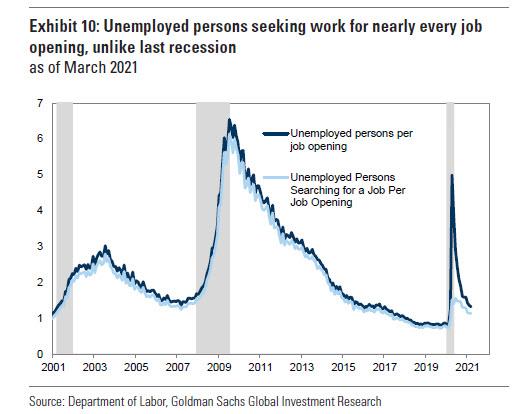

In addition to inflation, companies are contending with a range of labor-related challenges as they emerge from the pandemic, largely as a result of the Biden's decision to reward workers for doing nothing. As Goldman notes, "firms are having difficulty finding labor, particularly in transportation and hospitality. In response, some companies plan to ramp up hiring or bring recalled employees back to work sooner than expected." Goldman economists expect over 6 million cumulative job gains by the end of the year as low-wage workers are re-employed in hard-hit industries (Exhibit 10). Few companies commented on the potential implications of a minimum wage hike, and sentiment varied on this topic.

(Click on image to enlarge)

Post-recession labor market challenges

- J.B. Hunt Transport Services, Inc. (JBHT): Final comment from me on the availability of professional drivers for our asset-based businesses and our carrier providers is under unusual pressure currently. While we have faced driver hiring issues at varying degrees of difficulty during previous tightening cycles, we see the current pressure being meaningfully more pronounced and likely prolonged.

- Fifth Third Bancorp (FITB): And then on the other side of the equation, labor shortages, in particular, as it relates to the skilled trades. And the by-product of that is we’re not seeing the inventory building that you might otherwise expect to see yet.

- Allegion plc (ALLE): However, completion rates have been lagging starts due to labor and supply shortages, which should improve as we move further past the pandemic.

- Huntington Bancshares Incorporated (HBAN): In the last 4, 5 weeks, I’ve had about 50 CEOs in small meeting virtual conversations. Universally, they talk about inability to get adequate labor, very high turnover and clear wage inflation at the low end. A consequence of that will be more investment by many of them into automation all the way through, including packaging.

- Union Pacific Corporation (UNP): There are some challenges on the trade side, certainly some labor issues at the terminals. And then you look at the trucking capacity to even go long haul, there’s tightness there. And so what we’re focused on here is what we can control.

- TE Connectivity Ltd. (TEL): Labor cost is not a major issue on the inflation side, but labor availability in certain places that are still being more impacted by COVID continues to drive some inefficiencies, and there’s no doubt whether that’s in Mexico or in Central Europe.

- Regions Financial Corporation (RF): Probably the biggest challenge they face is workforce and hiring people to work. Heard a number of stories, sort of anecdotally over the last 2-plus weeks, about restaurant service being slow in so many places because restaurant owners are having difficulty bringing their workforce back.

- Pool Corporation (POOL): I think the labor market has been tight for quite some time. So there are certain positions that are in short supply for virtually every business drivers, for instance. In the construction trade, though, I mean labor has been tight for quite some time. There’s certainly been some inflation on that side, but I haven’t heard of crazy increases. So I don’t know that even the inflation that they’re seeing on labor would act as a throttle on demand at this point.

- Pentair plc (PNR): Labor continues to be a challenge, and it’s something that we need to address. It’s — in many places of the business, it’s a challenge, to be totally honest. But we — our guidance should not be impacted by that, but it’s certainly on our radar screen.

- Lennar Corporation (LEN): To manage for these disruptions in the supply chain of materials as well as to be the builder of choice in a continually constrained labor market, we employ the following strategies and processes.

- Dover Corporation (DOV): Operationally, it is getting kind of difficult out there in terms of sourcing raw materials, labor availability, a variety of different things out there.

- Darden Restaurants, Inc. (DRI): I think our greatest challenge right now is staffing. It’s staffing, trying to attract people to come to work. That’s why we’re strengthening our employment proposition, which is already strong. We’ve got to staff it. We’ve got to train people. We’ll train people now and in a very high-volume environment.

- Citizens Financial Group, Inc. (CFG): Labor, bringing people back to work, which, frankly, when we talk to many of our corporate customers has been a gating factor. It’s hard to actually fill out their needs, and we’re trying to be helpful on that with some initiatives around workforce development.

- Genuine Parts Company (GPC): I know the challenges some of our suppliers are up against with raw materials, with the global supply chain, labor issues. When that comes back up to more normal levels, that’s just going to be increased upside for our business.

No major labor challenges

- PPG Industries, Inc. (PPG): Labor for PPG is not a huge piece of our business. What I would put into your model is traditional 2% to 3% kind of number.

- Regions Financial Corporation (RF): We’ve been able to keep expenses generally flat while providing increased compensation every year for the teams that remain with us. Investing significantly in our business, hiring additional bankers and other associates who are working actively in our technology function and risk management and other parts of our business.

- CSX Corporation (CSX): Walking down the expense line items, labor and fringe was up 2%, driven by higher incentive compensation as well as inflation and other costs.

- Old Dominion Freight Line, Inc. (ODFL): On the labor inflation standpoint, we gave our wage increase in September of last year. We would not expect — or we’re seeing the effects of that, and that was part of that overall core inflation of 4% to 4.5%. So that was probably, all in, 3% to 3.5%.

- Omnicom Group Inc (OMC): In the midst of the pandemic, our key strategic objectives served us well. These strategies are centered around hiring and retaining the best talent, driving organic growth by evolving our service offerings, improving operational efficiencies and investing in areas of growth.

- PepsiCo, Inc. (PEP): In terms of labor pressures, right now, in the U.S., it’s actually okay. We haven’t seen a lot of labor inflation, and we’re able to get employees reasonably well right now. So how that’s going to play going forward remains to be seen as the economy picks up. But at least, as for right now, we’re doing fine on that front.

- Chipotle Mexican Grill, Inc. (CMG): In the last year, what we’ve seen with labor inflation has — it’s been more modest than it had been in the last 5 years. In the last 5 years, we’ve seen inflation in kind of the mid-single-digit range. And with some of the dislocations going on with COVID, actually, the labor inflation dropped to the low single digits. But we expect — I think most people expect that’s going to tick back up.

Hiring, training, or bringing back employees

- American Airlines Group, Inc. (AAL): What we’re doing rather than hiring new flight attendants is bringing flight attendants back from leave earlier than their leave would have extended. So having them come back off of leaves than they would have otherwise. Once we get through that, we’ll need to hire, but we’re not there yet.

- Southwest Airlines Co. (LUV): Roughly half of our recalled employees will return in second quarter and some training will be required for those employees that we recalled as we prepare for them to go back to work.

- Adobe Inc. (ADBE): We talked about in Q3 that we’re going to start to ramp hiring, and so we have done that.

- United Airlines Holdings, Inc. (UAL): As we announced earlier this month, we recently restarted the process of hiring pilots and have already announced plans to bring on over 300.As demand continues to rebound, we expect to train more than 5,000 pilots overthe next decade.

- Accenture Plc Class A (ACN): We increased hiring approximately 50% both year-over-year and since last quarter, and we’ve onboarded over 100,000 people virtually over the last 12 months with new innovative approaches.

Minimum wage

- First Republic Bank (FRC): We’re pleased to have recently increased our company-wide minimum wage to $30 per hour, up from $25, which we instituted in 2018.

- Domino’s Pizza, Inc. (DPZ): The final thing I’d say about labor that will present an ongoing challenge, not just for Domino’s, but for others across the industry, is the — just the changes in minimum wage around the country. As that moves differentially from one market to another, certainly, it puts pressures in some places and not in others.

- Chipotle Mexican Grill, Inc. (CMG): Now the way to think about this is our minimum wage — or our average wage right now is $12 for our crew, it’s $13 for all of our hourly employees. We’re not that far off of, like, for example, a $15 number. But let’s say, for example, that there’s going to be an across-the-board 10% increase in our wages, that would have an impact on our margins of, call it, 150 to 200 basis points. And that would — to offset that with menu pricing, that would take a 2% to 3% price increase. So all of that is very, very manageable. And we feel like if there is going to be significant increased inflation because of market-driven or because of federal minimum wage, we think everybody in the restaurant industry is going to have to pass those costs along to the customer, and we think we’re in a much, much better position to do that than other companies out there.

- Bank of America Corp (BAC): We reported $57 billion in expense for the year 2015, 6 years ago, even though all the investments we have made in technology and the build-out of branches in new markets, new sales resources and just having more customers, more activities, the inflation in health care and real estate and other costs, moving our teammates’ starting wages from $15 to $20 an hour during that time period.

Emerging Theme: Cryptocurrency

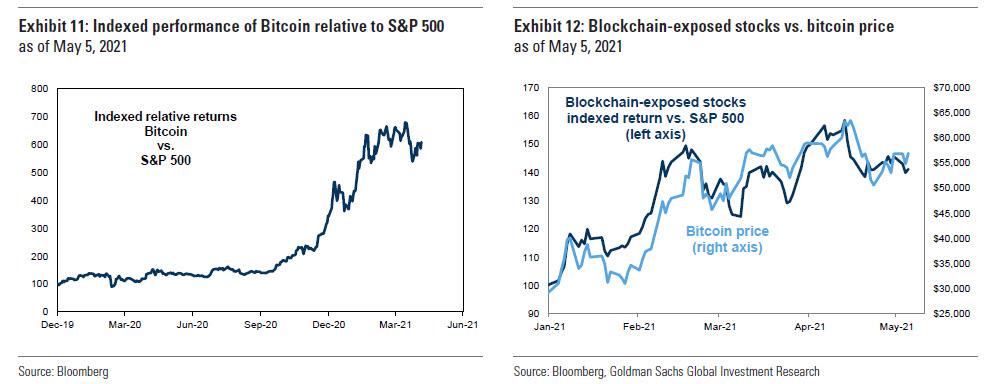

This quarter, Goldman identified an emergent theme in company commentary which will garner much more attention in coming quarters: Cryptocurrency. From Bitcoin to Dogecoin, a number of cryptocurrencies have appreciated sharply in recent months. Bitcoin has outperformed S&P 500 since the start of 2020 (+695% vs. +29%) and investors, managements, and governments all took notice. Goldman recently created a screen of 19 stocks withblockchain and cryptocurrency exposure. In aggregate, the indexed performance ofthese companies track the price of Bitcoin well.

A handful of companies discussed cryptocurrency in earnings calls this quarter. Following strong public interest, some companies are already offering services that provide exposure to cryptocurrency or accepting it as payment, either through internal platforms or through third party cryptocurrency ventures. Most of these firms are concentrated in the Financials sector, providing investors with the ability to trade and hold digital currencies. Some companies are still analyzing potential opportunities in this growing space but anticipate future involvement.

(Click on image to enlarge)

- Mastercard Incorporated (MA): We have several new crypto partnerships approved for launch this quarter, including a partnership with Gemini, a leading crypto platform here in the U.S., to launch a first of its kind cryptocurrency rewards credit card that allows consumers to receive crypto rewards on everyday purchases. ... And over in Spain, Crypton, a crypto exchange launching a Mastercard Crypto Card. On central bank digital currencies, we continue to engage with central banks around the world, and our virtual testing platform is helping them design features, similar issuance and evaluate interoperability with existing payment systems. In partnership with the Central Bank of Bahamas and Island Pay, we launched the world’s first CBDC-linked payment card, enabling people to pay for goods and services using fiat currency anywhere Mastercard is accepted.

- Morgan Stanley (MS): We’ve allowed, within our Wealth Management platform, qualified investors to get access through 2 specific passive funds that give access to the crypto currency... and as we continue to see more or stronger interest, we’ll continue to try to work with the regulators and others to provide services that we think are appropriate.

- Bank of New York Mellon Corporation (BK): We recently announced the establishment of a new digital assets unit, which is building a multi-asset platform that will allow us to custody traditional as well as digital assets, including cryptocurrencies in a new and creative way. The growing client demand for digital assets and improved regulatory clarity presents an opportunity for us to extend our current service offerings over time through this emerging field.

- Cboe Global Markets Inc (CBOE): We know market participants are looking for exposure in crypto. We’ve talked in the past, we’re trying to build an ecosystem. So we start with access to market data, that’s the CoinRoutes agreement. From there, you know we have a VanEck bitcoin trust ETF in front of the SEC.

- CME Group Inc. (CME): That continued with... Ether futures, micro Bitcoin futures... the main point is that we are constantly finding ways to assist our clients with the world’s most diverse product offering across all the critical global asset classes.

- Northern Trust Corporation (NTRS): We’ve partnered with Standard Chartered in a venture called Zodia, which will provide that crypto custody.

- Visa Inc. (V): We’re going to now be able to support digital currencies as an additional settlement currency on our network.

- Nasdaq, Inc. (NDAQ): We are partners with several crypto markets on their surveillance and their technology.

- S&P Global, Inc. (SPGI): We haven’t launched any products yet, we’re close to.

- First Republic Bank (FRC): We do not lend to crypto companies clients, however, they can invest in crypto-related funds through their brokerage accounts.

- MSCI Inc. (MSCI): Then there is the cryptocurrency... we’re definitely looking into that... we haven’t come up yet with the right products or the right indices. We’re analyzing that importantly.

- State Street Corporation (STT): We’ve got a number of initiatives in place to figure out how we can establish a leadership position there.

- Blackrock, Inc. (BLK): We are investigating how we could create different products if there’s client demand related to crypto.

- Conagra Brands, Inc. (CAG): You should be on the lookout for additional crypto-themed activations in the future

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more