Is Rush Street Interactive Primed For Explosive Growth?

Photo by nicolas perez on Unsplash

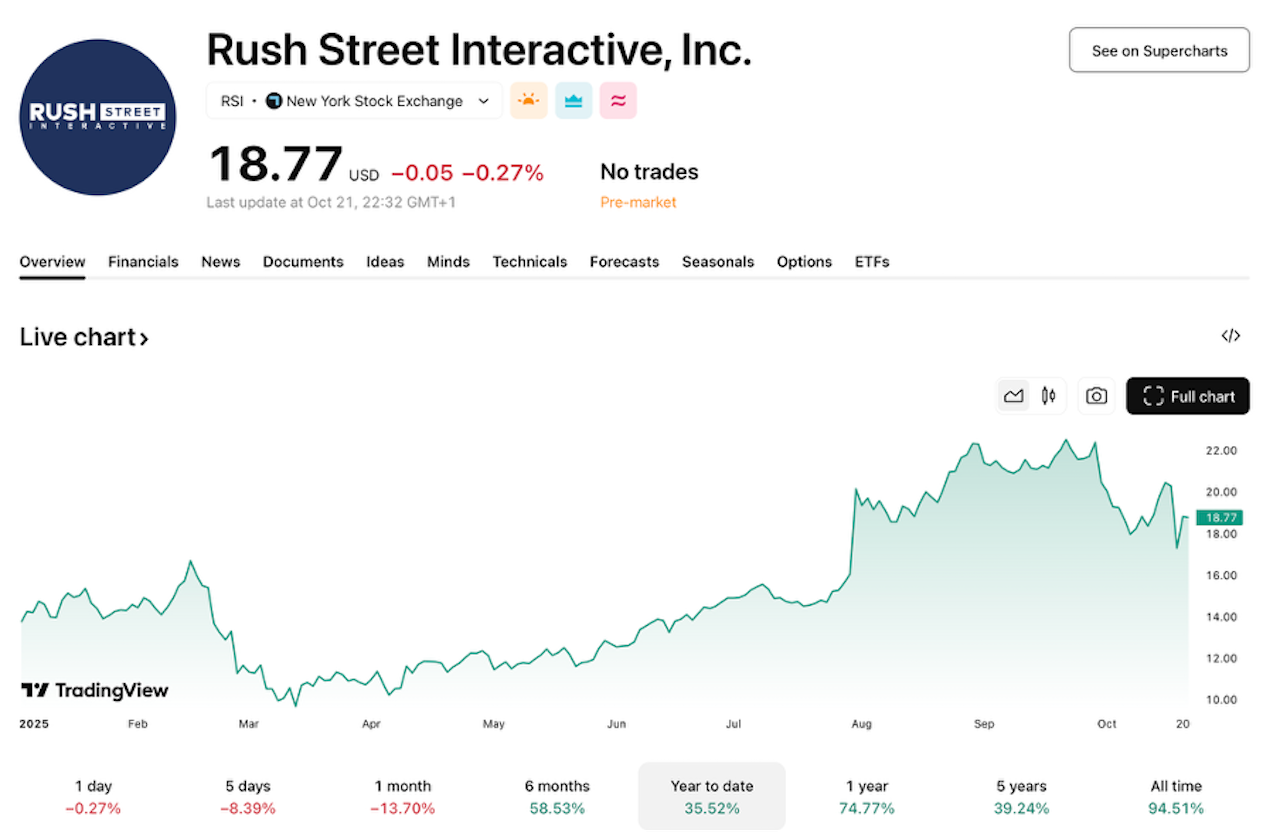

One glance at Rush Street Interactive‘s (NYSE: RSI) rollercoaster October would normally have investors fleeing, but behind the recent trading volatility lies perhaps one of the most compelling growth stories to have emerged in the online gaming sector.

Undeniably, a sentiment-driven sell-off saw shares plummet 15% on Friday, reacting to the news that Colombia was considering introducing a 19% VAT on gaming deposits – one of RSI’s key Latin American markets. Needless to say, astute market analysts simply believed the drop was an exaggerated response to a policy proposal unlikely to materialize.

Somewhat predictably, Rush Street Interactive’s stock rebounded 9.7% by Monday, a rally that echoes the firm’s overall momentum, which has seen its stock surge 37.17% so far this year.

Rush Street Interactive at a Glance

| Category | Details |

| Full Name | Rush Street Interactive, Inc. |

| Ticker | RSI (NYSE) |

| Sectors | Online Gaming, iGaming, and Sports Betting |

| Key Brands | BetRivers, PlaySugarHouse, RushBet |

| Headquarters | Chicago, Illinois, USA |

| CEO | Richard Schwartz |

| President & CFO | Kyle Sauers |

| Market Cap | $1.79 billion |

| Employees | 880+ (2024) |

| Price-to-Earnings Ratio (P/E) | 88.81 |

| Recent Events | Recently promoted Sauers to President, Colombia tax concerns, partners with Playtech for U.S. & Latin American markets. |

RSI’s resilient fundamentals are inspiring investor confidence

Granted, in a sector dominated by online gaming titans DraftKings (Nasdaq: DKNG) and FanDuel (NYSE: FLUT) who seemingly monopolize the headlines, Rush Street’s stock has continued to outpace the majority of its rivals, hitting 52-week highs of $22.50 as recently as August.

In addition to this, its Q2 EPS of $0.11 blew past market expectations, which prompted both Needham and Benchmark to propel RSI’s Buy rating status, with projected targets of $22–$24 per share while currently trading at $18.77.

(Click on image to enlarge)

Chart from TradingView.

Financially, too, it’s hard to argue with Rush Street’s balance sheet either. Currently sitting at an enviable $1.02 billion in revenue, 35.3% gross margin, and an Altman Z-Score of 5, fundamentally reaffirming RSI as a capital-strong, low-debt performer.

Having recently appointed CFO Kyle Sauers to President, with a debt-to-equity ratio of just 0.05 and a sizable institutional backing of nearly 94% – confidence on Wall Street in RSI doesn’t seem fazed despite its market jitters.

Gaming sector’s rising star continues to expand its own horizons

Operationally speaking, the firm is purposefully building on its existing international footprint, which includes 15 U.S. states, Canada, plus a notable stronghold in Latin America, led by its flagship gaming platform and award-winning BetRivers brand.

Rush Street has also been recognized for its commitment to responsible gaming, having already secured five consecutive EGR Customer Services Operator of the Year awards, making it one of the most trusted names in the industry.

From a valuation standpoint, RSI trades at a P/S of 3.1 and a price-to-earnings ratio (P/E) of 93.5. That P/E is exceptionally high, which might represent overinflated market hype but could also represent growth opportunities. Given its RSI-14 indicator is hovering near oversold levels, savvy investors may view it as a rare buying opportunity ahead of its Q3 results next week.

On the face of it, Rush Street Interactive certainly looks less like a speculative bet and more like a maturing digital gaming powerhouse, which, for investors prepared to look beyond the short-term turbulence, its stealth-like growth could see it become one of the most desirable stocks in the U.S. gaming sector heading into 2026.

More By This Author:

Netflix Stock Sinks On Earnings Miss: Time To Buy?Alphabet Stock Drops After Launch Of ChatGPT’s Atlas Browser

GM Stock Rises As Investors Look At Bright Side