Is Russia The New Lehman Brothers?

In September 2008, Lehman Brother’s spectacular fall almost led to the collapse of the global financial system. After Lehman spiraled into the largest bankruptcy in US history, we learned that Lehman and other banks were leveraged over 30 to 1 and that other banks who were “counterparties” to Lehman transactions suffered massive financial losses jeopardizing the solvency of many of those banks.

Following Russia’s invasion of Ukraine, we have learned that US companies and Wall Street banks have tremendous exposure to Russia.

Wall Street firms such as Citigroup, Goldman Sachs, JP Morgan and Deutsche Bank had thousands of staff in Russia and billions of Russian assets. Those firms are either pulling out completely or pausing operations. Expected losses include billions tied to derivatives linked to Russian investments and will result in large write-offs by these banks. Numerous hedge funds also have significant exposure to Russia as do various exchange traded funds (ETFs).

Banks aren’t the only businesses that have exposure to Russia; other businesses such as the Big Four accounting firms, law firms and business consultants such as McKinsey & Co., are also pulling out or pausing operations in Russia and will suffer massive financial losses. McDonald's (MCD) estimates that it is losing $50 million a day as a result of the cessation of its business in Russia.

Wealthy Russians are also on the hook. Swiss banks announced that they hold $213 billion of assets held by Russian clients. Switzerland may freeze those assets to prevent them from being used to assist Russia’s war effort.

Not to mention that fact that Russia is now threatening to nationalize foreign companies that have paused operations in Russia.

What is an investor to do if part of their portfolio is exposed to Russia?

The answer is that the US Securities and Exchange Commission (SEC) must issue a rule as soon as possible requiring US banks and Wall Street brokerage firms to disclose their exposure to Russia in the near and long term.

Only then can investors make an informed decision about whether to stay invested in assets linked to Russia.

Had a rule been created requiring banks and US companies to disclose their exposure to Lehman, many investors could have potentially avoided significant losses. Remember, Lehman went bankrupt in September 2008, the market lows didn’t happen until March 2009, a full six months later.

As the war in Ukraine continues, investors should be made aware of their exposure to Russia and decide whether or not it is worth the risk.

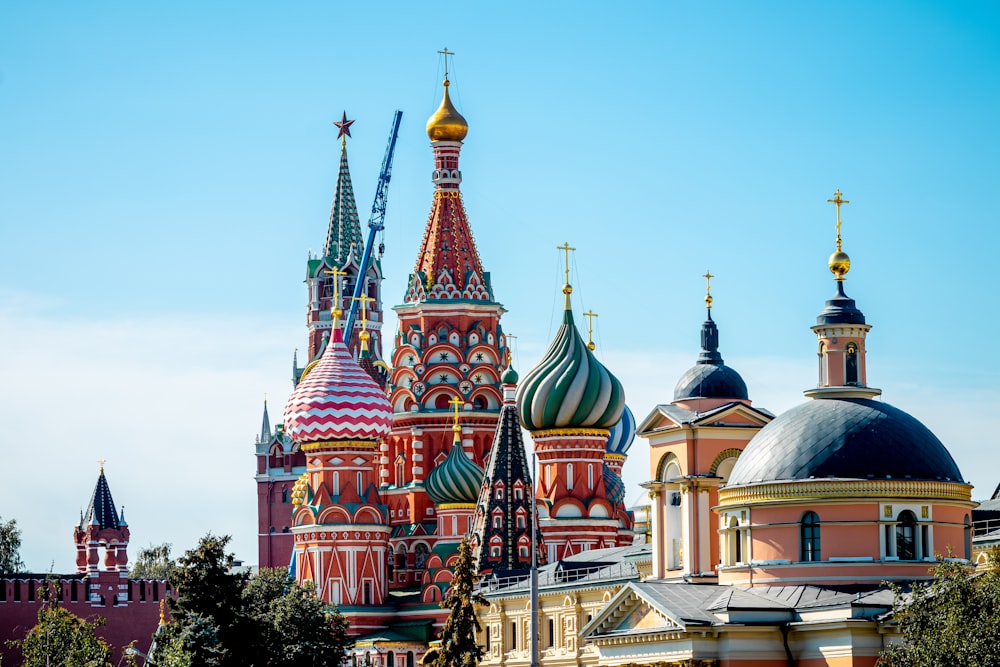

Image Source: Unsplash

Disclaimer:This article does not contain investment, tax or legal advice.

You mean is Citi the new Lehman Brothers.