“It Plays Out In Cycles” Stock Market (And Sentiment Results)

Bank of America Fund Manager Survey Update

On Tuesday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed 222 institutional managers with ~$587B AUM:

Here were the 5 key points:

1) Opinion follows trend. 54% of managers now expect international stocks to be the best-performing asset over the next five years. Only 24% think U.S. assets will continue to outperform.

2) Managers are the most underweight the U.S. dollar they’ve been in 20+ years.

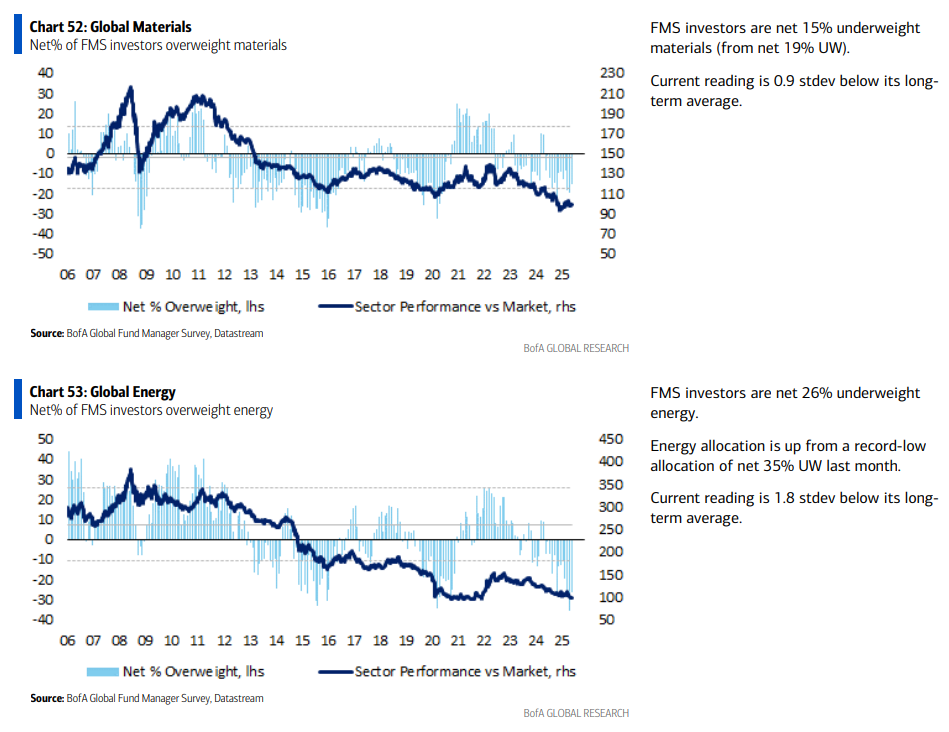

3) Materials and Energy remain unloved, with managers net 26% underweight Energy, up from last month’s record low allocation, and net 15% underweight Materials.

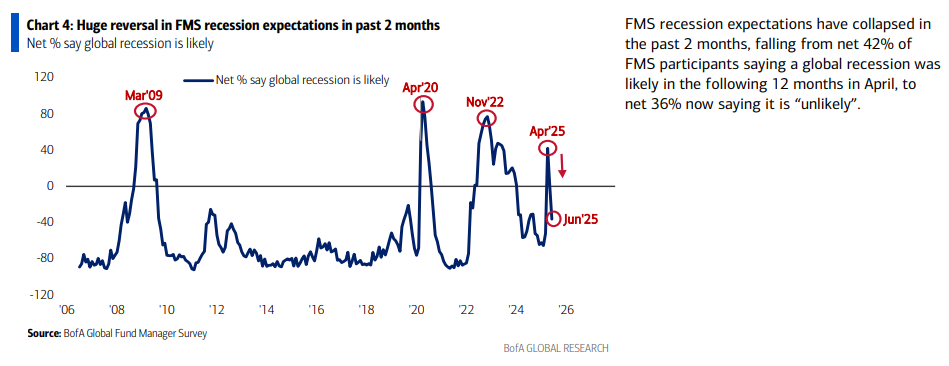

4) The “doomsday” recession expectations we saw in April have collapsed, reversing from 42% of managers saying a global recession was likely to now a net 36% saying it is unlikely. Trapped bears continue to fuel the pain trade to the upside…

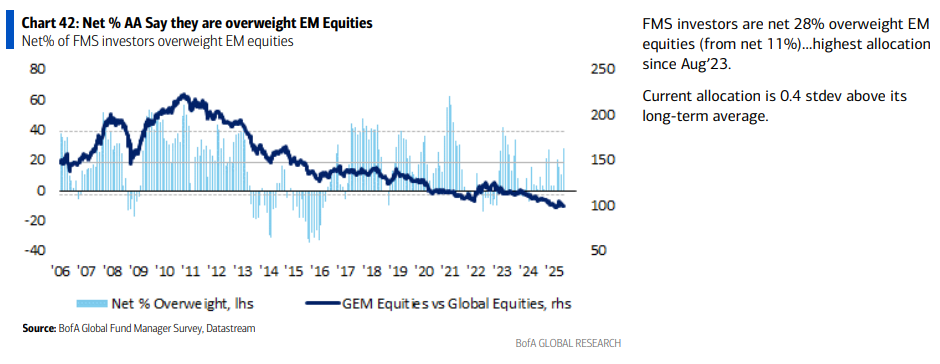

5) Managers are net 28% overweight emerging market equities, up from last month’s net 11% and the highest allocation since August 2023.

Albemarle Update (ALB)

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

Our favorite theme heading into 2025 was “Last Shall Be First,” with Healthcare and Materials as our top two sectors. Both had been left for dead after posting anemic returns in 2024, but earnings for the two were expected to recover handsomely in 2025. Healthcare was projected to grow earnings by 20.7% and Materials by 18.9%, both ranking among the top four overall sectors.

Six months into the year, Healthcare has largely held up, now projected to deliver 14.5% earnings growth and rank third overall. Materials stumbled out of the gates and took tariffs on the chin, with earnings growth now expected to be just 7.8%, dropping it to the sixth-ranked sector.

But as they say, being too early is indistinguishable from being wrong. That’s exactly how this one has played out so far, with the Materials recovery looking more like a 2026 story:

And if we zoom out, the “delay” in the recovery could end up being more like a blessing in disguise. That’s because our #1 pick for the theme is Albemarle, a position that at the time wasn’t large yet because the price had run away from us. We don’t “buy up,” and were hoping to get a second bite at the apple. Luckily, we’ve gotten the opportunity served on a silver platter to size in accordingly.

Albemarle is the world’s largest and lowest cost lithium producer. The rollercoaster story of lithium over the last five years goes something like this. Demand went through the roof in late 2021 and throughout 2022, as the EV and renewables boom took off in full force. Automakers were scaling production and stockpiling lithium, all while supply was heavily constrained from years of underinvestment and logistical bottlenecks. This perfect storm sent prices up more than 8x, reaching all time highs north of $80,000 per metric ton, and Albemarle was minting more cash than they knew what to do with.

But the high prices quickly brought a wave of new supply. Small-scale producers in China, many fully subsidized, flooded the market and created a massive supply glut. Lithium prices came crashing back down, and Albemarle’s stock fell with them — down more than 80% to where it sits today.

The good news for Albemarle is that, as we mentioned, they are the largest and lowest-cost producer worldwide. This has allowed them to cut operating costs and capex and pretty much sit on their hands and wait for cyclically low lithium prices to recover. Meanwhile, the longer prices stay in the pain zone, the more low-quality, marginal producers will get taken out on a stretcher.

To put this into context, ALB management estimates that ~40% of current global lithium capacity is AT OR BELOW BREAKEVEN, with only ~1/3 of that supply having come offline so far.

This should continue to support ALB and lithium prices from the supply side, with analysts expecting the supply glut to shrink and largely be gone by 2026.

So with supply starting to dry up and marginal producers coming offline, the focus now shifts to the other side of the equation: demand.

And what becomes immediately clear is that DEMAND has never been the issue for lithium. It has gone up and to the right with no signs of slowing, with consensus still calling for 15 to 20% CAGR over the next decade. Meanwhile, all the headline noise about slowing EV growth in North America, still up 17% YoY, has created a catharsis among investors. But that completely misses the point. The reality is that North America accounts for just 10% of global EV sales. The real story is China, which makes up more than 60% of the market and just posted 41% growth in the first quarter.

Meanwhile, while everyone stays focused on the EV narrative, they are missing what may be the biggest shift happening under the surface: data centers and stationary storage. Just a few years ago, this segment was expected to make up around 5% of total lithium demand. Today, projections are closer to 30%.

A few weeks ago, Ken Hoffman, an expert in lithium and battery materials formerly at McKinsey, laid out his case for a lithium recovery. He sees the bottom in 2025, a gradual recovery starting in 2026, and prices reaching $15,000 to $20,000 per metric ton by year end.

While the market obsesses over the temporary supply glut, Hoffman’s thesis is built on something you won’t hear anywhere else: UNDERAPPRECIATED DEMAND. He projects global demand could reach 6 to 10 million metric tons by 2035. Again, demand in 2024 was about 1.2 million, and Albemarle’s high-end forecast for 2030 is 3.3 million.

If that scenario plays out, Albemarle isn’t just a double. It’s a MULTIBAGGER…

Now, onto Albemarle earnings. Here’s everything you need to know following the Q1 report…

10 Key Points

1) Through April, management had achieved ~90% run rate against the midpoint of their $350 million cost and productivity savings program. More importantly, they’ve identified additional opportunities to reach the high end of the $300 to $400 million range, with potential for even more upside.

2) Adjusted EBITDA margins in Q1 came in at 25%, up over 400 basis points YoY, with SG&A costs down over 20% as the cost savings program continues to bear fruit.

3) In light of cyclically low prices, management continues to cut back on capex, with full year 2025 expectations of $700 to $800 million, down more than 50% YoY. This comes down from an already low base in 2024 that was reduced by over $450 million compared to 2023’s $2.1 billion of capex. The long term mid cycle capex target remains around 6% of revenues.

4) Cash from operations in Q1 totaled $545 million, including a $350 million customer prepayment, resulting in an operating cash flow conversion of 204%. Excluding the prepayment, conversion still came in at 73%, above the long term average of 60 to 70%, bringing full year 2025 expectations to north of 80%.

5) Not only did management maintain their full-year 2025 outlook, they also reiterated their expectation of breakeven free cash flow for the year after delivering slightly positive FCF in Q1, with positive FCF expected during 2026.

6) The direct impact of tariffs is expected to be minimal, totaling $30 to $40 million for the full year BEFORE ANY MITIGATIONS. This is largely due to ALB’s global footprint, with most lithium production sold directly into Asia, and the critical mineral exemptions that are currently in place. Management has mitigations underway to SIGNIFICANTLY reduce the overall realized impact, including increased sales to lower tariff countries and optimizing supply chains.

7) Management has estimated that ~40% of the current global lithium capacity is currently AT OR BELOW BREAKEVEN, with only ~1/3 of that supply having come offline. AKA the longer prices remain in the pain zone, the more low quality, marginal producers will get taken out on a stretcher.

8) For the full year, lithium demand is expected to grow between 15% and 40%, with management currently forecasting growth around the mid 20% range. Long term demand growth remains strong, with lithium demand projected to more than 2x by 2030 from 1.2 million metric tons in 2024 to up to 3.3 million metric tons growing at a near 20% CAGR.

9) Despite the headline noise, global EV demand continues to remain strong, up 34% YoY. Strong sales in China continue to lead the way, up 41% YoY, and remain over 60% of the total global EV market. Long term demand expectations remain intact, with EV market penetration expected to exceed ICE by the end of the decade, reaching about 54% global penetration.

10) Stationary storage continues to be one of the main demand drivers for lithium. The market is expected to grow at a 20 to 30% CAGR through 2030, with GWh growing from 190 in 2024 to between 600 and 970 in 2030.

Earnings Call Highlights

Morningstar Analyst Note

General Market

The CNN “Fear and Greed Index” ticked down from 64 last week to 61 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 82.66% this week from 81.62% equity exposure last week.

Our podcast|videocast will be out sometime today. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, Not Advice. See Terms

Not a solicitation.

More By This Author:

“The GENIUS Trade Nobody Wants” Stock Market (And Sentiment Results)…

“What The Consumer Wants” Stock Market (And Sentiment Results)

“Cleanup To Comeback” Stock Market (And Sentiment Results)

Long all mentioned tickers.

Disclaimer: Not investment advice. For educational purposes only: Learn more at more