Is The Market Facing A Flashing Yellow Or Red Light?

Image Source: Pixabay

Market Wrap

Despite what can be described as an Oprah Winfrey-level amount of tariff announcements coming out of the White House since Friday’s market close, yesterday was relatively muted. Major broad equity indexes ended the day little changed with the Nasdaq Composite rising a mere 0.07%, the Dow gaining 0.16%, and the S&P 500 adding 0.24%. The only exception was the Russell 2000 as small caps shed 0.34% by the close.

Sector leadership came from Healthcare as a federal judge effectively quashed a lawsuit brought by the Federal Trade Commission. The suit alleges that pharmacy benefit managers systematically selected the highest-priced insulin products for customers, unfairly adding additional costs to patients. Gains in CVS Health (CVS), and United Health Group (UNH), among others, helped push the Dow and the S&P 500 higher. The remaining sectors saw results ranging from 0.80% (Consumer Staples) to -1.18% (Materials). Materials was impacted by Celanese Corporation’s (CE) 21.46% decline as markets punished the company following its latest earnings release and guidance.

The Tematica Select Model Suite saw leadership coming from CHIPs Act and Core Holdings while the remaining strategies took a breather with some strategies’ holdings seeing some profit taking.

Is The Market Facing A Flashing Yellow or Red Light?

Following yet another record close for the S&P 500, futures point to equities trading off later this morning. With trading volumes for the SPDR S&P 500 ETF Trust (SPY) over the last few days well below their average trading volume levels and even less than 2024 Christmas week volumes, there seems to be a lack of conviction in the market. Fueling that is what can be described as ballooning risks that include tariff tensions and earnings growth concerns; a Fed that now expects to keep rates elevated for some time and is also worried about the impact of tariffs on inflation; and a market multiple that can once again be characterized as stretched.

Meanwhile, data published by Barclays showed that at the end of January individual investors’ exposure to stocks is in the 96th percentile of data dating back to 1997. To that we can layer in findings from JPMorgan that sentiment across that group has also reached the highest on record, surpassing levels seen during the meme-stock mania of 2021. While the Fear & Greed Index is only flashing Neutral, the Citibank Panic Euphoria Index’s latest reading hit 0.70, up from its prior reading of 0.67. Both of those figures are deep into Euphoria territory, which begins when the indicator hits 0.40.

While we look at the noteworthy year-to-date returns across several of our models, including Luxury Buying Boom(+14.74%), Digital Lifestyle (13.68%), and EPS Diplomats Model (+12.11%) compared to the 4.46% gain for the S&P 500, we have to contemplate if we are at or near at time worthy of employing our Market Hedge Model? See below for a detailed table of our year-to-date model performance.

As we and hopefully you ponder that, the earnings cavalcade continues today, but among the latest throng of reports, the two that Team Tematica will be focused on are from Walmart (WMT) and Rackspace Technology (RXT). With Walmart, we’ll be interested in comments about its grocery business as shoppers contend with sticky inflation for some goods and higher prices for eggs, beef, and other items. We’ll also be listening for Walmart’s comments about Trump tariffs and how that could pressure its supply chain. Finally, we’ll be curious about any discussion on technology investments, including AI, to drive productivity and contain costs. In other words, we’ll be mining for Cash-Strapped Consumer, Artificial Intelligence, and Digital Lifestyle nuggets.

Turning to Rackspace, front and center will be progress on the company’s turnaround strategy but also what it shares about cloud and AI adoption. Part of our focus will be on the company’s bookings as well as end market comments spanning public and private cloud. As you can guess, those comments and others will be the ones we’re collecting for our Cloud Computing, Artificial Intelligence, and Digital Infrastructure models.

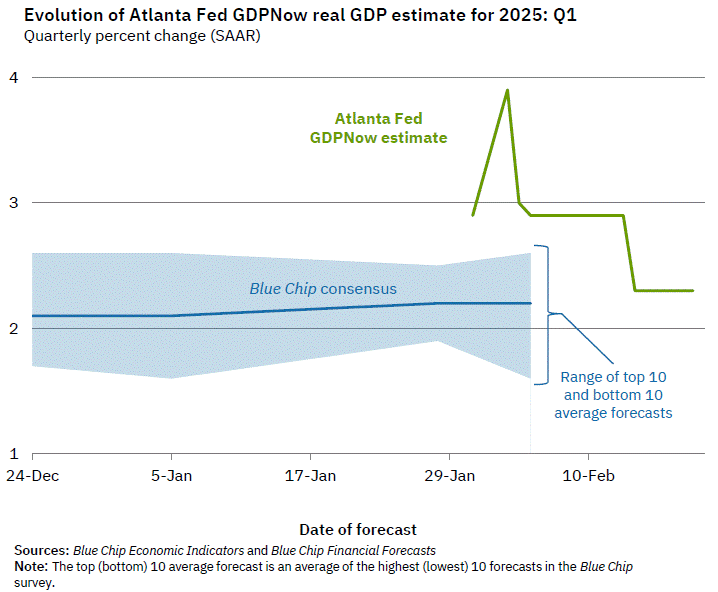

In terms of the economy, folks are puzzling through the potential impact of what is a growing list of forthcoming tariffs. However, following yesterday’s disappointing January Housing Starts print, the Atlanta Fed’s rolling GDP forecast better known as GDPNow remained at 2.3% for the current quarter. Granted, that figure is based on just over a handful of data points, and we’ll see more than a few revisions in the next few weeks as we start to get February data.

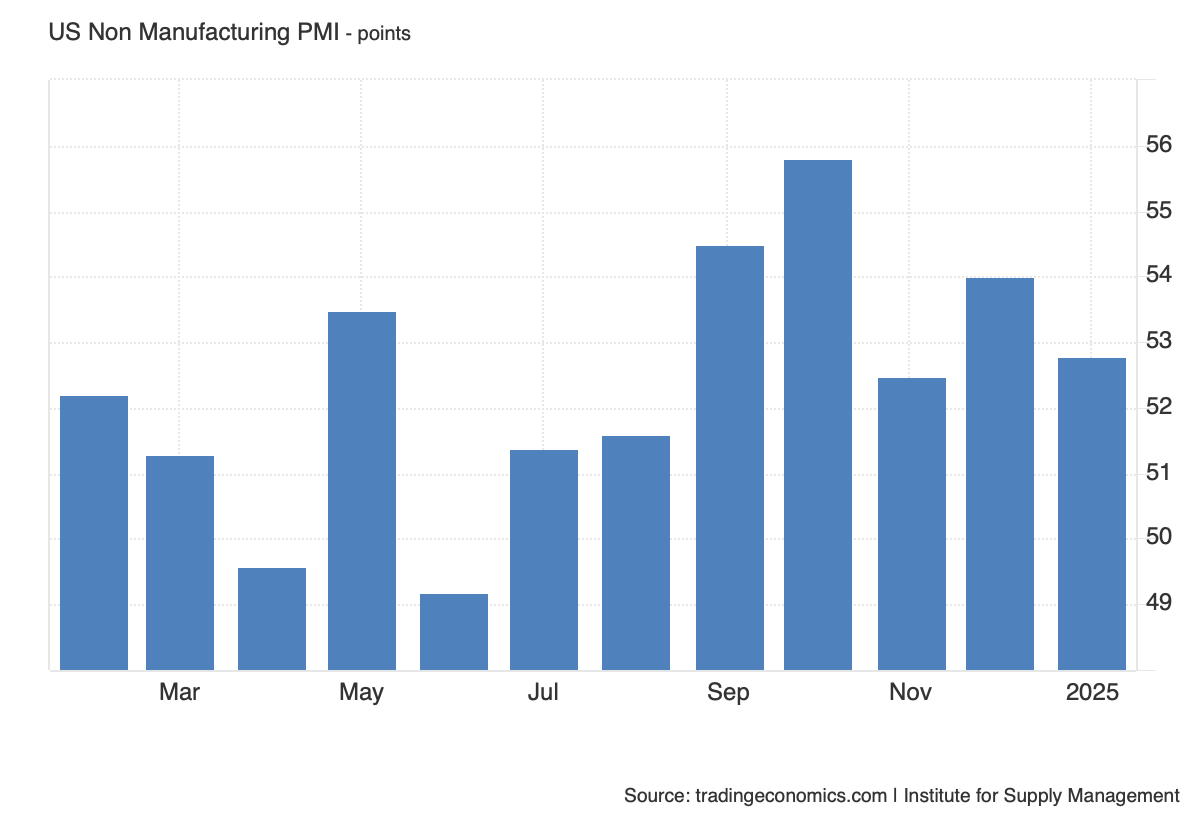

The first hard look at that data set comes on Friday with the release of S&P Global’s Flash February PMI report. Coming off recent inflation data, you can bet folks will be pouring over the Flash report’s findings but the two things we’ll be as interested in are what the data shows for the overall Service economy in February and early findings on tariffs. Why the Service economy? For starters, it accounts for nearly 80% of US GDP. Second, headline January Service PMI figures from S&P Global and ISM both showed that part of the economy growing but at a far slower pace compared to prior months. We’ll also be watching to see if the January decline in New Orders, an indicator of future activity, continued in February.

More By This Author:

Reciprocal Trump Tariffs To Trump January PPI DataWhat Will Powell Say On Inflation And Tariffs Today?

Why Fed Speakers May Lean More Hawkish

Disclosure: None.