Is This 1929?

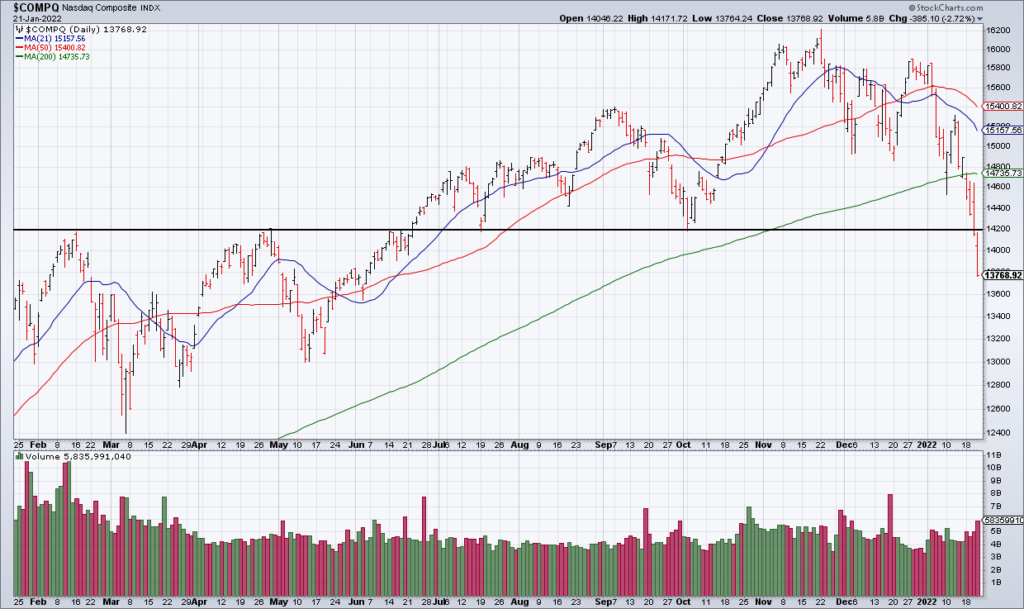

From Aug. 24, 1921 through Sept. 3, 1929, the Dow Jones Industrial Average surged from 63.90 to 381.17 (+497%). From March 9, 2009 through Nov. 19, 2021, the Nasdaq Composite surged from 1,268.64 to 16,057.44 (+1166%).

In terms of the magnitude of the bull market, then, yes: the rally we have seen over the last 13 years is comparable – in fact more than double – in size to the one we experienced in the 1920's. In addition, the primary cause has been the same: Easy money.

From Sept. 3, 1929 through Nov. 13, 1929, the Dow Jones Industrial Average crashed from 381.17 to 198.69 (-48%). The question arises: Are we in for a similar crash this time around? While possible, I think not because of a key difference in the policy climate between now and then: The Fed put.

While Powell pivoted on “transitory” at the end of last November, I don’t think it’s at all far-fetched that he could pivot once again if financial markets crash. Too many people hold stocks now compared to 100 years ago, the economy is far more dependent on financial markets than it was then, and the Fed is far more activist.

I find it almost impossible to believe that the Fed would stand on the sidelines in the event that a 1929-type crash unfolded. Indeed, it wouldn’t surprise me in the least if Powell is notably more dovish at next Wednesday’s Fed Press Conference. So while I do believe this is fundamentally 1929 redux, history is likely to rhyme rather than repeat.

The analogies are pretty chilling. luckily the markets are off to fantasy land the last 2 years and not really correlating with the actual economy, so I'd say it's closer to the dot com bubble. Especially some random twitter users pump and dumping penny stocks.