Is This Gambling Stock A Sleeping Giant? The Case For Light & Wonder

A casual glance at Light & Wonder’s (Nasdaq: LNW) yo-yoing YTD stock performance and you could be forgiven if it prompted an involuntary eyebrow raise.

Yet, behind the scenes, several analysts believe that LNW is quietly shaping up as one of the most intriguing bargain opportunities in the gaming and entertainment sector.

Light & Wonder at a Glance

| Category | Details |

| Full Name | Light & Wonder Inc. |

| Ticker | Nasdaq: LNW |

| Sectors | Gaming / iGaming / Digital Casinos |

| Key Brands | SciPlay, Grover Charitable Gaming, The Wizard of Oz Slots, and Land-based gaming terminals |

| Headquarters | Las Vegas, Nevada, USA |

| CEO | Matt Wilson |

| Market Cap | $8.5 billion |

| Employees | 6,800 (2025) |

| Price to Earnings Ratio (P/E) | 23.3X |

| Recent Events | Secured UAE vendor license | Partnership with Warner Bros. & BetMGM for Wizard of Oz slots | $1B share repurchase plan. |

So much so that, despite trading well below its 2024 highs, Light & Wonder stock was recently upgraded to a Zacks Rank #2 (Buy), reflecting an underlying expectation of an imminent reversal of fortunes.

Fundamentally, Light & Wonder is still very much a gaming powerhouse that bridges traditional casino gaming with the highly lucrative, not to mention rapidly expanding, digital domain.

In fact, of its three key divisions – Gaming, SciPlay, and iGaming – LNW’s strategic omnichannel presence within the in-person casinos market, as well as the booming online sector, arguably demonstrates a balanced and very scalable business model.

LNW boasts solid fundamentals reinforced by institutional ownership

Firstly, the company’s financial foundations are solid. In 2024, LNW revenues climbed 9.9% to $3.19 billion, while its operating margins also surged to an impressive 22.9%, superseding the five-year average of 12.3% – a sure sign of a leaner, more profitable operating model.

While its free cash flow remains under pressure from its sizable investments, these themselves lean towards positioning LNW for sustainable digital growth.

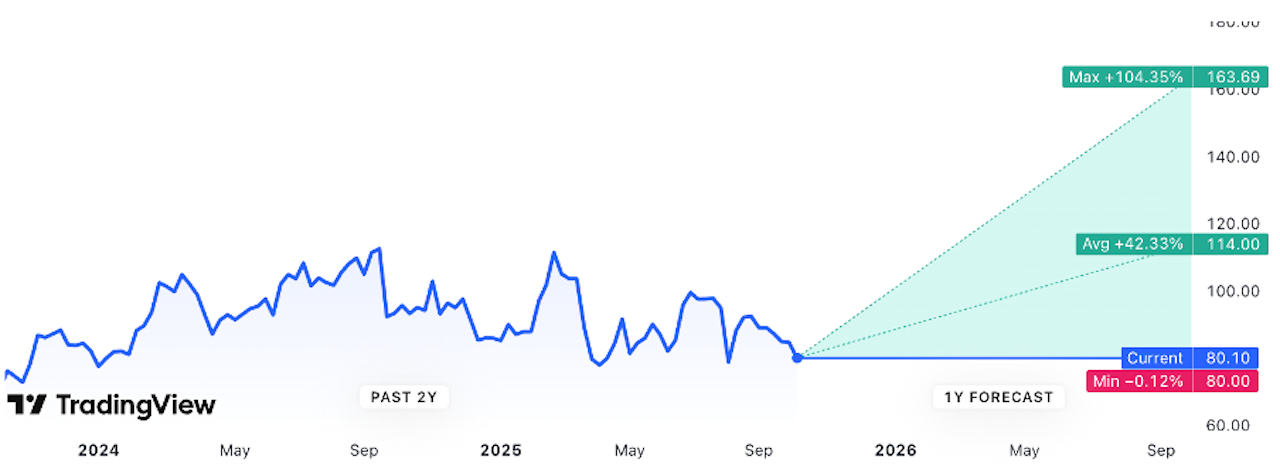

(Click on image to enlarge)

Light & Wonder has the potential to bounce in the near future. Chart from TradingView.

Furthermore, its iGaming and social casino divisions are also expanding rapidly, tapping into legalized online gambling markets in the U.S. and beyond, which in turn is driving recurring, high-margin revenues.

Valuation-wise, LNW undoubtedly presents as a compelling investment bargain, with stock trades also registering at 23.3 times forward earnings, trending below the broader market average of 26.

Institutional investors also seem to agree, with 90% of the firm’s shares held by professional investors, including billionaire James Packer, who took an AU$310 million stake in August through his CPH 2030 fund.

Add to that, LNW’s active $1 billion buyback program, which underlines the board’s confidence in the company’s future, further bolstering the case that the company’s prospects are on the rise.

Big-ticket collaborations, growing global footprint highlight LNW’s potential

Strategically, Light & Wonder continues to expand its operations on a number of fronts. Recent high-profile wins include becoming one of the first gaming suppliers licensed to operate in the UAE, along with deals with Warner Bros. (Nasdaq: WBD) and BetMGM (NYSE: MGM) to launch The Wizard of Oz slot series across North America and Ontario.

Given that shares are already down roughly 24% from their 52-week high and the Relative Strength Index is dipping below 30, LNW already looks primed for a sizable rebound.

Ultimately, for long-term investors, Light & Wonder indeed feels like it is residing in oversold territory currently, which, if you can look beyond short-term volatility, shares all the hallmarks of being currently undervalued, particularly compared to its peers in the gaming sector. Accordingly, LNW shares are unquestionably ones to watch out for ahead of Q3 2025 results on November 5.

More By This Author:

DPZ: Is This Warren Buffett Stock A Buy After Earnings?3 Reasons Why Bank Of America Stock Jumped 5%

Gold Glitters As Bitcoin Stumbles: What’s The Superior Safe-Haven Asset?